what are the answers of the questions?

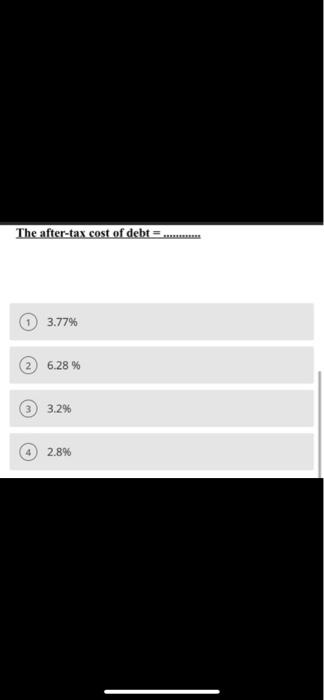

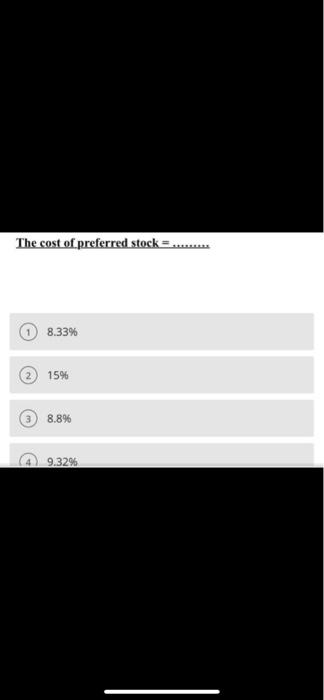

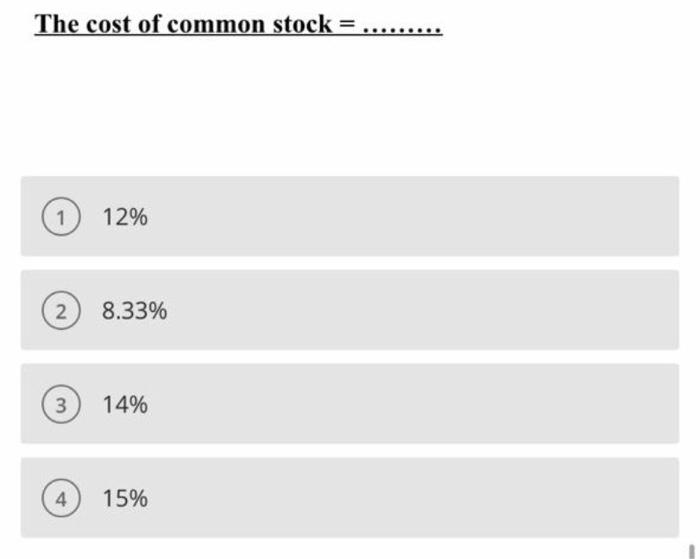

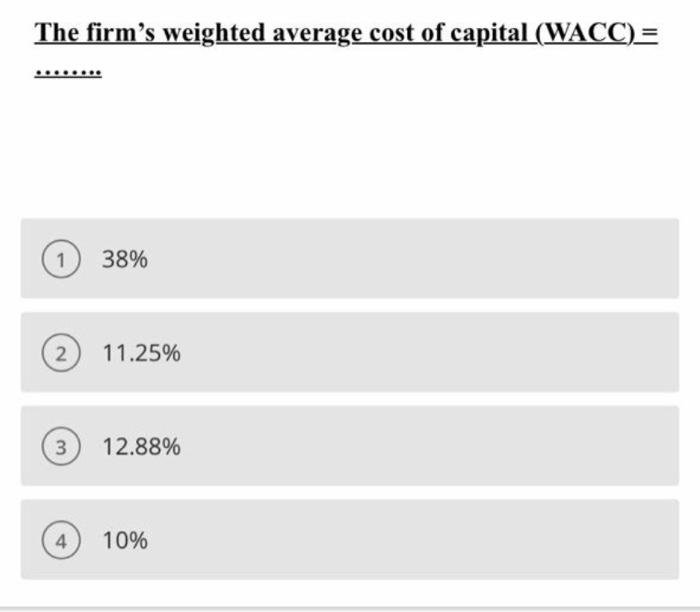

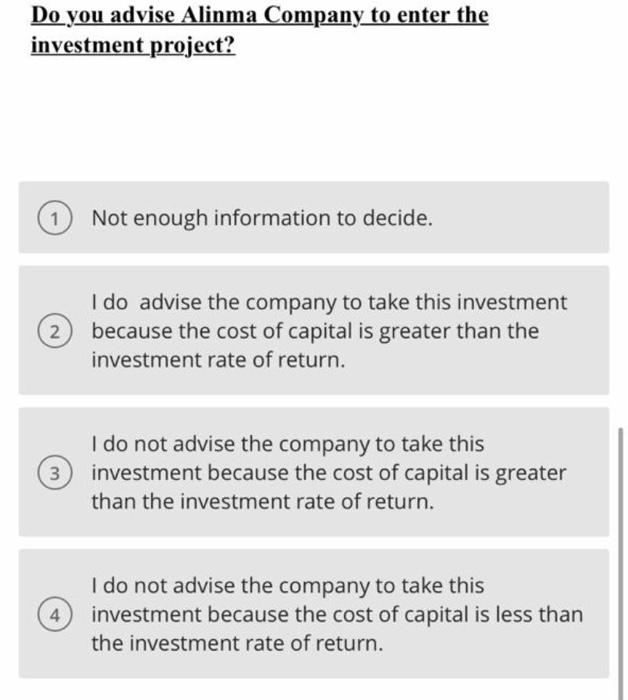

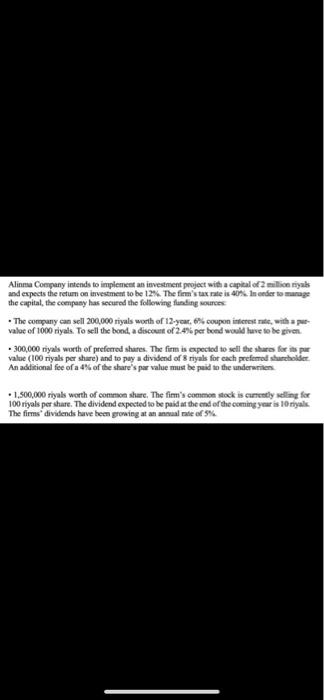

Alinma Company intends to implement an investment project with a capital of 2 million riyaks and expects the retum on investment to be 12%. The firm's tax rate is 40%. In order to manage the capital, the company has secured the following sunding sources The company can sell 200,000 riyals worth of 12-year. 6 coupon interest rate with a pe value of 1000 riyals. To sell the bond, a discount of 2.4% per bond would love to be given. . 300,000 riyals worth of preferred shares. The firm is expected to sell the shares for its par Value (100 riyals per share) and to pay a dividend of 8 nyals for each prefere shareholder An additional fee of a 4% of the share's par value must be paid to the underwriten 1,500,000 riyals worth of common share. The firm's common stock is currently ding for 100 riyals per share. The dividend expected to be paid at the end of the coming year is 10 riyal The firms dividends have been growing at an annual rate of 5% The after-tax cost of debt 3.77% 2 6.28 % w 3.2% 2.8% The cost of preferred stock =....... 8.33% 2 15% 3 8.8% 9.32% The cost of common stock 1 12% 2 8.33% 3 14% 4 15% The firm's weighted average cost of capital (WACC) = 1 38% 2 11.25% 3 12.88% 4 10% Do you advise Alinma Company to enter the investment project? Not enough information to decide. 2 I do advise the company to take this investment because the cost of capital is greater than the investment rate of return. 3 3 I do not advise the company to take this investment because the cost of capital is greater than the investment rate of return. 