Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which of the following statements are correct about returns? 1 . In expectation, geometric average return or the so - called time - weighted average

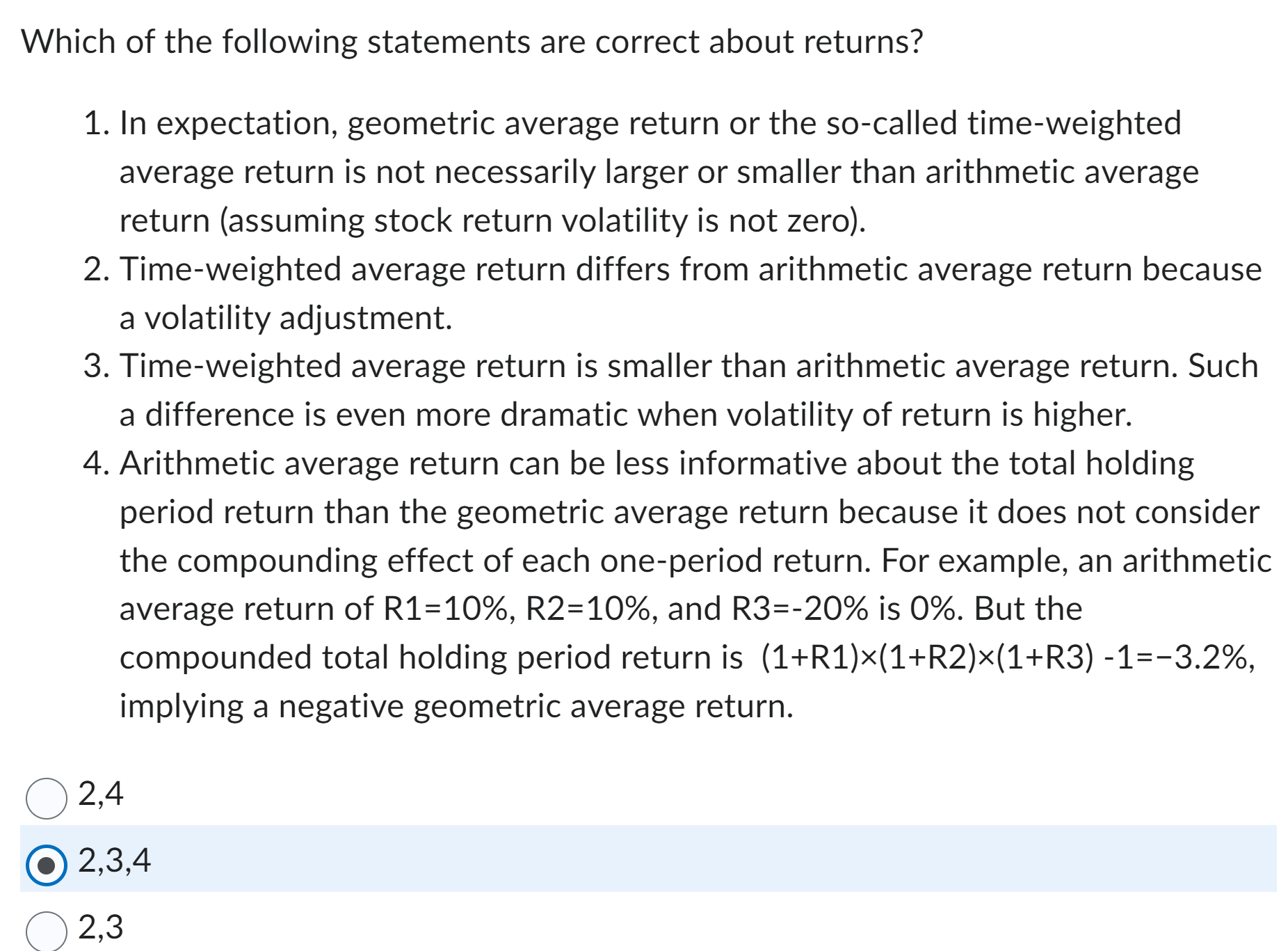

Which of the following statements are correct about returns?

In expectation, geometric average return or the socalled timeweighted average return is not necessarily larger or smaller than arithmetic average return assuming stock return volatility is not zero

Timeweighted average return differs from arithmetic average return because a volatility adjustment.

Timeweighted average return is smaller than arithmetic average return. Such a difference is even more dramatic when volatility of return is higher.

Arithmetic average return can be less informative about the total holding period return than the geometric average return because it does not consider the compounding effect of each oneperiod return. For example, an arithmetic average return of mathrmRmathrmR and mathrmR is But the compounded total holding period return is R timesR timesR implying a negative geometric average return.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started