Answered step by step

Verified Expert Solution

Question

1 Approved Answer

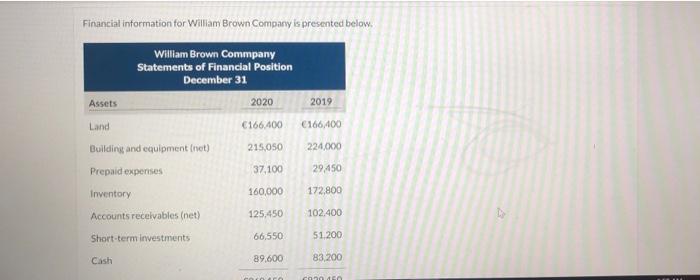

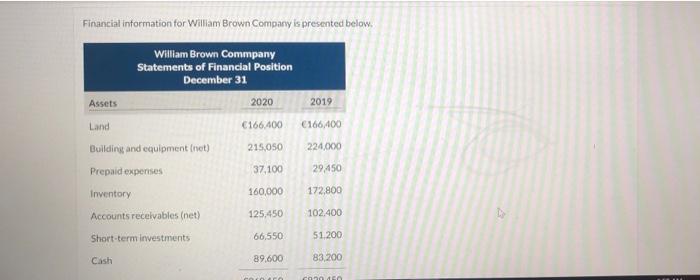

what the right answer ? Financial information for William Brown Company is presented below. William Brown Commpany Statements of Financial Position December 31 Assets 2020

what the right answer ?

