What would the journal entry look like for 3-3?

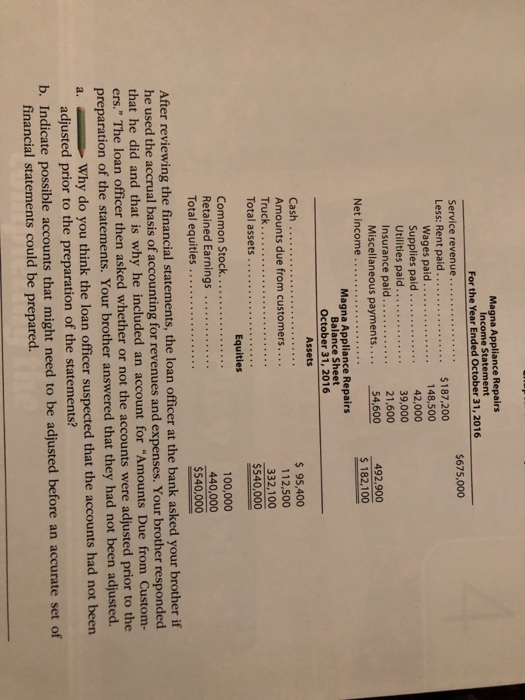

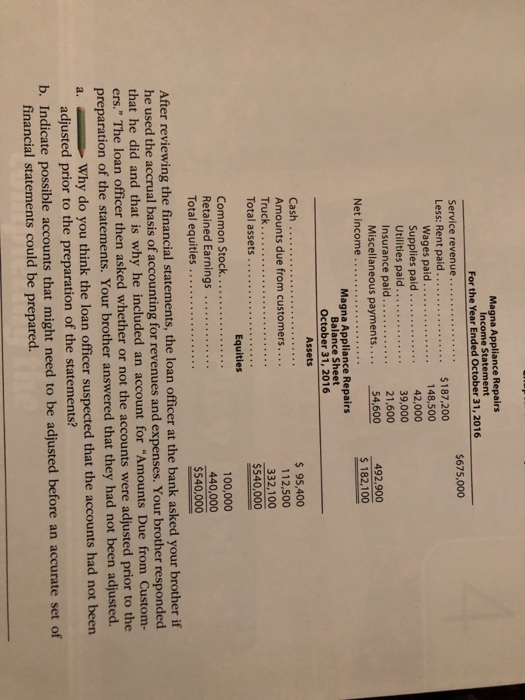

llgure la take the accounting course and find out whether she's just messing with me. Sonia: I never really thought about it. Whe Pete: Hmmm... I guess it could record the scanned at the door...or... when we get off the plane...or when our n do you think Delta Air Lines will record its revenues from this flight? revenue when it sells the ticket...or...when the boarding passes are company pays for the tickets on, I don't know. I'll ask my accounting instructor. s when Delta Air Lines should recognize the revenue from ticket sales properly match revenues and expenses. CP 3-3 Adjustments and financial statements Several years ago, your brother opened Magna Appliance Repairs. He made investment and added money from his personal bank account as nee money for living expenses at irregular intervals. As the business grew, he hired 2 a small initial ded. He withdrew an as- sistant. He is now considering adding more employees, purchasing additional service trucks, and purchasing the building he now rents. To secure funds for the expansion, your brother submitted a loan application to the bank and included the most recent financial statements (which follow) prepared from accounts maintained by a part-time bookkeeper. Magna Appliance Repairs Income Statement For the Year Ended October 31, 2016 $675,000 Wages paid Supplies paid Utilities paid Insurance paid Miscellaneous payments.... 148,500 39,000 21,600 54,600 492,900 $ 182,100 Net income Magna Appliance Repairs Balance Sheet October 31, 2016 Assets Cash Amounts due from customers.... Truck Total assets 95,400 112,500 332,100 $540,000 Equities 100,000 440,000 Retained Earnings Total equities After reviewing the financial statements, the loan officer at the bank asked your brother if he used the accrual basis of accounting for revenues and expenses. Your brother responded that he did and that is why he included an account for "Amounts Due from ers." The loan officer then asked whether or not the accounts were adjusted prior to the preparation of the statements. Your brother answered that they had not been adjusted. aWhy do you think the loan officer suspected that the accounts had not adjusted prior to the preparation of the statements? b. Indicate possible accounts that might need to be adjusted before an accurate set of financial statements could be prepared

What would the journal entry look like for 3-3?

What would the journal entry look like for 3-3?