Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the: Gross Margin Profit? Net Profit margin? Total assets turnover ratio? Fixed asset turnover ratio? Current ratio? Cash ratio? Time interest ratio? Price

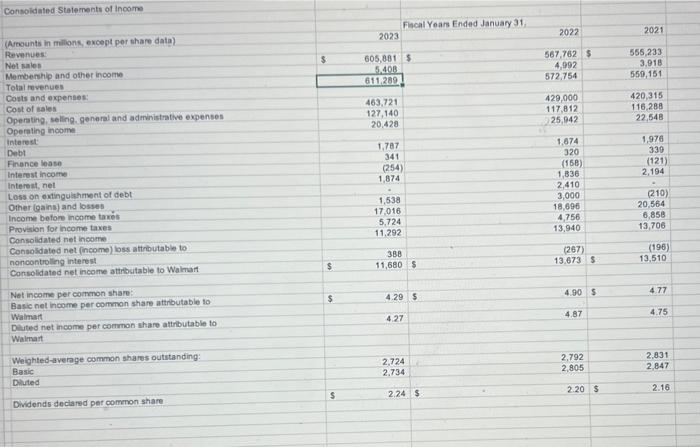

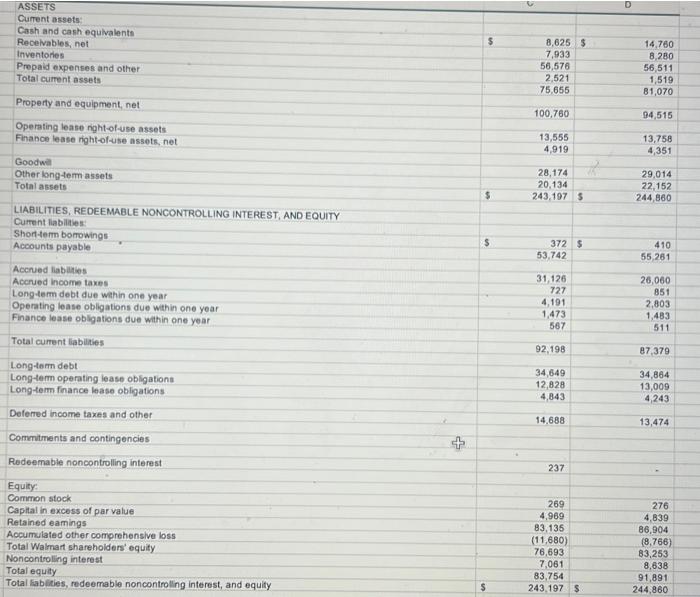

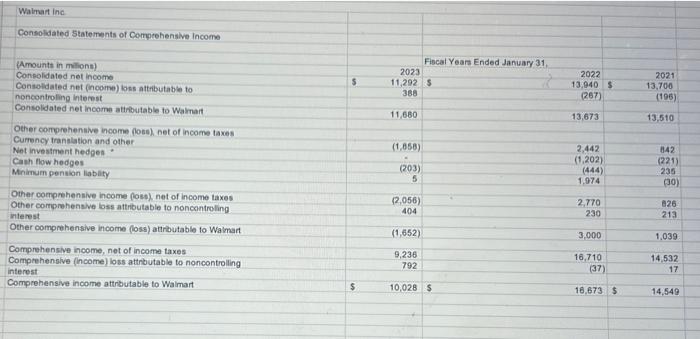

