Answered step by step

Verified Expert Solution

Question

1 Approved Answer

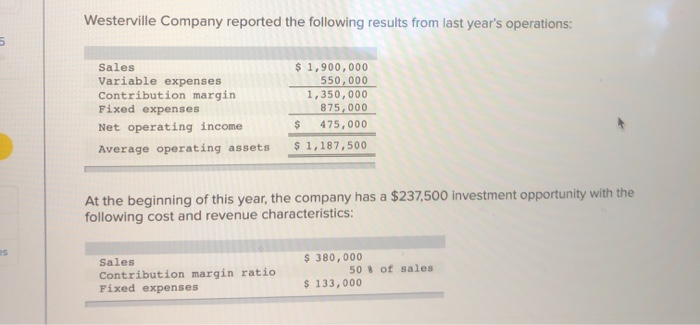

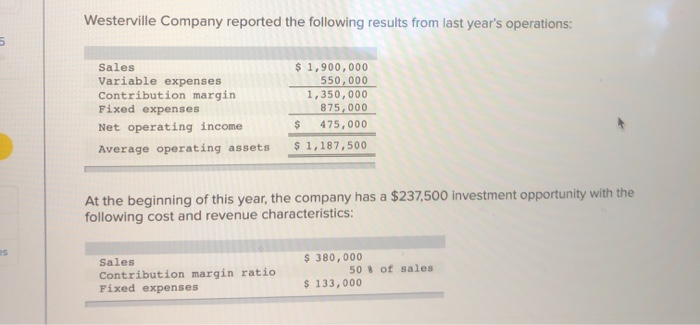

Westerville Company reported the following results from last year's operations: Sales Variable expenses Contribution margin Fixed expenses Net operating income Average operating assets $ 1,900,000

