Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which of the following is FALSE? O A) If ANY partner withdraws from the partnership during the current tax year while the business of the

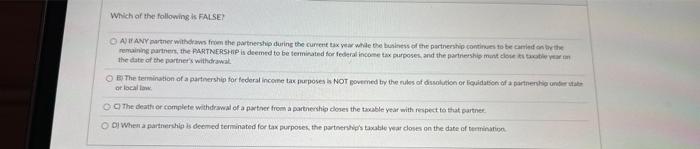

Which of the following is FALSE? O A) If ANY partner withdraws from the partnership during the current tax year while the business of the partnership continues to be carried on by the remaining partners, the PARTNERSHIP is deemed to be terminated for federal income tax purposes, and the partnership must close its taxable year on the date of the partner's withdrawal. O B) The termination of a partnership for federal income tax purposes is NOT governed by the rules of dissolution or liquidation of a partnership under state or local law. OC) The death or complete withdrawal of a partner from a partnership closes the taxable year with respect to that partner. OD) When a partnership is deemed terminated for tax purposes, the partnership's taxable year closes on the date of termination.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started