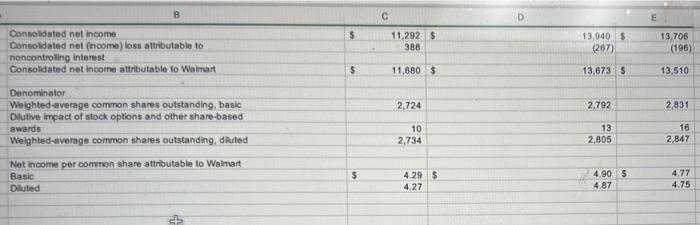

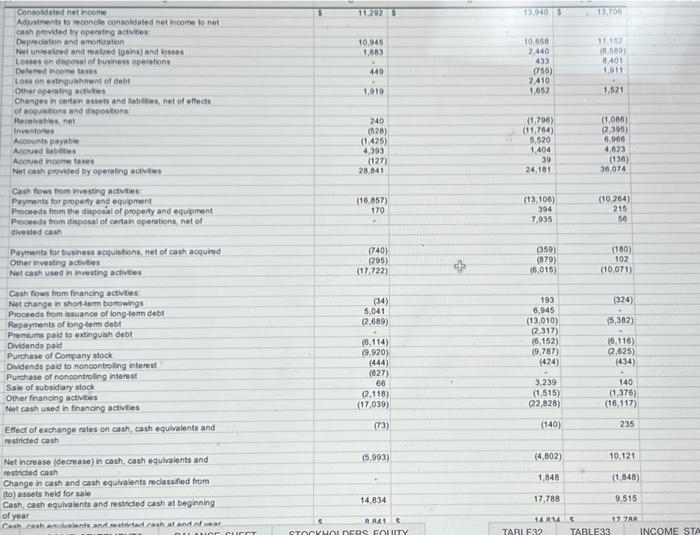

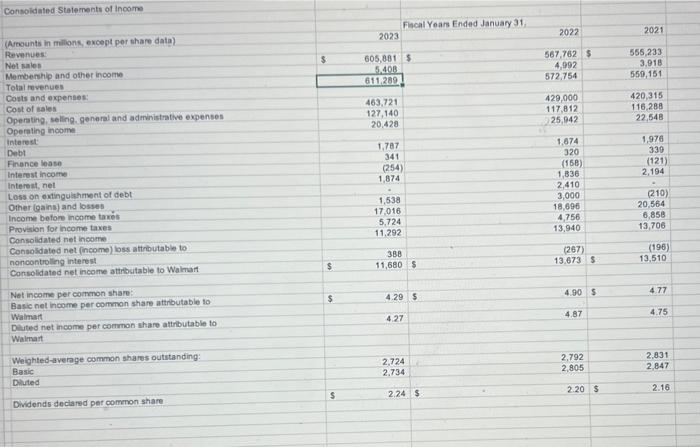

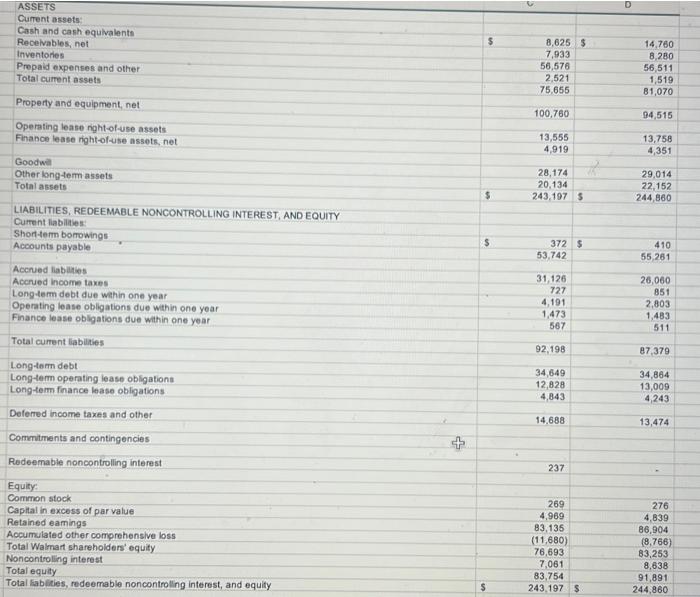

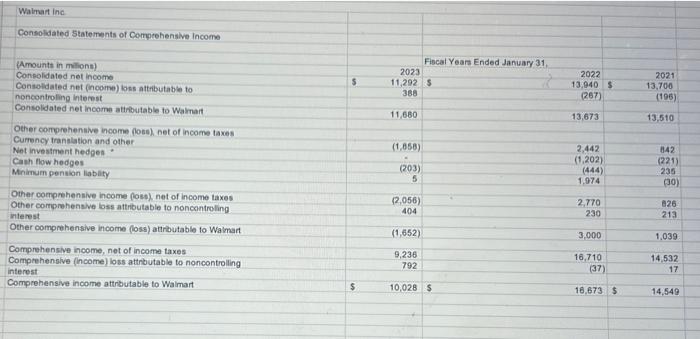

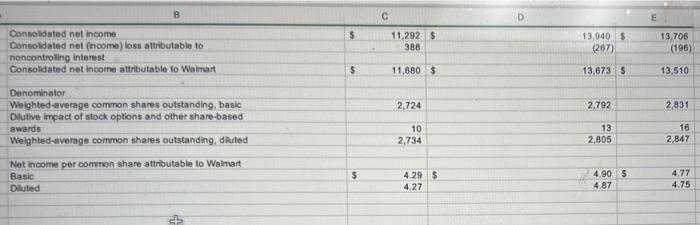

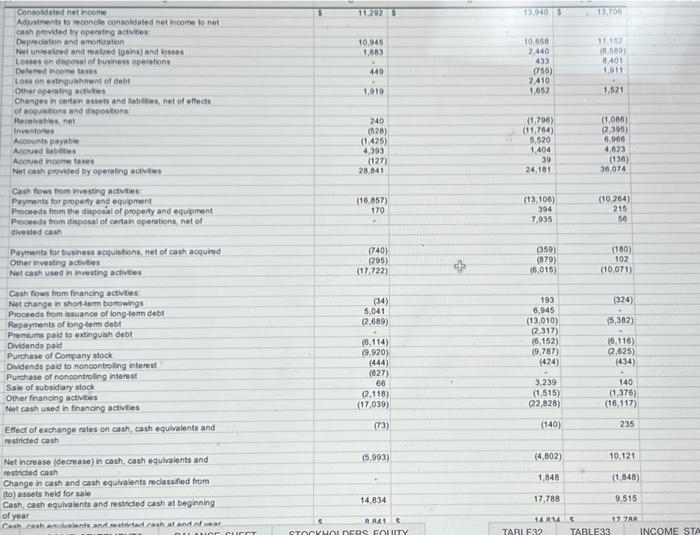

What is the:

