Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What are some tax-advantaged accounts, and how can they help me save money on taxes? What is asset allocation, and why is it important for

- What are some tax-advantaged accounts, and how can they help me save money on taxes?

- What is asset allocation, and why is it important for my investment portfolio?

- How can I prepare for a financial emergency, such as a job loss or unexpected medical expense?

- What is the difference between a stock split and a reverse stock split?

- How can I determine the right time to sell a stock or other investment?

- What is the difference between a traditional mortgage and an adjustable-rate mortgage, and which one is right for me?

- What is the difference between a stock and a bond?

- What is the purpose of a stock exchange?

- What is diversification in investing?

- What is a mutual fund?

- What is a hedge fund?

- What is the difference between a growth and a value stock?

- What is market capitalization?

- What is a dividend?

- What is a yield?

- What is inflation?

- What is the Federal Reserve?

- What is monetary policy?

- What is fiscal policy?

- What is a budget deficit?

- What is a trade deficit?

- What is the national debt?

- What is a credit score?

- What is a credit report?

- What is a credit card?

- What is a debit card?

- What is a checking account?

- What is a savings account?

- What is a money market account?

- What is a certificate of deposit?

- What is a mortgage?

- What is a home equity loan?

- What is a car loan?

- What is a personal loan?

- What is a credit union?

- What is a bank?

- What is a financial planner?

- What is a financial advisor?

- What is a retirement plan?

- What is a 401(k)?

- What is an IRA?

- What is a Roth IRA?

- What is a traditional IRA?

- What is a SEP IRA?

- What is a SIMPLE IRA?

- What is a pension plan?

- What is a annuity?

- What is a life insurance policy?

- What is a disability insurance policy?

- What is a long-term care insurance policy?

- What is a health savings account?

- What is a flexible spending account?

- What is a 529 plan?

- What is a Coverdell Education Savings Account?

- What is a mutual fund expense ratio?

- What is a load fee?

- What is a no-load fund?

- What is a 12b-1 fee?

- What is a share class?

- What is a prospectus?

- What is a stock index?

- What is the Dow Jones Industrial Average?

- What is the S&P 500?

- What is the NASDAQ?

- What is a stock split?

- What is a reverse stock split?

- What is an initial public offering (IPO)?

- What is a secondary offering?

- What is insider trading?

- What is short selling?

- What is a margin account?

- What is a stop order?

- What is a limit order?

- What is a market order?

- What is a trailing stop order?

- What is a stop-limit order?

- What is a bull market?

- What is a bear market?

- What is a correction?

- What is a recession?

- What is a depression?

- What is a bubble?

- What is a Ponzi scheme?

- What is a pyramid scheme?

- What is a pump-and-dump scheme?

- What is a dividend yield?

- What is a capital gain?

- What is a capital loss?

- What is a dividend reinvestment plan (DRIP)?

- What is dollar-cost averaging?

- What is a bond rating?

- What is a junk bond?

- What is a municipal bond?

- What is a treasury bond?

- What is a corporate bond?

- What is a convertible bond?

- What are some strategies for paying off credit card debt?

- How can I determine my risk tolerance when it comes to investing?

- What is the difference between a traditional IRA and a Roth IRA?

- How do I calculate my net worth, and why is it important?

- What is a 401(k) plan, and how does it work?

- What are some common mistakes to avoid when investing in the stock market?

- What is a credit score, and how is it calculated?

- How can I reduce my monthly expenses and increase my savings?

- What are some factors to consider when choosing a financial advisor?

- What is the best way to save for retirement, and how much should I be saving each month?

- How can I improve my credit score, and why is it important?

- What are some ways to invest in real estate, and what are the potential risks and benefits?

- What is a mutual fund expense ratio, and why is it important to consider when choosing a fund?

- What are some tax-advantaged accounts, and how can they help me save money on taxes?

- What is asset allocation, and why is it important for my investment portfolio?

- How can I prepare for a financial emergency, such as a job loss or unexpected medical expense?

- What is the difference between a stock split and a reverse stock split?

- How can I determine the right time to sell a stock or other investment?

- What is the difference between a traditional mortgage and an adjustable-rate mortgage, and which one is right for me?

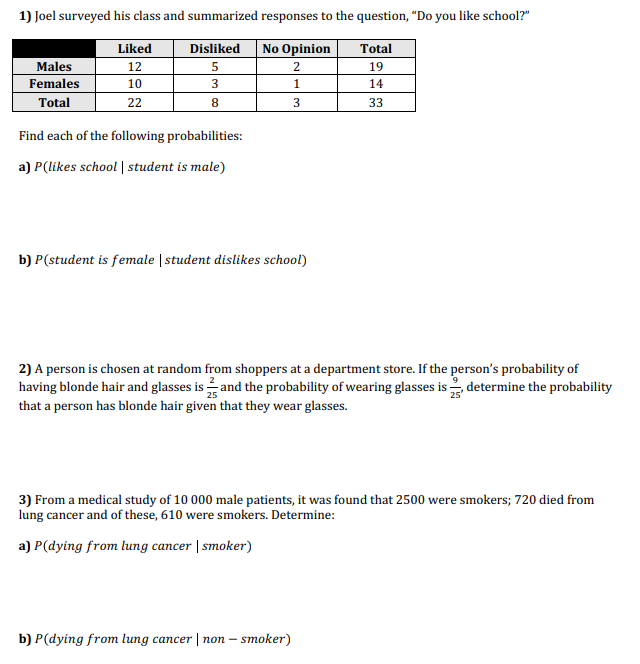

1) Joel surveyed his class and summarized responses to the question, "Do you like school?" Liked Disliked 12 5 10 3 22 8 Males Females Total Find each of the following probabilities: a) P(likes school student is male) No Opinion 2 1 3 b) P(student is female | student dislikes school) Total 19 14 33 2) A person is chosen at random from shoppers at a department store. If the person's probability of having blonde hair and glasses is and the probability of wearing glasses is determine the probability that a person has blonde hair given that they wear glasses. 3) From a medical study of 10 000 male patients, it was found that 2500 were smokers; 720 died from lung cancer and of these, 610 were smokers. Determine: a) P(dying from lung cancer | smoker) b) P(dying from lung cancer | non-smoker)

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 What is the Federal Reserve The Federal Reserve often referred to as the Fed is the central bank of the United States It was established in 1913 to provide a stable monetary and financial system The ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started