Answered step by step

Verified Expert Solution

Question

1 Approved Answer

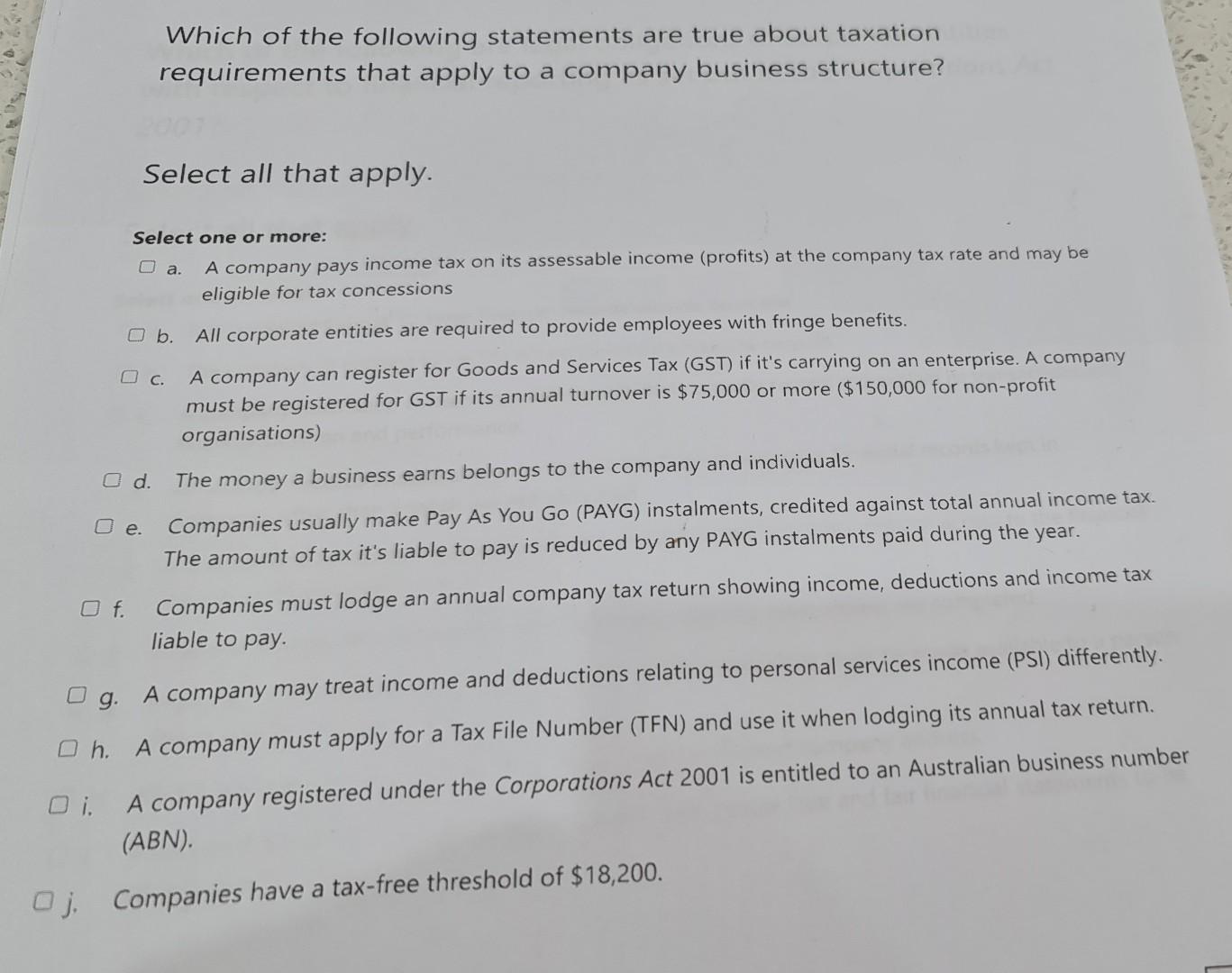

Which of the following statements are true about taxation requirements that apply to a company business structure? Select all that apply. Select one or more:

Which of the following statements are true about taxation requirements that apply to a company business structure? Select all that apply. Select one or more: a. A company pays income tax on its assessable income (profits) at the company tax rate and may be eligible for tax concessions b. All corporate entities are required to provide employees with fringe benefits. c. A company can register for Goods and Services Tax (GST) if it's carrying on an enterprise. A company must be registered for GST if its annual turnover is $75,000 or more $150,000 for non-profit organisations) d. The money a business earns belongs to the company and individuals. e. Companies usually make Pay As You Go (PAYG) instalments, credited against total annual income tax. The amount of tax it's liable to pay is reduced by any PAYG instalments paid during the year. f. Companies must lodge an annual company tax return showing income, deductions and income tax liable to pay. g. A company may treat income and deductions relating to personal services income (PSI) differently. h. A company must apply for a Tax File Number (TFN) and use it when lodging its annual tax return. i. A company registered under the Corporations Act 2001 is entitled to an Australian business number (ABN) j. Companies have a tax-free threshold of $18,200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started