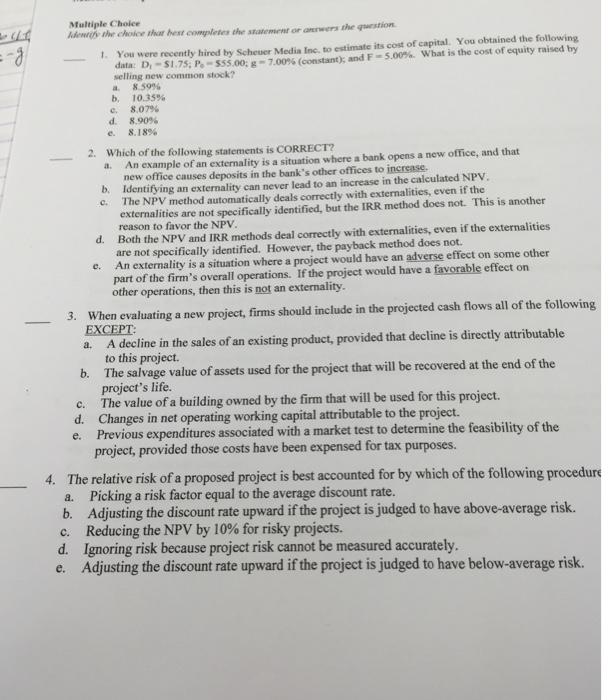

Which of the following statements is CORRECT? An example of an externality is a situation where a bank opens a new office, and that new office causes deposits in the bank's other offices to increase. Identifying an externality can never lead to an increase in the calculated NPV. The NPV method automatically deals correctly with externalities, even if the externalities are not specifically identified, but the IRR method does not. This is another reason to favor the NPV. Both the NPV and IRR methods deal correctly with externalities, even if the externalities are not specifically identified. However, the payback method does not. An externality is a situation where a project would have an adverse effect on some other pan of the firm's overall operations. If the project would have a favorable effect on other operations, then this is not an externality. When evaluating a new project, firms should include in the projected cash flows all of the following EXCEPT: A decline in the sales of an existing product, provided that decline is directly attributable to this project. The salvage value of assets used for the project that will be recovered at the end of the project's life. The value of a building owned by the firm that will be used for this project. Changes in net operating working capital attributable to the project. Previous expenditures associated with a market test to determine the feasibility of the project, provided those costs have been expensed for tax purposes. The relative risk of a proposed project is best accounted for by which of the following procedure Picking a risk factor equal to the average discount rate. Adjusting the discount rate upward if the project is judged to have above-average risk. Reducing the NPV by 10% for risky projects. Ignoring risk because project risk cannot be measured accurately. Adjusting the discount rate upward if the project is judged to have below-average risk. Which of the following statements is CORRECT? An example of an externality is a situation where a bank opens a new office, and that new office causes deposits in the bank's other offices to increase. Identifying an externality can never lead to an increase in the calculated NPV. The NPV method automatically deals correctly with externalities, even if the externalities are not specifically identified, but the IRR method does not. This is another reason to favor the NPV. Both the NPV and IRR methods deal correctly with externalities, even if the externalities are not specifically identified. However, the payback method does not. An externality is a situation where a project would have an adverse effect on some other pan of the firm's overall operations. If the project would have a favorable effect on other operations, then this is not an externality. When evaluating a new project, firms should include in the projected cash flows all of the following EXCEPT: A decline in the sales of an existing product, provided that decline is directly attributable to this project. The salvage value of assets used for the project that will be recovered at the end of the project's life. The value of a building owned by the firm that will be used for this project. Changes in net operating working capital attributable to the project. Previous expenditures associated with a market test to determine the feasibility of the project, provided those costs have been expensed for tax purposes. The relative risk of a proposed project is best accounted for by which of the following procedure Picking a risk factor equal to the average discount rate. Adjusting the discount rate upward if the project is judged to have above-average risk. Reducing the NPV by 10% for risky projects. Ignoring risk because project risk cannot be measured accurately. Adjusting the discount rate upward if the project is judged to have below-average risk