Consolideted Staternents of income (Arounts in milligns, excegt por thare data) Revenues: Net sales Membenhip and other income Tolai tovenues \begin{tabular}{|r|} \hline 505,881 \\ \hline 5,408 \\ \hline 611,289 \\ \hline \end{tabular} Covts and expentes: Cost of ales Operating, selling. genoral and administrative expenses Operating inoorme Interest: Debt Finence lease Interest income Interest, net Loss on extingulahment of debt Other (gains) and losses Income befor income taws Provision for income taxes Consolidated net incomp Consoldated net (ncome) loss attributable to noncontrollng interest Consolidated net income attributable to Walmart Net income per cormon share: Basic net income per common shame attrbutable to Waimart Deited net income per common share altributable to Walmast Weighted-avenge common shares outstanding: Basic Dluted Didends declared per common share 52.24$ ASSETS Cument assets: Cash and cach equlvalente Recelvables, net Inventorles Prepaid expenses and other Total current assets Property and equipment, net Operating lease nght-of-use assets Finabce lease right-of-use assets, net Goodwill Other longterm assets Total assets LIABILITIES, REDEEMABLE NONCONTROLLING INTEREST, AND EQUITY Cument labilites: Shortem borrowings Accounts payable Accrued liablikes Accrued income taxes Longterm debt due wahin one year Operating lease obligations due within one year Finance lease obligations due within one year Total cument liabilties Longtert debt Longtem operating lease obligation Longtem finance lease obligations Deferred income taxes and other Commitments and contingencies Redeemable noncontrolling interest 237 Equity: Common stock Capital in excess of par value Retained eamings Aocumulated other comprehensive loss Total Walmart shareholders' equity Noncontroling interest Total equily Total kablities, redeemable noncontrolling interest, and equity Walmart inc Consolidated Statements of Compcehensive income Wmounts in miliont) Fiscal Years Ended January 31, Conpolidated net incomo Consoldated net (noome) loss attributable to noncontroling interst Consoldated net income attibutable to Walmait \begin{tabular}{|r|r|r|r|} \hline 2023 & & & \\ \hline 11,292 & 5 & 2022 & 2021 \\ \hline 388 & 13,040 & 5 & 13,700 \\ \hline 11,680 & (267) & (106) \\ \hline \end{tabular} Other comprehentive income (lose), net of income taxes Cumency tranalation and oaher Net investment hedgen Cash flow hedges Mrimum pension liablity \begin{tabular}{|c|c|} \hline 2,442 & 042 \\ (1,202) & (221) \\ (444) & 235 \\ 1,074 & (30) \\ \hline \end{tabular} Other compmehensive income (lost) net of income taxes Other comprenensive loss attributable to noncontroling interest Other comprehensive income (oss) attrbutable to Waimart Comprehensive income, net of income taxes Comprehensive (income) loss attributable to noncontrolling interest Comprehensive income attrbutable to Waimart Comprenensive income attrbutable to Wamart $ \begin{tabular}{|r|} \hline(1,858) \\ (203) \\ 5 \end{tabular} \mid ,056)404(1,652)9,23679210,028 Denominator Weighted average common shares outstanding, basic 2,7922,831 Dlutive impact of stock options and other share-based award 5 Weighted-avernge common shares outstanding, dluted 10 2,734 \begin{tabular}{rr|} \hline 13 & 16 \\ \hline 2,805 & 2,847 \\ \hline \end{tabular} Net income per common share attributable to Walmart Basic Dlled $4.29 $ Consosdated net noome 11,2521=13,94015=13,706 Moputiments to reconcle consoldated net income to net cash preveded by operating actwte: Depreciation and amortuation Net uneatred and reatred (gohv) and bses Loses on copceal of busnets operations Detered heoime takes Lows on wathoulahment of cebe Other operating actyites \begin{tabular}{|r|r|r|} \hline 10,045 & 10,050 & 11,457 \\ \hline 1,683 & 2,440 & (0,5801 \\ \hline 449 & 433 & 0,401 \\ \hline & 055) & 1,011 \\ 1,910 & 2,410 & \\ & 1,652 & 1,521 \\ \hline \end{tabular} Changes h certain assets and labtres, net of effects of Acquintions and dispotzens Phenkables, nel Inventores Acoounis payabie Acorved Bablties Acirved inoome taxes Net cash provifed by operating activites \begin{tabular}{|r|r|r|} \hline 240 & (1,796) & (1,060) \\ (528) & (11,764) & (2,305) \\ (1,426) & 5,520 & 6,066 \\ 4,323 & 1,404 & 4,623 \\ (127) & 30 & (136) \\ \hline 28,841 & 24,181 & 36,074 \\ \hline \end{tabular} Cash fows fom investing actives: Payments for property and equipment Proceeds from the dapotai of propeny and equipment Proceeds trom disposal of certan operations, net of \begin{tabular}{|r|r|r|} \hline(16.857) & (13,106) & (10,264) \\ \hline 170 & 394 & 215 \\ \hline & 7.935 & 56 \\ \hline \end{tabular} divested cash Payenents for business acquiations, net of cash acquired Other investing activites Net cavh used in iveuting actives \begin{tabular}{rrr} (959) & (160) \\ \hline(679) & 102 \\ (5.015) & (10,071) \\ \hline \end{tabular} Cash fowe from financing activites Net change in shortterm booowings Proceeds from issuance of longterm debt Repayments of long-lem debt Premiums paid to extingulah debt Dvidends pald Purchase of Company stock Dividends paid to noncontroling interest Purchase of noncontroling interest Sale of subsidary stock Other francing activtes Net cash used in finanoing activtes Eflect of exchange ntes on cash, cash equiralents and (73) mestricted cash Net increase (decrease) in cash, cash equivalents and restricted cash Change in cash and cash equivalents reclassfied from (to) assets held for sale Cash, cash eguhalents and restricted cash at beginning of year Consolideted Staternents of income (Arounts in milligns, excegt por thare data) Revenues: Net sales Membenhip and other income Tolai tovenues \begin{tabular}{|r|} \hline 505,881 \\ \hline 5,408 \\ \hline 611,289 \\ \hline \end{tabular} Covts and expentes: Cost of ales Operating, selling. genoral and administrative expenses Operating inoorme Interest: Debt Finence lease Interest income Interest, net Loss on extingulahment of debt Other (gains) and losses Income befor income taws Provision for income taxes Consolidated net incomp Consoldated net (ncome) loss attributable to noncontrollng interest Consolidated net income attributable to Walmart Net income per cormon share: Basic net income per common shame attrbutable to Waimart Deited net income per common share altributable to Walmast Weighted-avenge common shares outstanding: Basic Dluted Didends declared per common share 52.24$ ASSETS Cument assets: Cash and cach equlvalente Recelvables, net Inventorles Prepaid expenses and other Total current assets Property and equipment, net Operating lease nght-of-use assets Finabce lease right-of-use assets, net Goodwill Other longterm assets Total assets LIABILITIES, REDEEMABLE NONCONTROLLING INTEREST, AND EQUITY Cument labilites: Shortem borrowings Accounts payable Accrued liablikes Accrued income taxes Longterm debt due wahin one year Operating lease obligations due within one year Finance lease obligations due within one year Total cument liabilties Longtert debt Longtem operating lease obligation Longtem finance lease obligations Deferred income taxes and other Commitments and contingencies Redeemable noncontrolling interest 237 Equity: Common stock Capital in excess of par value Retained eamings Aocumulated other comprehensive loss Total Walmart shareholders' equity Noncontroling interest Total equily Total kablities, redeemable noncontrolling interest, and equity Walmart inc Consolidated Statements of Compcehensive income Wmounts in miliont) Fiscal Years Ended January 31, Conpolidated