Answered step by step

Verified Expert Solution

Question

1 Approved Answer

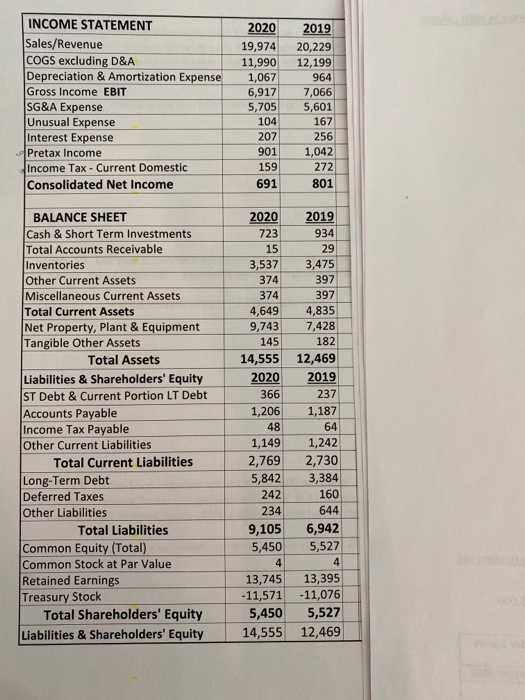

what is the dupont EBT using avg assets equity what is the tax burden? INCOME STATEMENT Sales/Revenue COGS excluding D&A Depreciation & Amortization Expense Gross

what is the dupont EBT using avg assets equity

INCOME STATEMENT Sales/Revenue COGS excluding D&A Depreciation & Amortization Expense Gross Income EBIT SG&A Expense Unusual Expense Interest Expense Pretax Income Income Tax - Current Domestic Consolidated Net Income 2020 19,974 11,990 1,067 6,917 5,705 104 207 901 159 691 2019 20,229 12,199 964 7,066 5,601 167 256 1,042 272 801 BALANCE SHEET Cash & Short Term Investments Total Accounts Receivable Inventories Other Current Assets Miscellaneous Current Assets Total Current Assets Net Property, Plant & Equipment Tangible Other Assets Total Assets Liabilities & Shareholders' Equity ST Debt & Current Portion LT Debt Accounts Payable Income Tax Payable Other Current Liabilities Total Current Liabilities Long-Term Debt Deferred Taxes Other Liabilities Total Liabilities Common Equity (Total) Common Stock at Par Value Retained Earnings Treasury Stock Total Shareholders' Equity Liabilities & Shareholders' Equity 2020 2019 723 934 15 29 3,537 3,475 374 397 374 397 4,649 4,835 9,743 7,428 145 182 14,555 12,469 2020 2019 366 237 1,206 1,187 48 64 1,149 1,242 2,769 2,730 5,842 3,384 242 160 234 644 9,105 6,942 5,450 5,527 4 4 13,745 13,395 -11,571 -11,076 5,450 5,527 14,555 12,469 what is the tax burden?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started