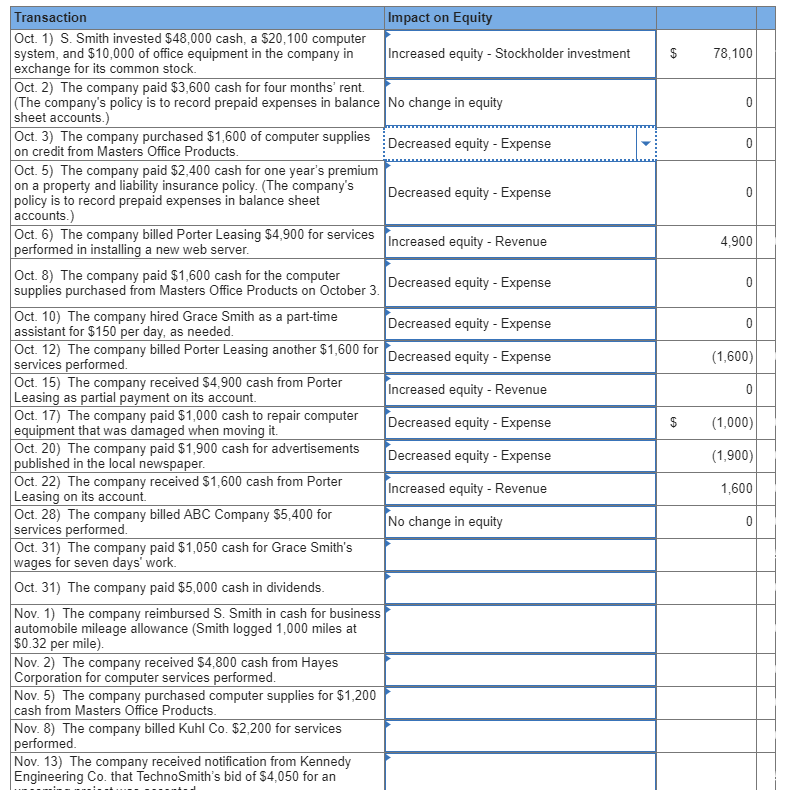

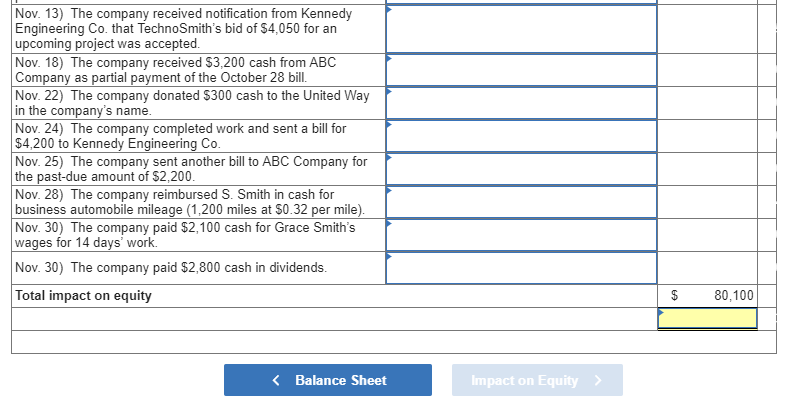

While the balance sheet reports the detail of individual assets and liabilities, Retained earnings is reported in total. The expanded accounting equation shows the four subsets of equity: Revenues, Expenses, stockholder investments and Dividends. Using the dropdown buttons, indicate the impact each transaction has on total equity (if any). Compare the total with the amount of equity reported on the balance sheet.

Impact on Equity ransaction Oct. 1) S. Smith invested $48,000 cash, a $20,100 computer system, and $10,000 of office equipment in the company in Increased equity Stockholder investment exchange for its common stock. Oct. 2) The company paid $3,600 cash for four months' rent. (The company's policy is to record prepaid expenses in balance |No change in equity sheet accounts.) Oct. 3) The company purchased $1,600 of computer supplies on credit from Masters Office Products S 78,100 Oct. 5) The company paid $2,400 cash for one year's premiunm on a property and liability insurance policy. (The company's policy is to record prepaid expenses in balance sheet accounts.) Oct. 6) The company billed Porter Leasing $4,900 for services Decreased equity Expense 4,900 Increased equity - Revenue Decreased equity - Expense Decreased equity - Expense erformed in installing a new web server Oct. 8) The company paid $1,600 cash for the computer supplies purchased from Masters Office Products on October 3 Oct. 10) The company hired Grace Smith as a part-time assistant for $150 per day, as needed Oct. 12) The company billed Porter Leasing services performed Oct. 15) The company received $4,900 cash from Porter Leasing as partial payment on its account. Oct. 17) The company paid $1,000 cash to repair computer equipment that was damaged when moving it. Oct. 20) The company paid $1,900 cash for advertisements published in the local newspaper Oct. 22) The company received $1,600 cash from Porter Leasing on its account. Oct. 28) The company billed ABC Company $5,400 for services performed Oct. 31) The company paid $1,050 cash for Grace Smith's wages for seven days work another $1,600 for Decreased equity (1,600) nse Increased equity - Revenue (1,000) (1,900) 1,600 Decreased equity Expense Decreased equity Expense Increased equity - Revenue No change in equity Oct. 31) The company paid $5,000 cash in dividends Nov. 1) The company reimbursed S. Smith in cash for business automobile mileage allowance (Smith logged 1,000 miles at $0.32 per mile) Nov. 2) The company received $4,800 cash from Hayes Corporation for computer services performed Nov. 5) The company purchased computer supplies for $1,200 cash from Masters Office Products Nov. 8) The company billed Kuhl Co. $2,200 for services performed Nov. 13) The company received notification from Kennedy Engineering Co. that TechnoSmith's bid of $4,050 for an Nov. 13) The company received notification from Kennedy Engineering Co. that TechnoSmith's bid of $4,050 for an upcoming project was accepted Nov. 18) The company received $3,200 cash from ABC Company as partial payment of the October 28 bill Nov. 22) The company donated $300 cash to the United Way in the company's name Nov. 24) The company completed work and sent a bill for $4,200 to Kennedy Engineering Co Nov. 25) The company sent another bill to ABC Company for the past-due amount of $2.200 Nov. 28) The company reimbursed S. Smith in cash for business automobile mileage (1,200 miles at $0.32 per mile) Nov. 30) The company paid $2,100 cash for Grace Smith's wages for 14 days work Nov. 30) The company paid $2,800 cash in dividends 80,100 Total impact on equity Balance Sheet Impact on Equity