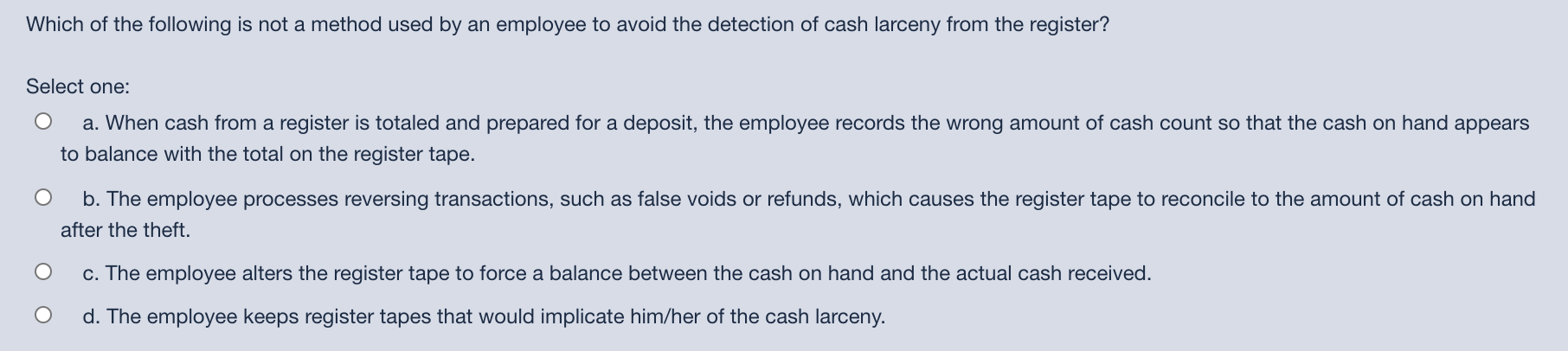

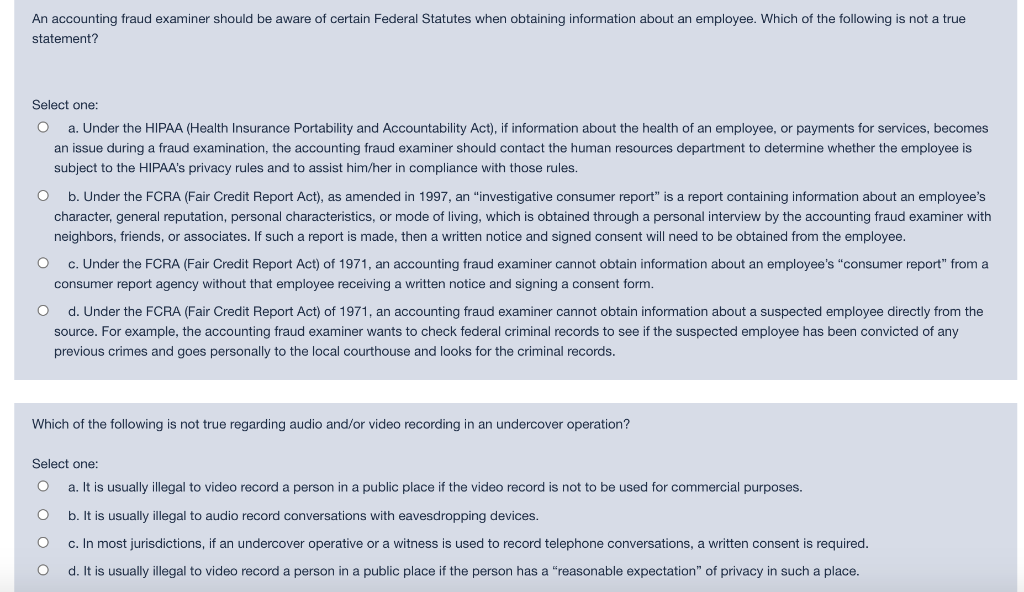

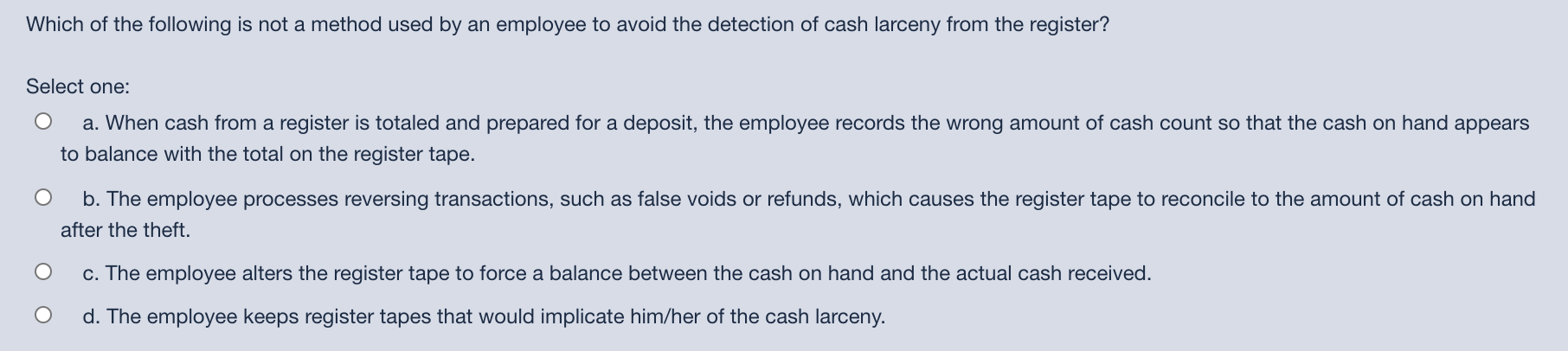

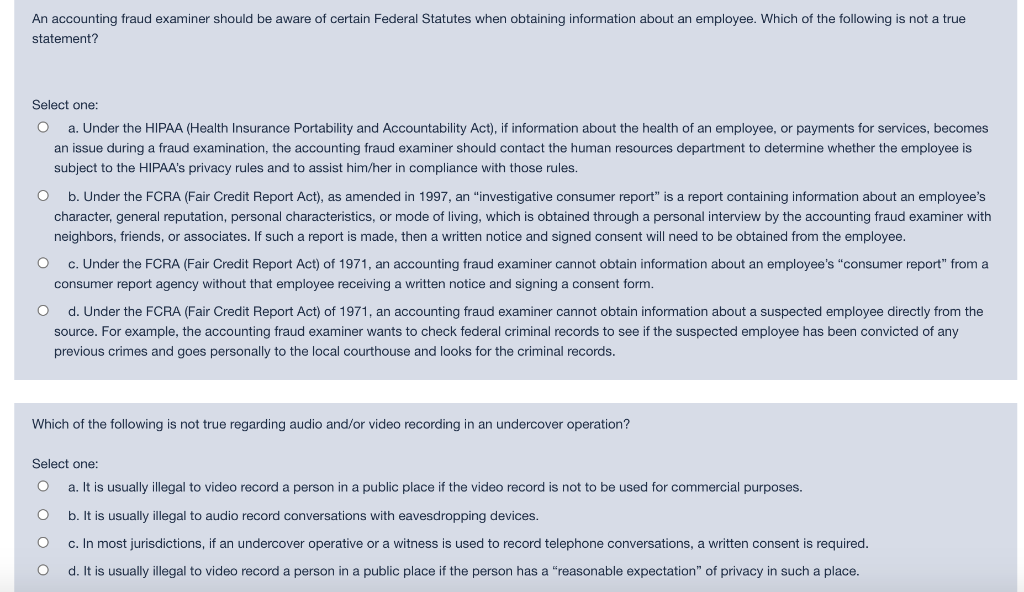

Which of the following is not a method used by an employee to avoid the detection of cash larceny from the register? Select one: a. When cash from a register is totaled and prepared for a deposit, the employee records the wrong amount of cash count so that the cash on hand appears to balance with the total on the register tape. b. The employee processes reversing transactions, such as false voids or refunds, which causes the register tape to reconcile to the amount of cash on hand after the theft. c. The employee alters the register tape to force a balance between the cash on hand and the actual cash received. O d. The employee keeps register tapes that would implicate him/her of the cash larceny. An accounting fraud examiner should be aware of certain Federal Statutes when obtaining information about an employee. Which of the following is not a true statement? Select one: 0 a. Under the HIPAA (Health Insurance Portability and Accountability Act), if information about the health of an employee, or payments for services, becomes an issue during a fraud examination, the accounting fraud examiner should contact the human resources department to determine whether the employee is subject to the HIPAA's privacy rules and to assist him/her in compliance with those rules. O b. Under the FCRA (Fair Credit Report Act), as amended in 1997, an "investigative consumer report" is a report containing information about an employee's character, general reputation, personal characteristics, or mode of living, which is obtained through a personal interview by the accounting fraud examiner with neighbors, friends, or associates. If such a report is made, then a written notice and signed consent will need to be obtained from the employee. 0 c. Under the FCRA (Fair Credit Report Act) of 1971, an accounting fraud examiner cannot obtain information about an employee's "consumer report" from a consumer report agency without that employee receiving a written notice and signing a consent form. O d. Under the FCRA (Fair Credit Report Act) of 1971, an accounting fraud examiner cannot obtain information about a suspected employee directly from the source. For example, the accounting fraud examiner wants to check federal criminal records to see if the suspected employee has been convicted of any previous crimes and goes personally to the local courthouse and looks for the criminal records. Which of the following is not true regarding audio and/or video recording in an undercover operation? 0 Select one: a. It is usually illegal to video record a person in a public place if the video record is not to be used for commercial purposes. 0 b. It is usually illegal to audio record conversations with eavesdropping devices. c. In most jurisdictions, if an undercover operative or a witness is used to record telephone conversations, a written consent is required. d. It is usually illegal to video record a person in a public place if the person has a "reasonable expectation" of privacy in such a place. 0 0