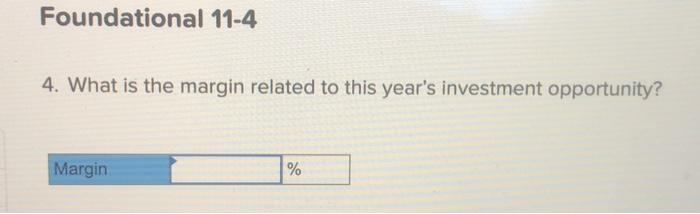

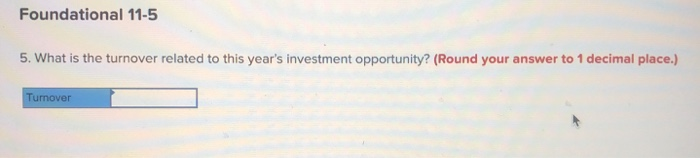

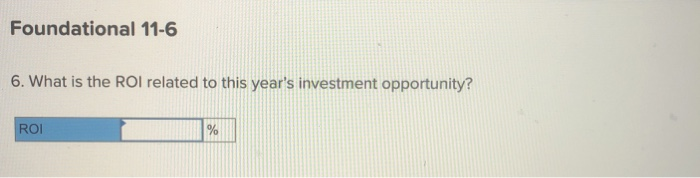

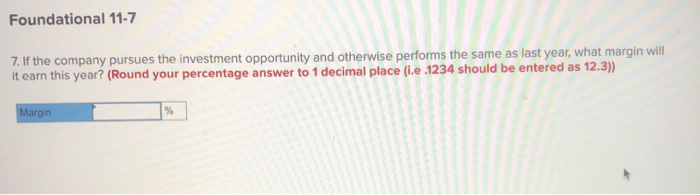

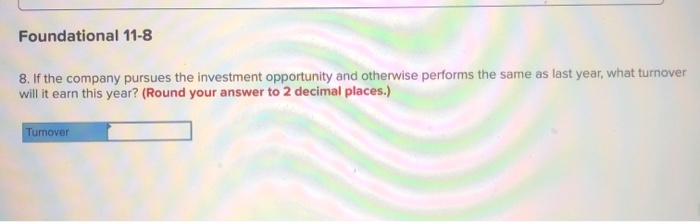

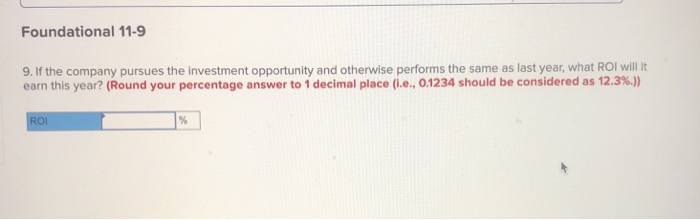

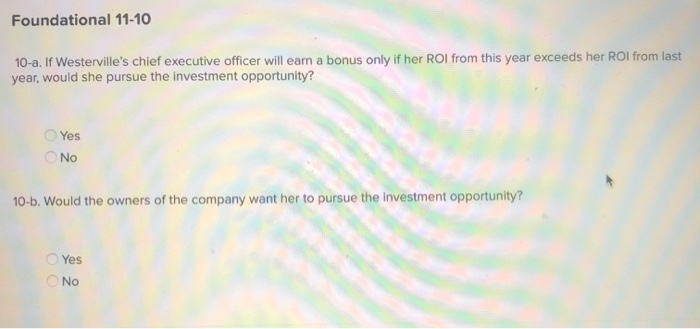

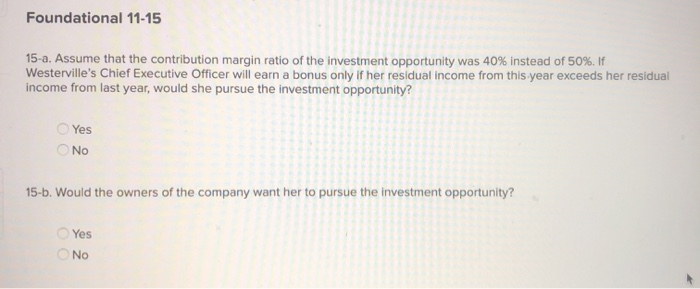

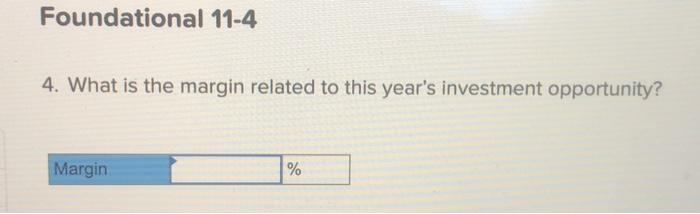

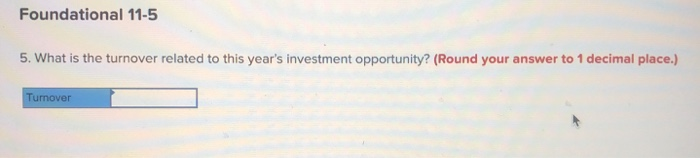

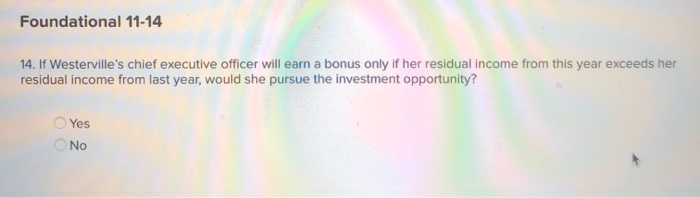

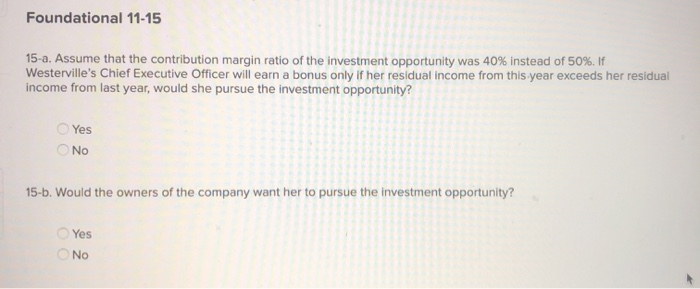

Westerville Company reported the following results from last year's operations: Sales Variable expenses Contribution margin Fixed expenses Net operating income Average operating assets $ 1,900,000 550,000 1,350,000 875,000 $ 475,000 $ 1,187,500 At the beginning of this year, the company has a $237,500 investment opportunity with the following cost and revenue characteristics: Sales Contribution margin ratio Fixed expenses $ 380,000 50 8 of sales $ 133,000 Foundational 11-4 4. What is the margin related to this year's investment opportunity? Margin Foundational 11-5 5. What is the turnover related to this year's investment opportunity? (Round your answer to 1 decimal place.) Turnover Foundational 11-6 6. What is the ROI related to this year's investment opportunity? ROI Foundational 11-7 7. If the company pursues the investment opportunity and otherwise performs the same as last year, what margin will it earn this year? (Round your percentage answer to 1 decimal place (i.e.1234 should be entered as 12.3)) Margin Foundational 11-8 8. If the company pursues the investment opportunity and otherwise performs the same as last year, what turnover will it earn this year? (Round your answer to 2 decimal places.) Turnover Foundational 11-10 10-a. If Westerville's chief executive officer will earn a bonus only if her ROI from this year exceeds her ROI from last year, would she pursue the investment opportunity? Yes No 10-b. Would the owners of the company want her to pursue the investment opportunity? Yes ONo Foundational 11-11 11. What is last year's residual income? Residual income Foundational 11-12 12. What is the residual income of this year's investment opportunity? Residual income Foundational 11-13 13. If the company pursues the investment opportunity and otherwise performs the same as last year, what residual income will it earn this year? Residual income Foundational 11-14 14. If Westerville's chief executive officer will earn a bonus only if her residual income from this year exceeds her residual income from last year, would she pursue the investment opportunit Yes No Foundational 11-15 15-a. Assume that the contribution margin ratio of the investment opportunity was 40% instead of 50%. If Westerville's Chief Executive Officer will earn a bonus only if her residual income from this year exceeds her residual income from last year, would she pursue the investment opportunity? Yes No 15-b. Would the owners of the company want her to pursue investment opportunity? Yes No

