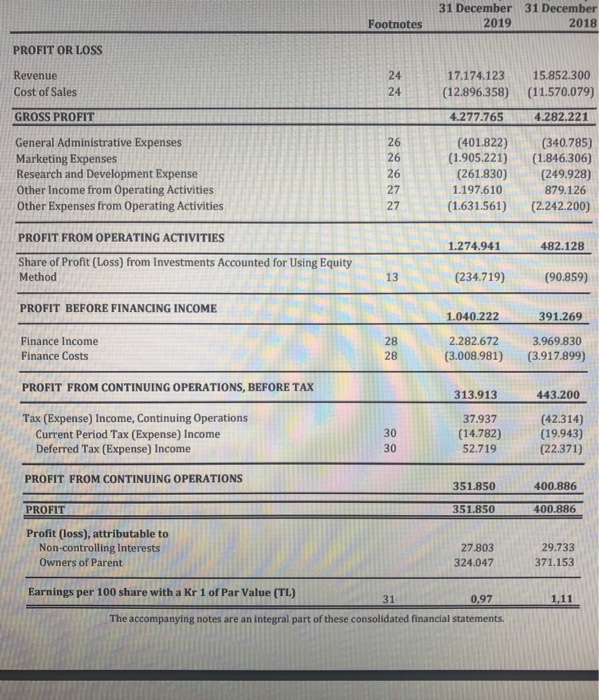

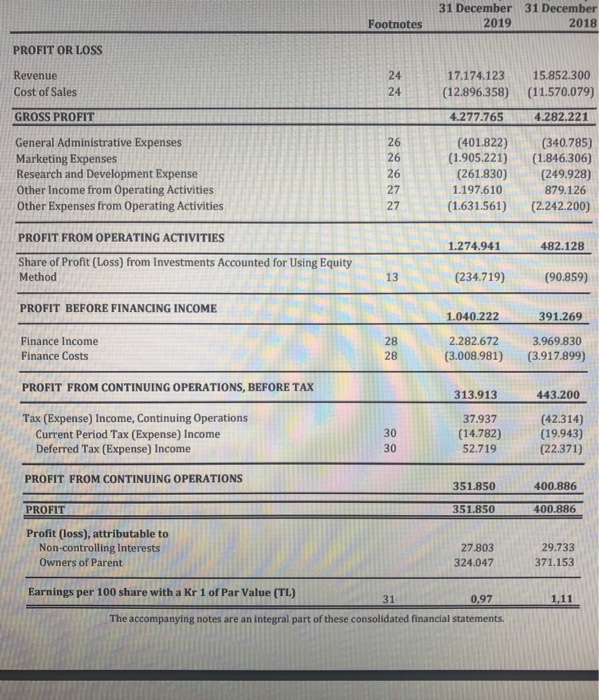

What is this company EBIT and EBITDA?

