Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the net salvage value at the end of year 3? Intro You're evaluating a new electron microscope for the QA (quality assurance) unit.

What is the net salvage value at the end of year 3?

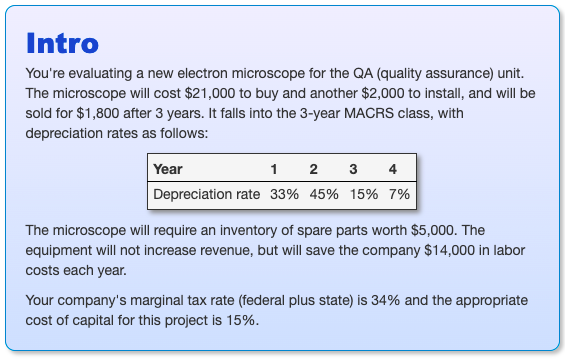

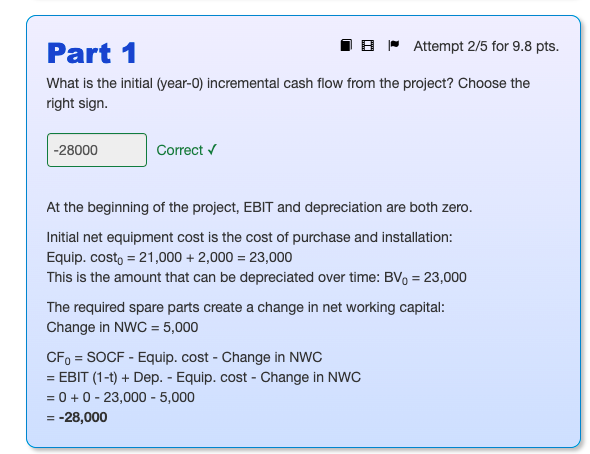

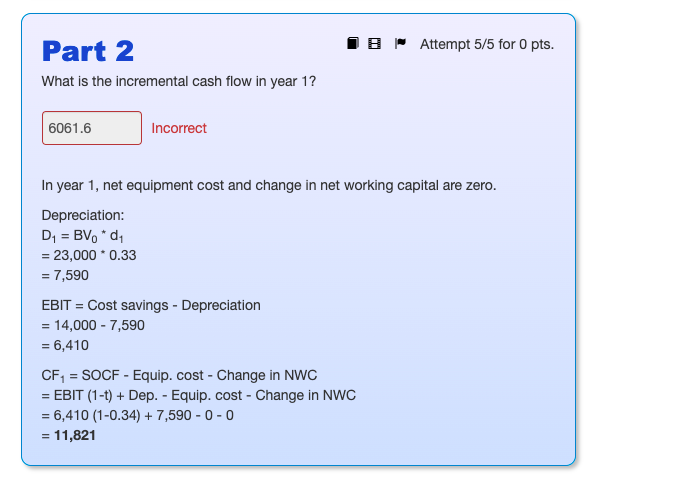

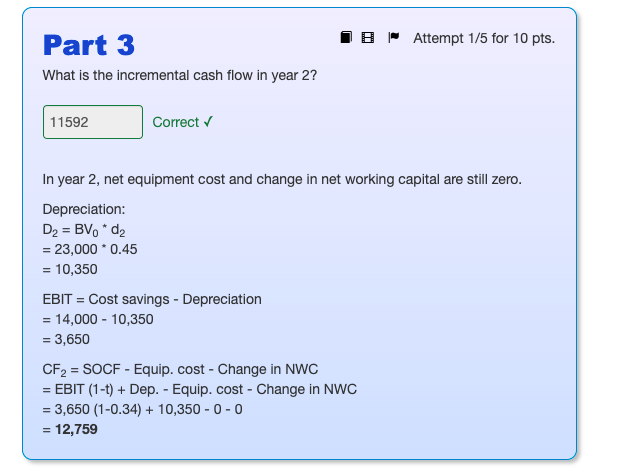

Intro You're evaluating a new electron microscope for the QA (quality assurance) unit. The microscope will cost $21,000 to buy and another $2,000 to install, and will be sold for $1,800 after 3 years. It falls into the 3-year MACRS class, with depreciation rates as follows: Year 1 2 3 4 Depreciation rate 33% 45% 15% 7% The microscope will require an inventory of spare parts worth $5,000. The equipment will not increase revenue, but will save the company $14,000 in labor costs each year. Your company's marginal tax rate (federal plus state) is 34% and the appropriate cost of capital for this project is 15%. Part 1 BAttempt 2/5 for 9.8 pts. What is the initial (year-0) incremental cash flow from the project? Choose the right sign. -28000 Correct At the beginning of the project, EBIT and depreciation are both zero. Initial net equipment cost is the cost of purchase and installation: Equip. costo = 21,000 + 2,000 = 23,000 This is the amount that can be depreciated over time: BV = 23,000 The required spare parts create a change in net working capital: Change in NWC = 5,000 CF = SOCF - Equip. cost - Change in NWC = EBIT (1-t) + Dep. - Equip. cost - Change in NWC = 0 +0 -23,000 - 5,000 = -28,000 BAttempt 5/5 for 0 pts. Part 2 What is the incremental cash flow in year 1? 6061.6 Incorrect In year 1, net equipment cost and change in net working capital are zero. Depreciation: D = BV * d = 23,000*0.33 = 7,590 EBIT = Cost savings - Depreciation = 14,000 - 7,590 = 6,410 CF = SOCF - Equip. cost - Change in NWC = EBIT (1-t) + Dep. - Equip. cost - Change in NWC = 6,410 (1-0.34) + 7,590-0-0 = 11,821 Part 3 BAttempt 1/5 for 10 pts. What is the incremental cash flow in year 2? 11592 Correct In year 2, net equipment cost and change in net working capital are still zero. Depreciation: D = BV0 * d = 23,000 * 0.45 = 10,350 EBIT = Cost savings - Depreciation = 14,000 - 10,350 = 3,650 CF = SOCF - Equip. cost - Change in NWC = EBIT (1-t) + Dep. - Equip. cost - Change in NWC = 3,650 (1-0.34) +10,350-0-0 = 12,759

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started