Answered step by step

Verified Expert Solution

Question

1 Approved Answer

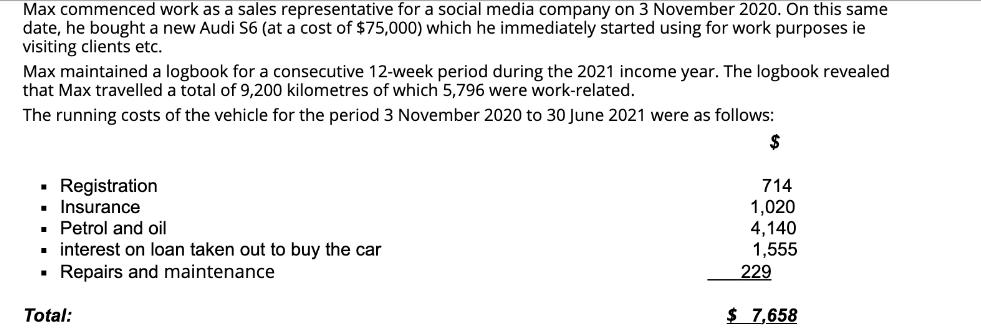

Max commenced work as a sales representative for a social media company on 3 November 2020. On this same date, he bought a new

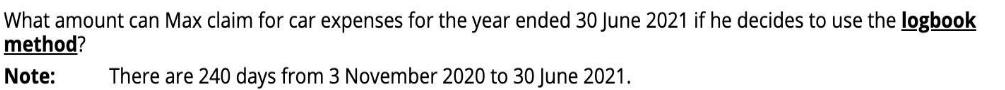

Max commenced work as a sales representative for a social media company on 3 November 2020. On this same date, he bought a new Audi S6 (at a cost of $75,000) which he immediately started using for work purposes ie visiting clients etc. Max maintained a logbook for a consecutive 12-week period during the 2021 income year. The logbook revealed that Max travelled a total of 9,200 kilometres of which 5,796 were work-related. The running costs of the vehicle for the period 3 November 2020 to 30 June 2021 were as follows: $ Registration Insurance I Petrol and oil I interest on loan taken out to buy the car Repairs and maintenance Total: 714 1,020 4,140 1,555 229 $ 7,658 What amount can Max claim for car expenses for the year ended 30 June 2021 if he decides to use the logbook method? Note: There are 240 days from 3 November 2020 to 30 June 2021.

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Calculating Maxs Car Expenses for Tax Purposes Heres how you can help Max calculate his car expenses ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started