Answered step by step

Verified Expert Solution

Question

1 Approved Answer

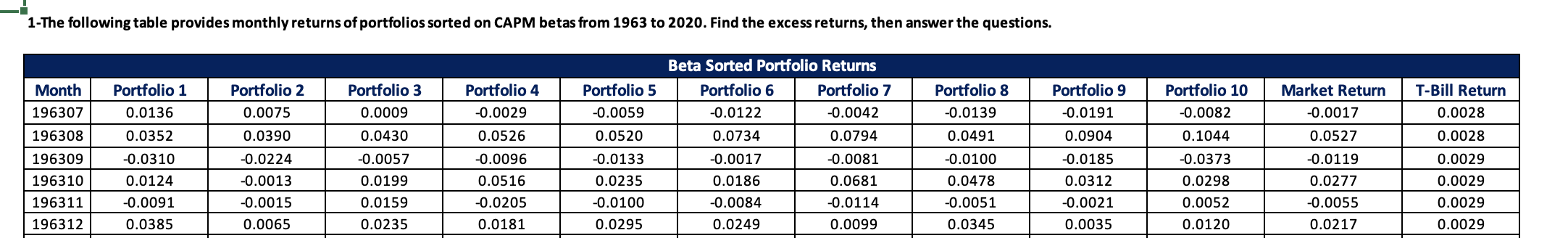

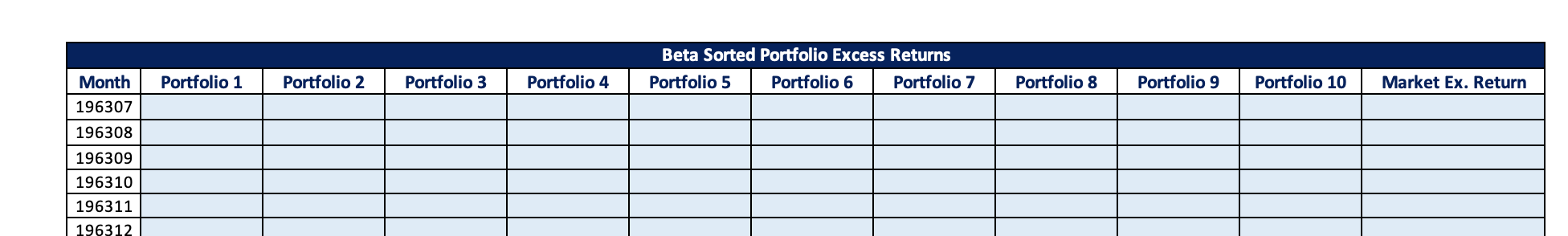

What formula do I use in Excel? 1-The following table provides monthly returns of portfolios sorted on CAPM betas from 1963 to 2020. Find the

What formula do I use in Excel?

1-The following table provides monthly returns of portfolios sorted on CAPM betas from 1963 to 2020. Find the excess returns, then answer the questions. Month Portfolio 8 Portfolio 1 0.0136 Portfolio 2 0.0075 Portfolio 4 -0.0029 Beta Sorted Portfolio Returns Portfolio 6 Portfolio 7 -0.0122 -0.0042 0.0734 0.0794 Portfolio 9 -0.0191 Portfolio 10 -0.0082 T-Bill Return 0.0028 196307 -0.0139 0.0491 196308 0.0526 0.0904 0.1044 0.0028 196309 196310 0.0352 -0.0310 0.0124 -0.0091 0.0385 -0.0185 Portfolio 3 0.0009 0.0430 -0.0057 0.0199 0.0159 0.0235 0.0390 -0.0224 -0.0013 -0.0015 0.0065 Portfolio 5 -0.0059 0.0520 -0.0133 0.0235 -0.0100 0.0295 -0.0096 0.0516 -0.0205 0.0181 -0.0081 0.0681 -0.0114 0.0029 0.0029 -0.0017 0.0186 -0.0084 0.0249 0.0312 Market Return -0.0017 0.0527 -0.0119 0.0277 -0.0055 0.0217 -0.0100 0.0478 -0.0051 0.0345 -0.0373 0.0298 0.0052 0.0120 196311 196312 -0.0021 0.0035 0.0029 0.0029 0.0099 Beta Sorted Portfolio Excess Returns Portfolio 5 Portfolio 6 Portfolio 7 Portfolio 1 Portfolio 2 Portfolio 3 Portfolio 4 Portfolio 8 Portfolio 9 Portfolio 10 Market Ex. Return Month 196307 196308 196309 196310 196311 196312 1-The following table provides monthly returns of portfolios sorted on CAPM betas from 1963 to 2020. Find the excess returns, then answer the questions. Month Portfolio 8 Portfolio 1 0.0136 Portfolio 2 0.0075 Portfolio 4 -0.0029 Beta Sorted Portfolio Returns Portfolio 6 Portfolio 7 -0.0122 -0.0042 0.0734 0.0794 Portfolio 9 -0.0191 Portfolio 10 -0.0082 T-Bill Return 0.0028 196307 -0.0139 0.0491 196308 0.0526 0.0904 0.1044 0.0028 196309 196310 0.0352 -0.0310 0.0124 -0.0091 0.0385 -0.0185 Portfolio 3 0.0009 0.0430 -0.0057 0.0199 0.0159 0.0235 0.0390 -0.0224 -0.0013 -0.0015 0.0065 Portfolio 5 -0.0059 0.0520 -0.0133 0.0235 -0.0100 0.0295 -0.0096 0.0516 -0.0205 0.0181 -0.0081 0.0681 -0.0114 0.0029 0.0029 -0.0017 0.0186 -0.0084 0.0249 0.0312 Market Return -0.0017 0.0527 -0.0119 0.0277 -0.0055 0.0217 -0.0100 0.0478 -0.0051 0.0345 -0.0373 0.0298 0.0052 0.0120 196311 196312 -0.0021 0.0035 0.0029 0.0029 0.0099 Beta Sorted Portfolio Excess Returns Portfolio 5 Portfolio 6 Portfolio 7 Portfolio 1 Portfolio 2 Portfolio 3 Portfolio 4 Portfolio 8 Portfolio 9 Portfolio 10 Market Ex. Return Month 196307 196308 196309 196310 196311 196312Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started