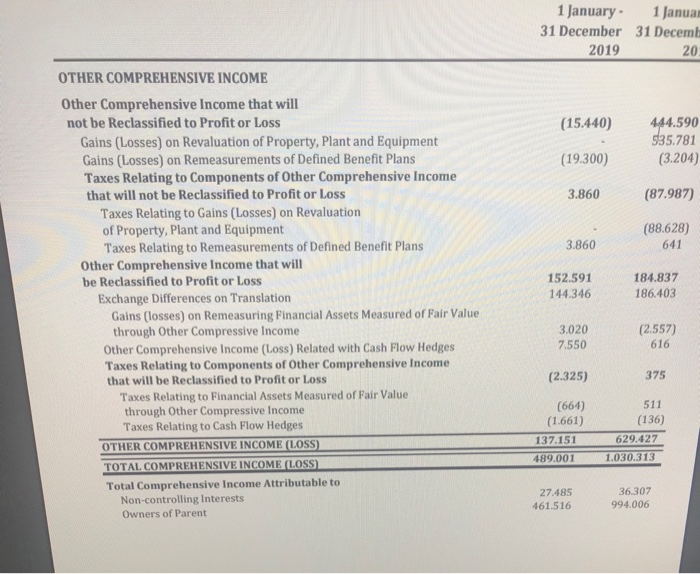

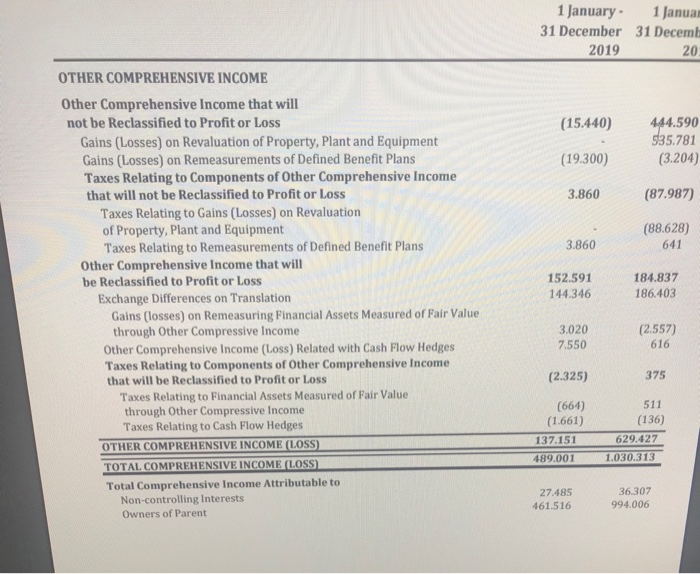

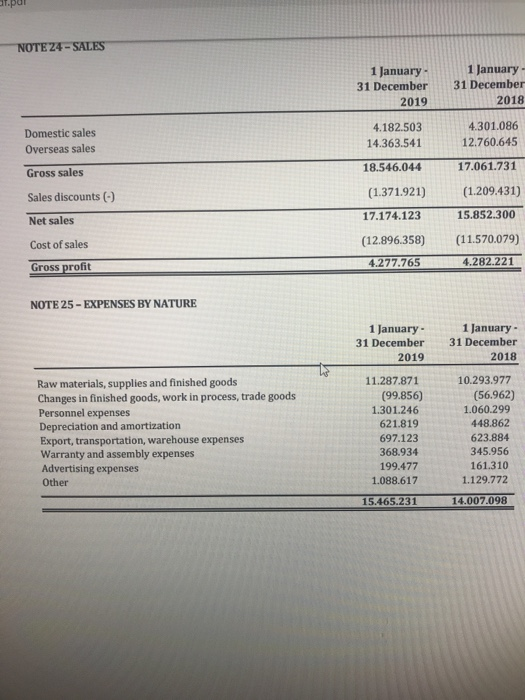

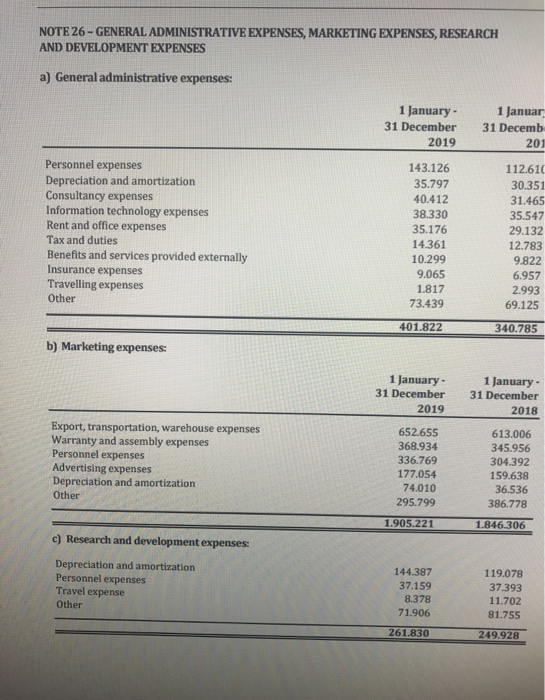

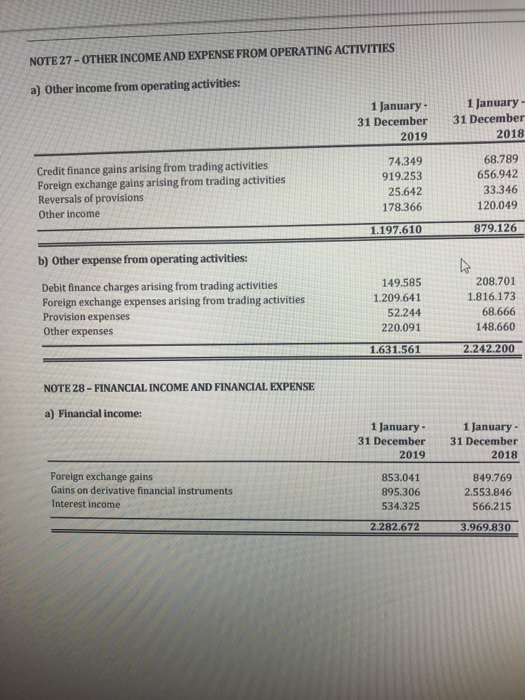

31 December 31 December 2019 2018 Footnotes PROFIT OR LOSS Revenue Cost of Sales 24 24 17.174.123 (12.896.358) 4.277.765 15.852.300 (11.570.079) 4.282.221 GROSS PROFIT General Administrative Expenses Marketing Expenses Research and Development Expense Other Income from Operating Activities Other Expenses from Operating Activities 26 26 26 27 27 (401.822) (1.905.221) (261.830) 1.197.610 (1.631.561) (340.785) (1.846.306) (249.928) 879.126 (2.242.200) 1.274.941 482.128 PROFIT FROM OPERATING ACTIVITIES Share of Profit (Loss) from Investments Accounted for Using Equity Method 13 (234.719) (90.859) PROFIT BEFORE FINANCING INCOME 1.040.222 391.269 Finance Income Finance Costs 28 28 2.282.672 (3.008.981) 3.969.830 (3.917.899) PROFIT FROM CONTINUING OPERATIONS, BEFORE TAX 313.913 443.200 Tax (Expense) Income, Continuing Operations Current Period Tax (Expense) Income Deferred Tax (Expense) Income 30 30 37.937 (14.782) 52.719 (42.314) (19.943) (22.371) PROFIT FROM CONTINUING OPERATIONS 351.850 400.886 PROFIT 351.850 400.886 Profit (loss), attributable to Non-controlling Interests Owners of Parent 27.803 324.047 29.733 371.153 1,11 Earnings per 100 share with a Kr 1 of Par Value (TL) 31 0,97 The accompanying notes are an integral part of these consolidated financial statements. 1 January 1 Janual 31 December 31 Decemb 2019 20 (15.440) 444.590 535.781 (3.204) (19.300) 3.860 (87.987) (88.628) 641 3.860 OTHER COMPREHENSIVE INCOME Other Comprehensive Income that will not be Reclassified to Profit or Loss Gains (Losses) on Revaluation of Property, Plant and Equipment Gains (Losses) on Remeasurements of Defined Benefit Plans Taxes Relating to Components of Other Comprehensive Income that will not be Reclassified to Profit or Loss Taxes Relating to Gains (Losses) on Revaluation of Property, Plant and Equipment Taxes Relating to Remeasurements of Defined Benefit Plans Other Comprehensive Income that will be Reclassified to Profit or Loss Exchange Differences on Translation Gains (losses) on Remeasuring Financial Assets Measured of Fair Value through Other Compressive Income Other Comprehensive Income (Loss) Related with Cash Flow Hedges Taxes Relating to Components of Other Comprehensive Income that will be Reclassified to Profit or Loss Taxes Relating to Financial Assets Measured of Fair Value through Other Compressive Income Taxes Relating to Cash Flow Hedges OTHER COMPREHENSIVE INCOME (LOSS) TOTAL COMPREHENSIVE INCOME (LOSS Total Comprehensive Income Attributable to Non-controlling Interests Owners of Parent 152.591 144.346 184.837 186.403 3.020 7.550 (2.557) 616 (2.325) 375 (664) (1.661) 137.151 489.001 511 (136) 629.427 1.030.313 