4 I do not advise the company to take this investment because the cost of capital is less than the investment rate of return. Alinma Company intends to implement an investment project with a capital of 2 million riyaks and expects the retum on investment to be 12%. The firm's tax rate is 40%. In order to manage the capital, the company has secured the following sunding sources The company can sell 200,000 riyals worth of 12-year. 6 coupon interest rate with a pe value of 1000 riyals. To sell the bond, a discount of 2.4% per bond would love to be given. . 300,000 riyals worth of preferred shares. The firm is expected to sell the shares for its par Value (100 riyals per share) and to pay a dividend of 8 nyals for each prefere shareholder An additional fee of a 4% of the share's par value must be paid to the underwriten 1,500,000 riyals worth of common share. The firm's common stock is currently ding for 100 riyals per share. The dividend expected to be paid at the end of the coming year is 10 riyal The firms dividends have been growing at an annual rate of 5% The after-tax cost of debt 3.77% 2 6.28 % w 3.2% 2.8% The cost of preferred stock =....... 8.33% 2 15% 3 8.8% 9.32% The cost of common stock 1 12% 2 8.33% 3 14% 4 15% The firm's weighted average cost of capital (WACC) = 1 38% 2 11.25% 3 12.88% 4 10% Do you advise Alinma Company to enter the investment project? Not enough information to decide. 2 I do advise the company to take this investment because the cost of capital is greater than the investment rate of return. 3 3 I do not advise the company to take this investment because the cost of capital is greater than the investment rate of return. 4 I do not advise the company to take this investment because the cost of capital is less than the investment rate of return