Answered step by step

Verified Expert Solution

Question

1 Approved Answer

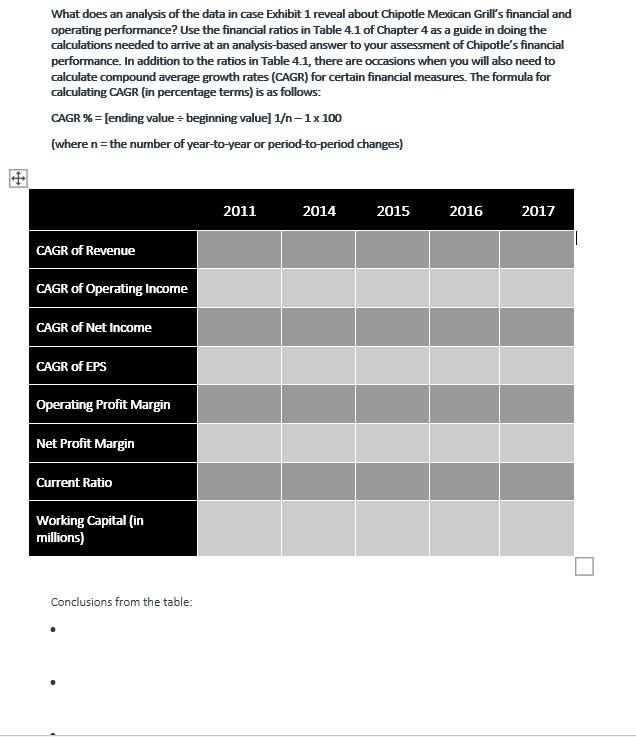

What does an analysis of the data in case Exhibit 1 reveal about Chipotle Mexican Grill's financial and operating performance? Use the financial ratios