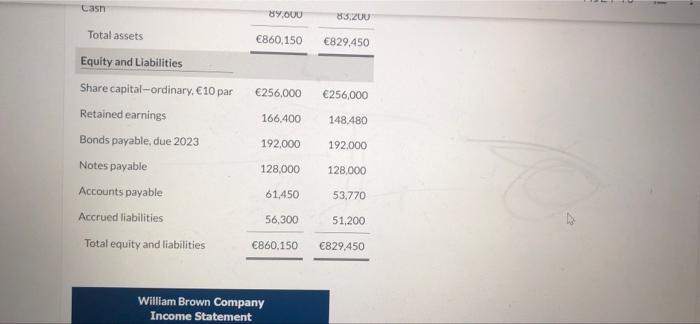

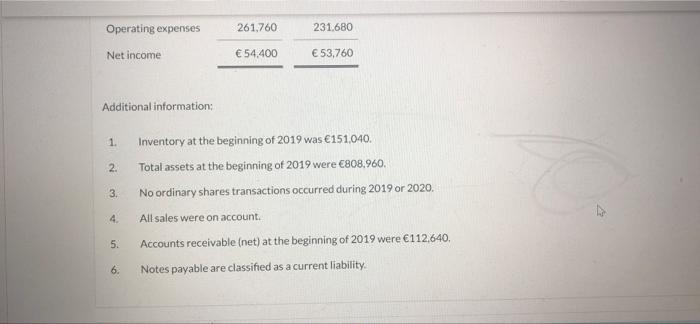

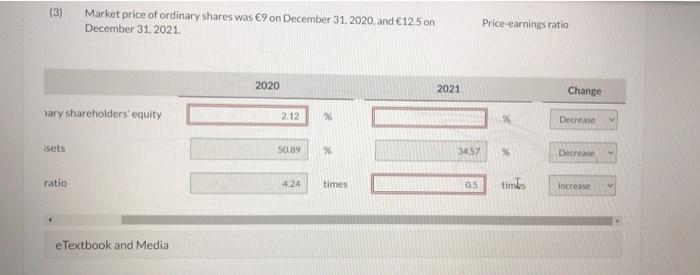

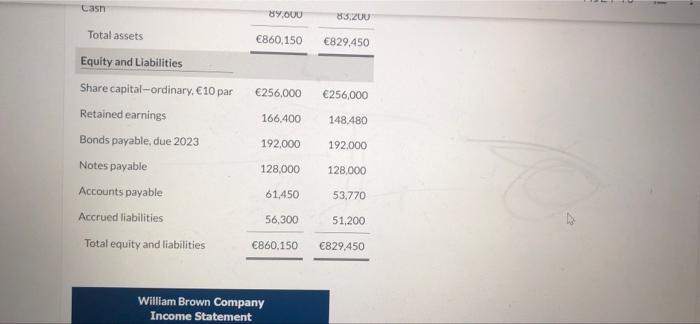

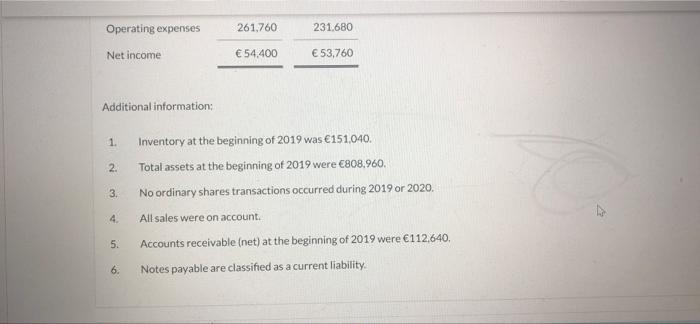

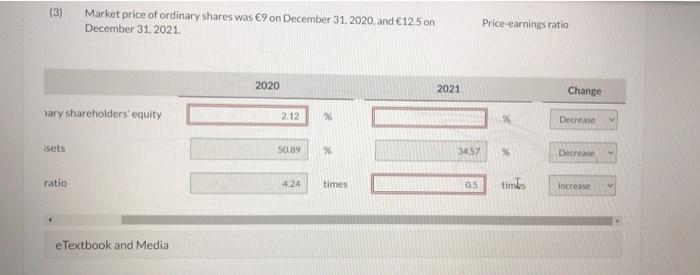

Financial information for William Brown Company is presented below. William Brown Commpany Statements of Financial Position December 31 Assets 2020 2019 Land 166.400 166,400 Building and equipment (net) 215,050 224,000 Prepaid expenses 37,100 29,450 Inventory 160,000 172,800 Accounts receivables (net) 125,450 102,400 Short-term investments 66,550 51.200 Cash 89.600 83,200 45 950 450 Cash Total assets Equity and Liabilities Share capital-ordinary, 10 par Retained earnings Bonds payable, due 2023 Notes payable Accounts payable Accrued liabilities Total equity and liabilities 89,000 83,200 860,150 829,450 256,000 256,000 166,400 148,480 192,000 192.000 128,000 128,000 61,450 53,770 56,300 51,200 860,150 829,450 William Brown Company Income Statement 1 Operating expenses 261,760 231.680 Net income 54,400 53,760 Additional information: 1. Inventory at the beginning of 2019 was 151,040. 2. Total assets at the beginning of 2019 were 808,960. 3. No ordinary shares transactions occurred during 2019 or 2020. 4. All sales were on account. 5. Accounts receivable (net) at the beginning of 2019 were 112,640. 6. Notes payable are classified as a current liability. Market price of ordinary shares was 9 on December 31, 2020, and 12.5 on December 31, 2021. 2020 2021 % % times (3) hary shareholders' equity sets ratio eTextbook and Media 2.12 50.89 4.24 34.57 0.5 Price-earnings ratio % % timbs Change Decrease Decrease Increase Financial information for William Brown Company is presented below. William Brown Commpany Statements of Financial Position December 31 Assets 2020 2019 Land 166.400 166,400 Building and equipment (net) 215,050 224,000 Prepaid expenses 37,100 29,450 Inventory 160,000 172,800 Accounts receivables (net) 125,450 102,400 Short-term investments 66,550 51.200 Cash 89.600 83,200 45 950 450 Cash Total assets Equity and Liabilities Share capital-ordinary, 10 par Retained earnings Bonds payable, due 2023 Notes payable Accounts payable Accrued liabilities Total equity and liabilities 89,000 83,200 860,150 829,450 256,000 256,000 166,400 148,480 192,000 192.000 128,000 128,000 61,450 53,770 56,300 51,200 860,150 829,450 William Brown Company Income Statement 1 Operating expenses 261,760 231.680 Net income 54,400 53,760 Additional information: 1. Inventory at the beginning of 2019 was 151,040. 2. Total assets at the beginning of 2019 were 808,960. 3. No ordinary shares transactions occurred during 2019 or 2020. 4. All sales were on account. 5. Accounts receivable (net) at the beginning of 2019 were 112,640. 6. Notes payable are classified as a current liability. Market price of ordinary shares was 9 on December 31, 2020, and 12.5 on December 31, 2021. 2020 2021 % % times (3) hary shareholders' equity sets ratio eTextbook and Media 2.12 50.89 4.24 34.57 0.5 Price-earnings ratio % % timbs Change Decrease Decrease Increase

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started