net incomo Consoldated net (noome) loss attributable to noncontroling interst Consoldated net income attibutable to Walmait \begin{tabular}{|r|r|r|r|} \hline 2023 & & & \\ \hline 11,292 & 5 & 2022 & 2021 \\ \hline 388 & 13,040 & 5 & 13,700 \\ \hline 11,680 & (267) & (106) \\ \hline \end{tabular} Other comprehentive income (lose), net of income taxes Cumency tranalation and oaher Net investment hedgen Cash flow hedges Mrimum pension liablity \begin{tabular}{|c|c|} \hline 2,442 & 042 \\ (1,202) & (221) \\ (444) & 235 \\ 1,074 & (30) \\ \hline \end{tabular} Other compmehensive income (lost) net of income taxes Other comprenensive loss attributable to noncontroling interest Other comprehensive income (oss) attrbutable to Waimart Comprehensive income, net of income taxes Comprehensive (income) loss attributable to noncontrolling interest Comprehensive income attrbutable to Waimart Comprenensive income attrbutable to Wamart $ \begin{tabular}{|r|} \hline(1,858) \\ (203) \\ 5 \end{tabular} \mid ,056)404(1,652)9,23679210,028 Denominator Weighted average common shares outstanding, basic 2,7922,831 Dlutive impact of stock options and other share-based award 5 Weighted-avernge common shares outstanding, dluted 10 2,734 \begin{tabular}{rr|} \hline 13 & 16 \\ \hline 2,805 & 2,847 \\ \hline \end{tabular} Net income per common share attributable to Walmart Basic Dlled $4.29 $ Consosdated net noome 11,2521=13,94015=13,706 Moputiments to reconcle consoldated net income to net cash preveded by operating actwte: Depreciation and amortuation Net uneatred and reatred (gohv) and bses Loses on copceal of busnets operations Detered heoime takes Lows on wathoulahment of cebe Other operating actyites \begin{tabular}{|r|r|r|} \hline 10,045 & 10,050 & 11,457 \\ \hline 1,683 & 2,440 & (0,5801 \\ \hline 449 & 433 & 0,401 \\ \hline & 055) & 1,011 \\ 1,910 & 2,410 & \\ & 1,652 & 1,521 \\ \hline \end{tabular} Changes h certain assets and labtres, net of effects of Acquintions and dispotzens Phenkables, nel Inventores Acoounis payabie Acorved Bablties Acirved inoome taxes Net cash provifed by operating activites \begin{tabular}{|r|r|r|} \hline 240 & (1,796) & (1,060) \\ (528) & (11,764) & (2,305) \\ (1,426) & 5,520 & 6,066 \\ 4,323 & 1,404 & 4,623 \\ (127) & 30 & (136) \\ \hline 28,841 & 24,181 & 36,074 \\ \hline \end{tabular} Cash fows fom investing actives: Payments for property and equipment Proceeds from the dapotai of propeny and equipment Proceeds trom disposal of certan operations, net of \begin{tabular}{|r|r|r|} \hline(16.857) & (13,106) & (10,264) \\ \hline 170 & 394 & 215 \\ \hline & 7.935 & 56 \\ \hline \end{tabular} divested cash Payenents for business acquiations, net of cash acquired Other investing activites Net cavh used in iveuting actives \begin{tabular}{rrr} (959) & (160) \\ \hline(679) & 102 \\ (5.015) & (10,071) \\ \hline \end{tabular} Cash fowe from financing activites Net change in shortterm booowings Proceeds from issuance of longterm debt Repayments of long-lem debt Premiums paid to extingulah debt Dvidends pald Purchase of Company stock Dividends paid to noncontroling interest Purchase of noncontroling interest Sale of subsidary stock Other francing activtes Net cash used in finanoing activtes Eflect of exchange ntes on cash, cash equiralents and (73) mestricted cash Net increase (decrease) in cash, cash equivalents and restricted cash Change in cash and cash equivalents reclassfied from (to) assets held for sale Cash, cash eguhalents and restricted cash at beginning of year Gross Margin Profit?

Net Profit margin?

Total assets turnover ratio?

Fixed asset turnover ratio?

Current ratio?

Cash ratio?

Time interest ratio?

Price / Earnings ( P /E )?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started