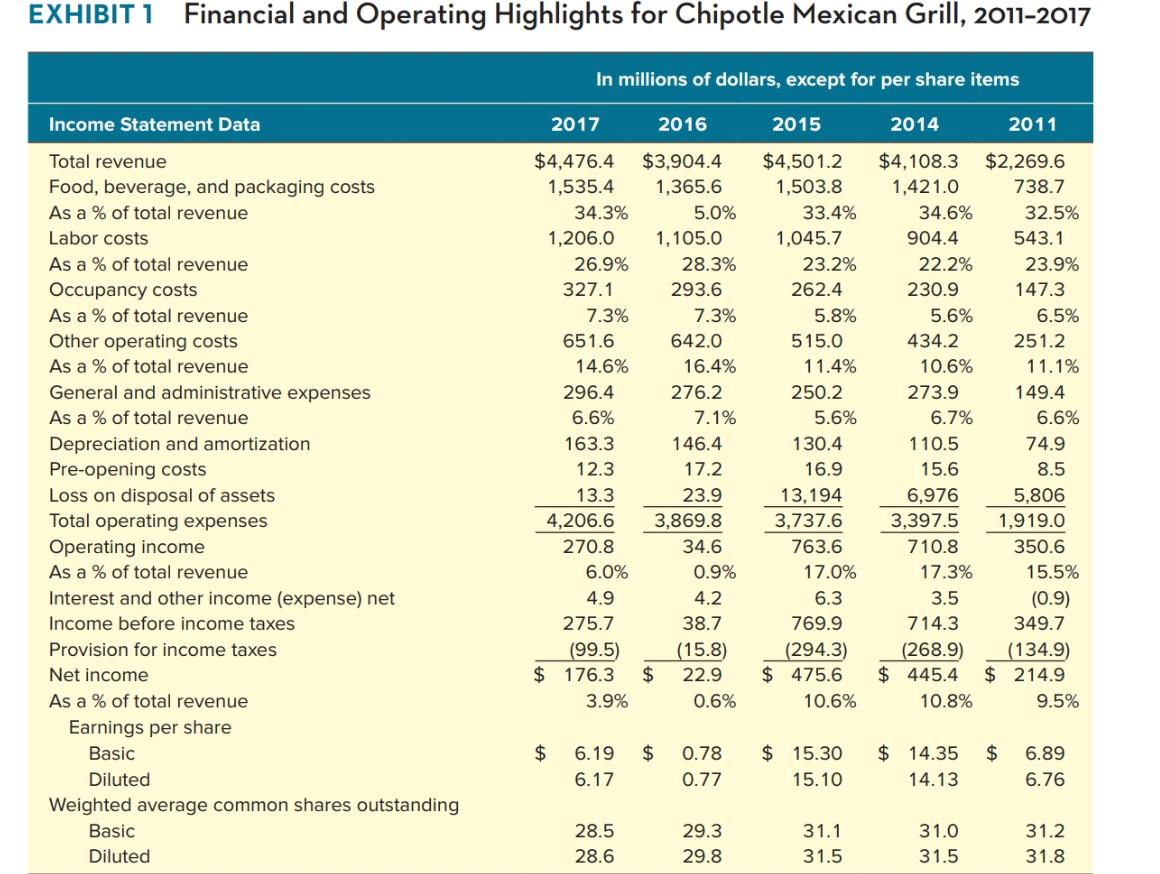

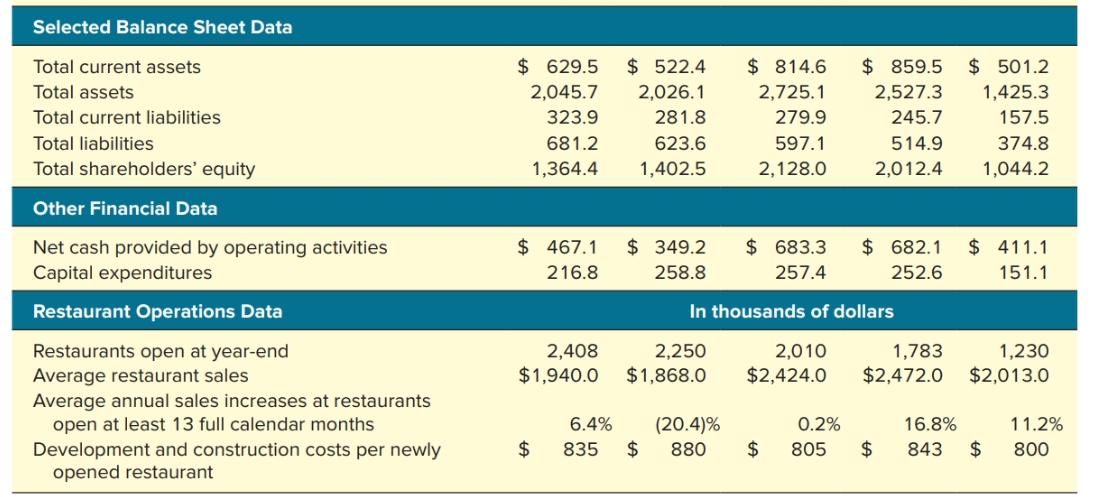

What does an analysis of the data in case Exhibit 1 reveal about Chipotle Mexican Grill's financial and operating performance? Use the financial ratios in Table 4.1 of Chapter 4 as a guide in doing the calculations needed to arrive at an analysis-based answer to your assessment of Chipotle's financial performance. In addition to the ratios in Table 4.1, there are occasions when you will also need to calculate compound average growth rates (CAGR) for certain financial measures. The formula for calculating CAGR (in percentage terms) is as follows: CAGR % = [ending value = beginning value] 1/n-1x 100 (where n= the number of year-to-year or period-to-period changes) 2011 2014 2015 2016 2017 CAGR of Revenue CAGR of Operating Income CAGR of Net Income CAGR of EPS Operating Profit Margin Net Profit Margin Current Ratio Working Capital (in millions) Conclusions from the table: EXHIBIT 1 Financial and Operating Highlights for Chipotle Mexican Grill, 2011-2017 In millions of dollars, except for per share items Income Statement Data 2017 2016 2015 2014 2011 Total revenue $4,476.4 $3,904.4 $4,501.2 $4,108.3 $2,269.6 738.7 Food, beverage, and packaging costs As a % of total revenue 1,535.4 1,365.6 1,503.8 1,421.0 34.3% 5.0% 33.4% 34.6% 32.5% Labor costs 1,206.0 1,105.0 1,045.7 904.4 543.1 As a % of total revenue Occupancy costs As a % of total revenue 26.9% 28.3% 23.2% 22.2% 23.9% 327.1 293.6 262.4 230.9 147.3 7.3% 7.3% 5.8% 5.6% 6.5% Other operating costs As a % of total revenue 651.6 642.0 515.0 434.2 251.2 14.6% 16.4% 11.4% 10.6% 11.1% General and administrative expenses 296.4 276.2 250.2 273.9 149.4 As a % of total revenue 6.6% 7.1% 5.6% 6.7% 6.6% Depreciation and amortization 163.3 146.4 130.4 110.5 74.9 Pre-opening costs Loss on disposal of assets Total operating expenses Operating income As a % of total revenue 12.3 17.2 16.9 15.6 8.5 13.3 23.9 13,194 6,976 5,806 4,206.6 3,869.8 3,737.6 3,397.5 1,919.0 270.8 34.6 763.6 710.8 350.6 6.0% 0.9% 17.0% 17.3% 15.5% Interest and other income (expense) net Income before income taxes 4.9 4.2 6.3 3.5 (0.9) 275.7 38.7 769.9 714.3 349.7 (15.8) 2$ Provision for income taxes (99.5) (294.3) $ 475.6 (268.9) $ 445.4 (134.9) Net income $ 176.3 22.9 $ 214.9 As a % of total revenue 3.9% 0.6% 10.6% 10.8% 9.5% Earnings per share Basic $ 6.19 $ 0.78 $ 15.30 $ 14.35 $ 6.89 Diluted 6.17 0.77 15.10 14.13 6.76 Weighted average common shares outstanding Basic 28.5 29.3 31.1 31.0 31.2 Diluted 28.6 29.8 31.5 31.5 31.8 Selected Balance Sheet Data Total current assets $ 629.5 $ 522.4 $ 814.6 $ 859.5 $ 501.2 Total assets 2,045.7 2,026.1 2,725.1 2,527.3 1,425.3 Total current liabilities 323.9 281.8 279.9 245.7 157.5 Total liabilities 681.2 623.6 597.1 514.9 374.8 Total shareholders' equity 1,364.4 1,402.5 2,128.0 2,012.4 1,044.2 Other Financial Data $ 467.1 $ 349.2 $ 683.3 $ 682.1 $ 411.1 Net cash provided by operating activities Capital expenditures 216.8 258.8 257.4 252.6 151.1 Restaurant Operations Data In thousands of dollars Restaurants open at year-end Average restaurant sales Average annual sales increases at restaurants open at least 13 full calendar months 2,250 $1,868.0 1,230 $2,013.0 2,010 2,408 $1,940.0 1,783 $2,472.0 $2,424.0 (20.4)% 2$ 6.4% 0.2% 16.8% 11.2% 24 $ 24 $ Development and construction costs per newly opened restaurant 835 880 805 843 800

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Analysis of the table shows that the financial performance of the Chipotle Mexican Grill indicates s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started