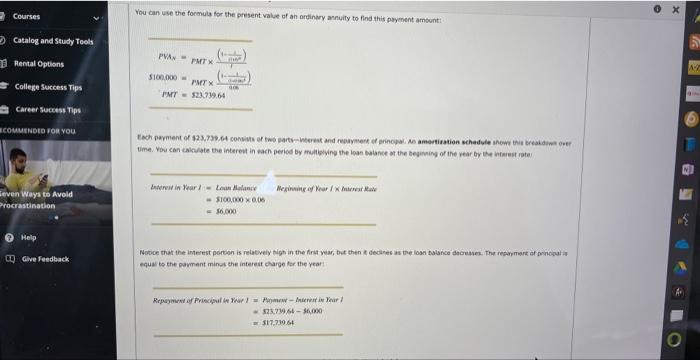

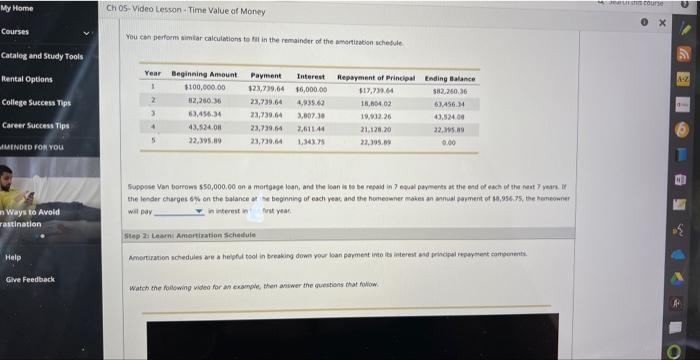

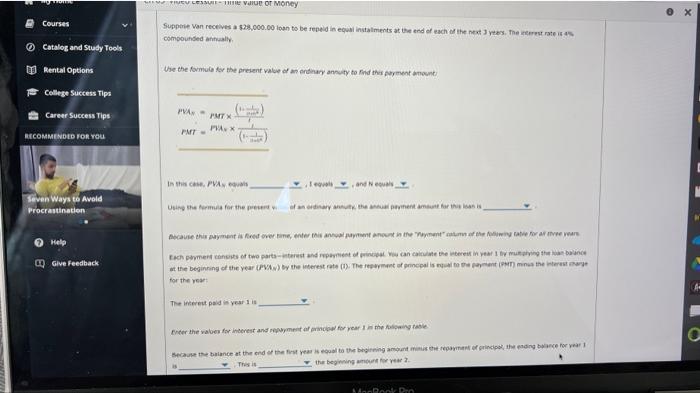

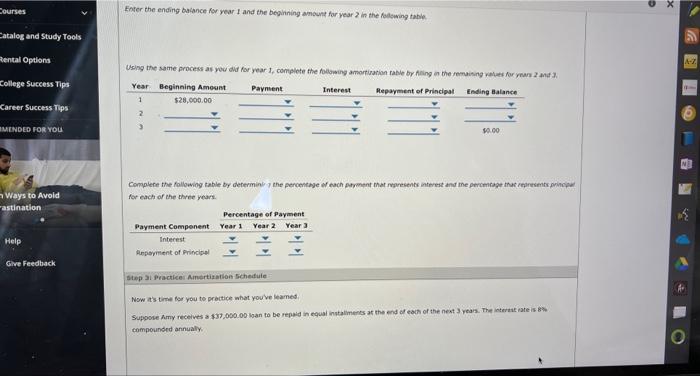

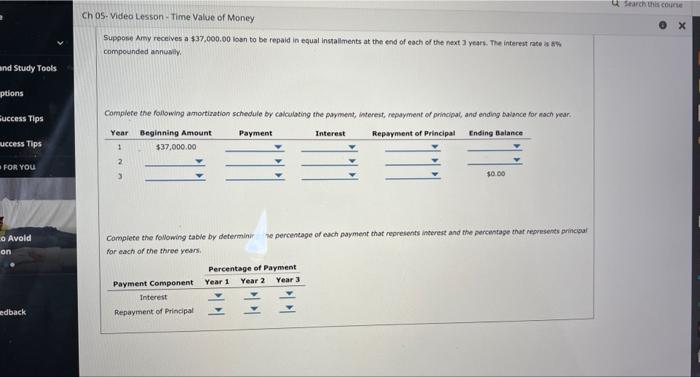

What is an amortized losn? A loan that requeses regular, foed paymervs over the the of the loan. A loon that gets pald off upen the death of the borrower. A loan that requires variable payments for the fint vear and then ford porments for the remainder of the loany term. A table that shows hew the laan will be repaid over time. An amertized foan is a loan that is to be repaid in equal ameunts on a monthiy, questefy, or annual basi, Many loans wuth as car loans, hamn mortgage loans, and twedent loass are paid off ever time in regular, fived instalments, these loans are a great reali iworld apphication of compound interest. For example, wppose a homeowner borrows $100 son a mertgage loan, and the loan is to be repaid in 5 equal payments at the end of esch of. the next 5 years. If the lender charges 6% ont. nce at the beginning of each yeat, what is the payment the homeowner mutt make each year? Given what you know about present value (r+, and future value (FV), you can deduce that the sum of the f of each parment the homeowner makes must add wo to $100,000 =i=13mm You can use the formula for the present value of an ordinery annuity to find this payment amount: Vou can use the focmula for the prisent value of an ortinary annuity to find this payment ambunti PMN=FHT1(1+1,m41 MNT =$23.739.64 equa to the payment minot the interest charge fac the yeari =$33.719Kt3s000=$17.7396t Yeu ceth perform simtar calculations ta fat in the remainder of the amertization schesule, will pay in interest in fric yeat. Step 2. Lami Amertiration schedufe Watch the following video for an exarpie, then aniwer the cuentions that fallow. Supperie Van rectives a 520,000.00 loan to be repeid in equal instalments at the end of each of the next 3 yess. The ireerve rate if 45 compounded afitualy. the the formulo tor the present wille of as eninary annuty to Fid this forment dnosnt: MAN=HMT1(1+1+11) PMPT =FA1(11+11)1 In the cose. Platy edwath for the year: The ifferest paid is year 1 is the beywing amburt ree yeac 2 . Finter the ending bacance for year 1 and the beginning ameunt for year 2 in the folsuming table. for each of the three yeurs. step 31 Practicei Amertization Schedule Now it's time for you to proctice what you've leames, Suppose Amy receives a $37,050.00 han to be repaid in equal instaliments at the end of each of the nent 3 years. The intertat iate is 8 . compounded annualy. Suppose Amy recelves a $37,000.00 loen to be repaid in equal installments at the end of each of the next 3 yearh. The interest nate as sw compounded annitably. Complete the following amortization schedule by calculating the parment, intereit, repayment of princisal, and ending baiance for nach year. Complete the following tade by determinir. re percentage of esch payment that represents interest and the percentage that represents princual for each of the three years