which question i just need answer

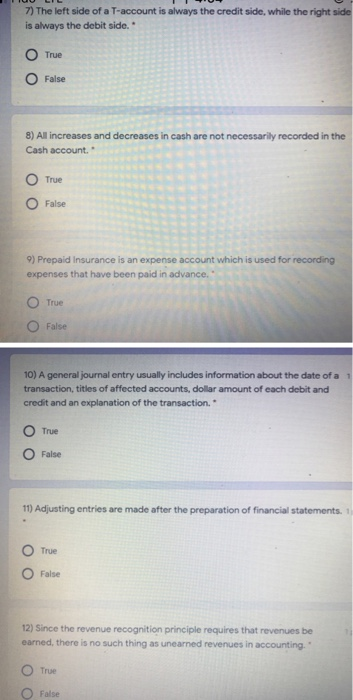

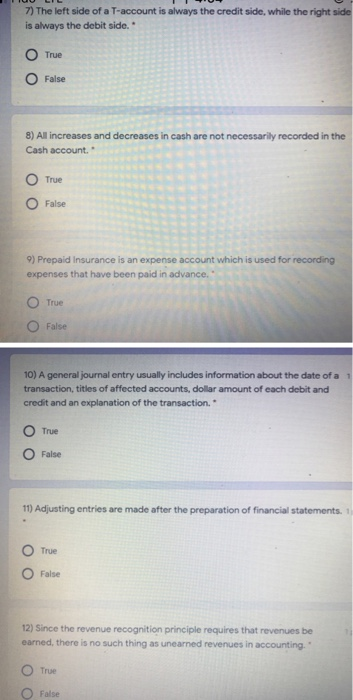

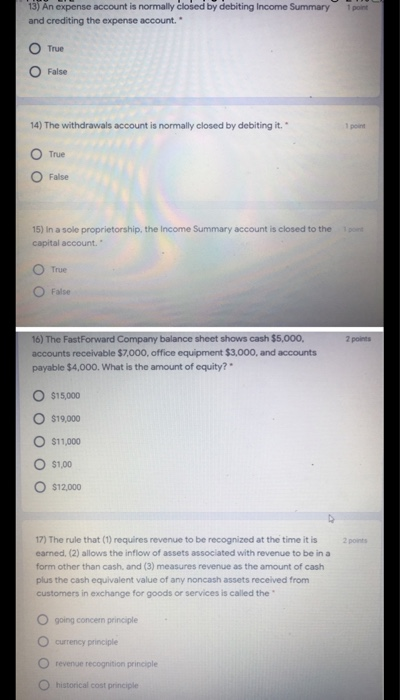

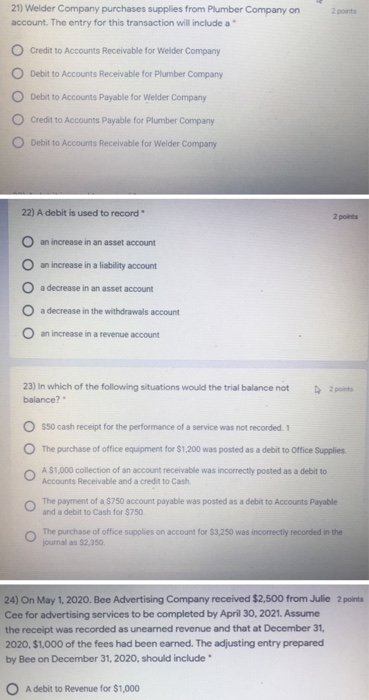

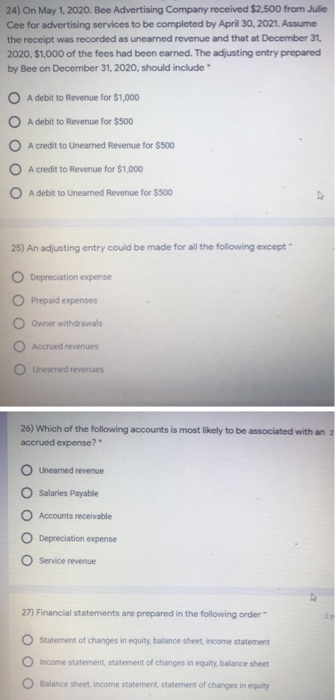

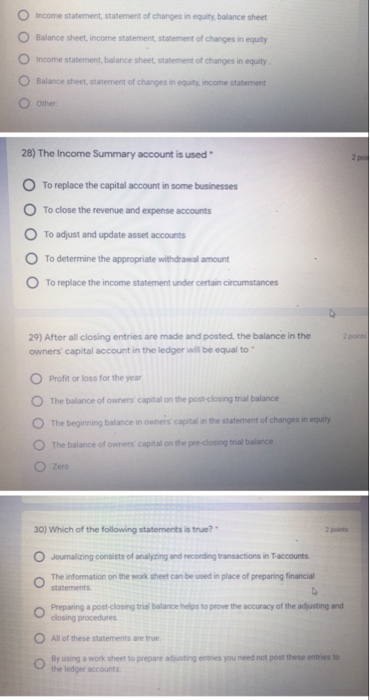

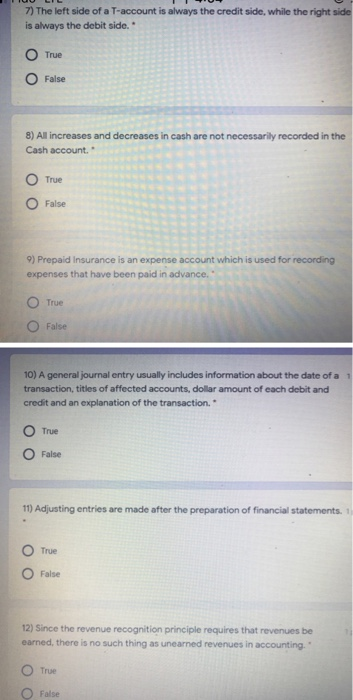

7) The left side of a T-account is always the credit side, while the right side is always the debit side." True False 8) All increases and decreases in cash are not necessarily recorded in the Cash account. O True False 9) Prepaid Insurance is an expense account which is used for recording expenses that have been paid in advance. True False 10) A general journal entry usually includes information about the date of a 1 transaction, titles of affected accounts, dollar amount of each debit and credit and an explanation of the transaction. True False 11) Adjusting entries are made after the preparation of financial statements. 1 True False 12) Since the revenue recognition principle requires that revenues be earned, there is no such thing as unearned revenues in accounting." O True O False 1 point 13) An expense account is normally closed by debiting Income Summary and crediting the expense account. True False 14) The withdrawals account is normally closed by debiting it. 1 pont True False 15) In a sole proprietorship, the income Summary account is closed to the capital account True O False 2 points 16) The FastForward Company balance sheet shows cash $5,000, accounts receivable $7,000, office equipment $3,000, and accounts payable $4,000. What is the amount of equity? O $15,000 $19,000 O $11,000 $1,00 $12,000 17) The rule that (1) requires revenue to be recognized at the time it is carned. (2) allows the inflow of assets associated with revenue to be in a form other than cash and (3) measures revenue as the amount of cash plus the cash equivalent value of any noncash assets received from customers in exchange for goods or services is called the going concern principle Currency principle revenue recognition principle OO historical cost principle currency principle revenue recognition principle historical cost principle business entity principle 18) The area of accounting aimed at serving the decision-making needs of points internal users is marketing auditing internal control financial accounting managerial accounting 19) If Girard Don, the owner of Girard's Software proprietorship, uses cash points of the business to purchase a personal computer, the business should record this use of cash with an entry to debit Girard Don, withdrawals and credit cash debit cash and credit Girard Don, withdrawals debit Girard Don, Salary and credit cash. debit Girard Don, capital and credit cash debit Salary Expense and credit cash 20) Which of the following statements is incorrect? 2 points The normal balance of the accounts receivable account is a debit The normal balance of the owner's withdrawals account is a debit. The normal balance of an expense account is a credit. The abnormal balance of a revenue account is a debit. The normal balance of an unearned revenues account is a credit 2 points 21) Welder Company purchases supplies from Plumber Company on account. The entry for this transaction will include a O Credit to Accounts Receivable for Welder Company O Debit to Accounts Receivable for Plumber Company Debit to Accounts Payable for Welder Company Credit to Accounts Payable for Plumber Company OO O Debit to Accounts Receivable for Welder Company 22) A debit is used to record 2 points an increase in an asset account an increase in a liability account a decrease in an asset account a decrease in the withdrawals account an increase in a revenue account 23) In which of the following situations would the trial balance not balance? 