27.485 461.516 36.307 994.006 NOTE 24-SALES 1 January 31 December 2019 1 January - 31 December 2018 4.182.503 14.363.541 4.301.086 12.760.645 18.546.044 17.061.731 (1.371.921) (1.209.431) Domestic sales Overseas sales Gross sales Sales discounts () Net sales Cost of sales Gross profit 17.174.123 15.852.300 (11.570.079) (12.896,358) 4.277.765 4.282.221 NOTE 25 - EXPENSES BY NATURE 1 January 31 December 2019 1 January - 31 December 2018 Raw materials, supplies and finished goods Changes in finished goods, work in process, trade goods Personnel expenses Depreciation and amortization Export, transportation, warehouse expenses Warranty and assembly expenses Advertising expenses Other 11.287.871 (99.856) 1.301.246 621.819 697.123 368.934 199.477 1.088.617 10.293.977 (56.962) 1.060.299 448.862 623.884 345.956 161.310 1.129.772 15.465.231 14.007.098 NOTE 26 - GENERAL ADMINISTRATIVE EXPENSES, MARKETING EXPENSES, RESEARCH AND DEVELOPMENT EXPENSES a) General administrative expenses: 1 January 31 December 2019 1 Januar 31 Decemb 201 Personnel expenses Depreciation and amortization Consultancy expenses Information technology expenses Rent and office expenses Tax and duties Benefits and services provided externally Insurance expenses Travelling expenses Other 143.126 35.797 40.412 38.330 35.176 14.361 10.299 9.065 1.817 73.439 112.610 30.351 31.465 35.547 29.132 12.783 9.822 6.957 2.993 69.125 401.822 340.785 b) Marketing expenses. 1 January - 31 December 2019 1 January 31 December 2018 Export, transportation, warehouse expenses Warranty and assembly expenses Personnel expenses Advertising expenses Depreciation and amortization Other 652.655 368.934 336.769 177.054 74.010 295.799 613.006 345.956 304.392 159.638 36.536 386.778 1.905.221 1.846.306 c) Research and development expenses Depreciation and amortization Personnel expenses Travel expense Other 144.387 37.159 8.378 71.906 119.078 37.393 11.702 81.755 261.830 249.928 NOTE 27 - OTHER INCOME AND EXPENSE FROM OPERATING ACTIVITIES a) Other income from operating activities: 1 January 31 December 2019 1 January 31 December 2018 Credit finance gains arising from trading activities Foreign exchange gains arising from trading activities Reversals of provisions Other income 74.349 919.253 25.642 178.366 68.789 656.942 33.346 120.049 1.197.610 879.126 b) Other expense from operating activities: Debit finance charges arising from trading activities Foreign exchange expenses arising from trading activities Provision expenses Other expenses 149.585 1.209.641 52.244 220.091 208.701 1.816.173 68.666 148.660 1.631.561 2.242.200 NOTE 28 - FINANCIAL INCOME AND FINANCIAL EXPENSE a) Financial income: 1 January - 31 December 2019 1 January - 31 December 2018 Foreign exchange gains Gains on derivative financial instruments Interest income 853.041 895.306 534.325 849.769 2.553.846 566.215 2.282.672 3.969.830