Westerville Company reported the following results from last year's operations: Sales Variable expenses Contribution margin Fixed expenses Net operating income Average operating assets $ 1,900,000 550,000 1,350,000 875,000 $ 475,000 $ 1,187,500 At the beginning of this year, the company has a $237,500 investment opportunity with the following cost and revenue characteristics: Sales Contribution margin ratio Fixed expenses $ 380,000 50 8 of sales $ 133,000 Foundational 11-4 4. What is the margin related to this year's investment opportunity? Margin Foundational 11-5 5. What is the turnover related to this year's investment opportunity? (Round your answer to 1 decimal place.) Turnover Foundational 11-6 6. What is the ROI related to this year's investment opportunity? ROI Foundational 11-7 7. If the company pursues the investment opportunity and otherwise performs the same as last year, what margin will it earn this year? (Round your percentage answer to 1 decimal place (i.e.1234 should be entered as 12.3)) Margin Foundational 11-8 8. If the company pursues the investment opportunity and otherwise performs the same as last year, what turnover will it earn this year? (Round your answer to 2 decimal places.) Turnover Foundational 11-10 10-a. If Westerville's chief executive officer will earn a bonus only if her ROI from this year exceeds her ROI from last year, would she pursue the investment opportunity? Yes No 10-b. Would the owners of the company want her to pursue the investment opportunity? Yes ONo Foundational 11-11 11. What is last year's residual income? Residual income Foundational 11-12 12. What is the residual income of this year's investment opportunity? Residual income Foundational 11-13 13. If the company pursues the investment opportunity and otherwise performs the same as last year, what residual income will it earn this year? Residual income Foundational 11-14 14. If Westerville's chief executive officer will earn a bonus only if her residual income from this year exceeds her residual income from last year, would she pursue the investment opportunit Yes No Foundational 11-15 15-a. Assume that the contribution margin ratio of the investment opportunity was 40% instead of 50%. If Westerville's Chief Executive Officer will earn a bonus only if her residual income from this year exceeds her residual income from last year, would she pursue the investment opportunity? Yes No 15-b. Would the owners of the company want her to pursue investment opportunity? Yes No

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started