Answered step by step

Verified Expert Solution

Question

1 Approved Answer

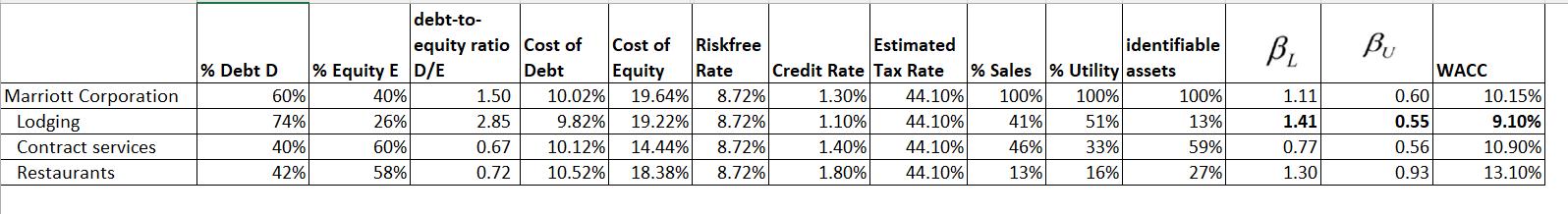

1. what is the best division to invest? 2. Why are the Cost of Equity requested by investors by division different? In what case would

1. what is the best division to invest?

2. Why are the "Cost of Equity" requested by investors by division different? In what case would they be the same?

3. why banks ask for different credit rate?

when

BL = Beta levered --> that is used for the calculation of the cost of equity

BU = Beta unlevered

Marriott Corporation Lodging Contract services Restaurants % Debt D 60% 74% 40% 42% % Equity E 40% 26% 60% 58% debt-to- equity ratio D/E 1.50 2.85 0.67 0.72 Cost of Debt Riskfree Estimated identifiable Rate Credit Rate Tax Rate % Sales % Utility assets 1.30% 44.10% 1.10% 44.10% 1.40% 44.10% 1.80% 44.10% 100% 100% 41% 51% 46% 33% 13% 16% Cost of 10.02% Equity 19.64% 8.72% 9.82% 19.22% 8.72% 10.12% 14.44% 8.72% 18.38% 10.52% 8.72% 100% 13% 59% 27% BL Bu 1.11 1.41 0.77 1.30 0.60 0.55 0.56 0.93 WACC 10.15% 9.10% 10.90% 13.10%

Step by Step Solution

★★★★★

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To determine the best division to invest in we need to consider factors such as the divisions cost of equity risk profile WACC Weighted Average Cost o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started