2 points $50 cash receipt for the performance of a service was not recorded. 1 The purchase of office equipment for $1.200 was posted as a debit to Office Supplies A $1,000 collection of an account receivable was incorrectly posted as a debit to Accounts Receivable and a credit to Cath. The payment of a $750 account payable was posted as a debit to Accounts Payable and a debit to Cash for $750 The purchase of office supplies on account for $3,250 was incorrectly recorded in the journal as $2,350 24) On May 1, 2020. Bee Advertising Company received $2,500 from Julie 2 points Cee for advertising services to be completed by April 30, 2021. Assume the receipt was recorded as unearned revenue and that at December 31, 2020, $1,000 of the fees had been earned. The adjusting entry prepared by Bee on December 31, 2020, should include A debit to Revenue for $1,000 24) On May 1, 2020. Bee Advertising Company received $2,500 from Julie Cee for advertising services to be completed by April 30, 2021. Assume the receipt was recorded as unearned revenue and that at December 31, 2020. $1,000 of the fees had been earned. The adjusting entry prepared by Bee on December 31, 2020, should include A debit to Revenue for $1,000 A debit to Revenue for $500 A credit to Unearned Revenue for $500 A credit to Revenue for $1,000 A debit to Unearned Revenue for $500 25) An adjusting entry could be made for all the following except Depreciation expense Prepaid expenses O Owner withdrawals Accrued revenues Unearned revenues 26) Which of the following accounts is most likely to be associated with an 2 accrued expense?" Unearned revenue Salaries Payable Accounts receivable Depreciation expense Service revenue 27) Financial statements are prepared in the following order Statement of changes in equity, balance sheet income statement Income statement, statement of changes in equity, balance sheet o . Balance sheet, income statement, statement of changes in equity Income statement, statement of changes in equity balance sheet Balance sheet income statement, statement of changes in equity Income statement, balance sheet statement of changes in equity Balance sheet statement of changes in equit income statement Other 28) The Income Summary account is used po To replace the capital account in some businesses To close the revenue and expense accounts To adjust and update asset accounts To determine the appropriate withdrawal amount To replace the income statement under certain circumstances 29) After all closing entries are made and posted, the balance in the owners' capital account in the ledger will be equal to Profit or loss for the year The balance of owners capital on the post-closing trial balance The beginning balance in owners capital in the statement of changes in equity The balance of owners capital on the pre-closing trial balance Zero 30) Which of the following statements is true? Journalizing consists of analyzing and recording transactions in Taccounts. The information on the work sheet can be used in place of preparing financial statements Preparing a post closing trial balance helps to prove the accuracy of the adjusting and closing procedures All of these statements are true By using a worksheet to prepare adjusting entries you need not post these entries to the ledger accounts