Question

Widget Company has been in operations for over a year. Widget adopted the calendar year for reporting purposes. At December 31, 2020, the company tried

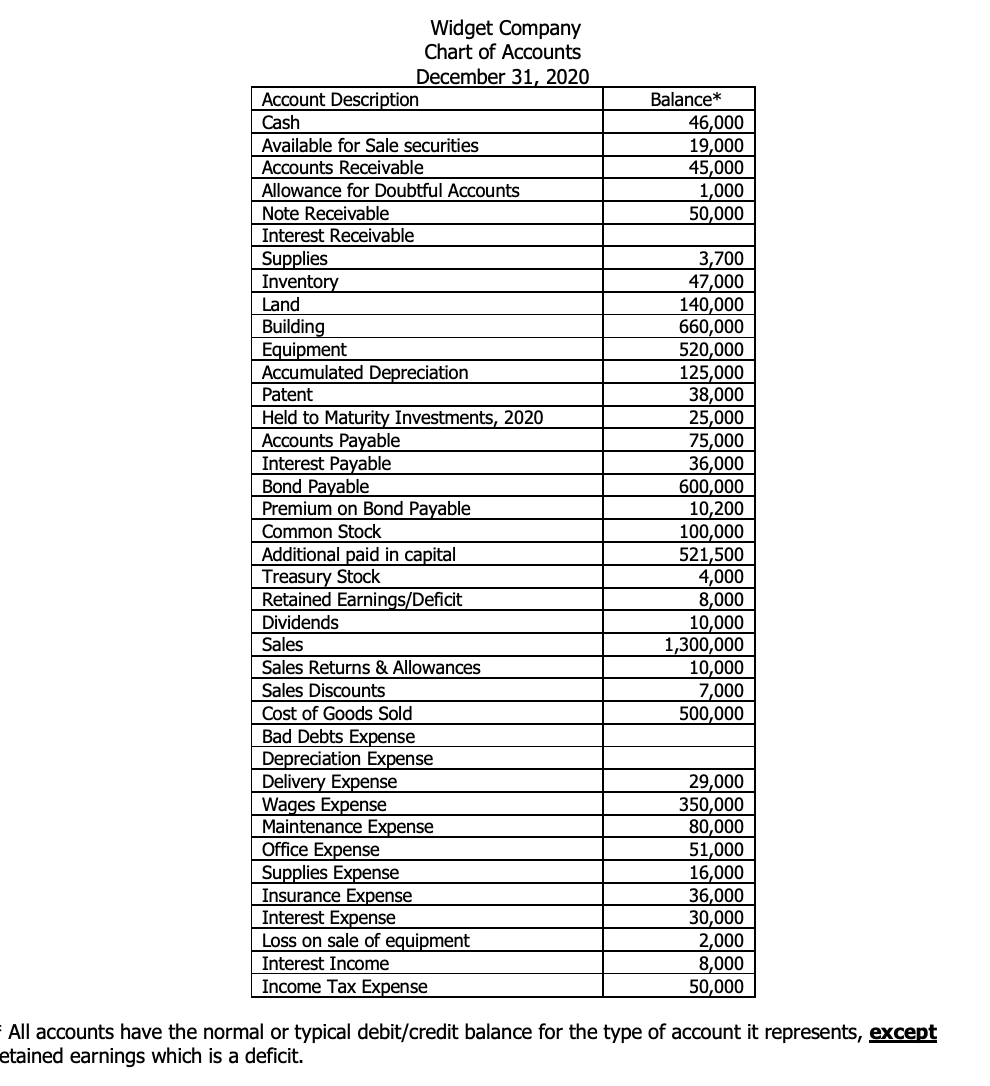

Widget Company has been in operations for over a year. Widget adopted the calendar year for reporting purposes. At December 31, 2020, the company tried to prepare its own financial statements. On December 31, 2020, a new accountant arrived and realized several adjustments needed to be made before completing the statements. She had Widget provide her with the (1) chart of accounts including ending balances and (2) additional information to permit the adjustment of the impacted accounts.

Information for the necessary adjustments or calculations as of December 31, 2020:

-

The company last received interest on the interest bearing note receivable on September 30, 2020.

Interest is due as of December 31, 2020. An adjusting entry is required for interest due since the

last payment. The annual interest rate is 6%. (Do not use the cash account.)

-

The company uses the straight line depreciation method assuming a $10,000 residual value for the

equipment and an estimated useful life of 5 years. The companys building is depreciated over 30

years with no salvage value. Record the annual depreciation for 2020 only.

-

The company uses the allowance method Aging of Receivables to estimate its uncollectible

accounts. The new Chief Financial Officer (CFO) decided to use the percent of receivables method and estimated that 10% of Accounts Receivables at December 31, 2020 will be uncollectible.

Instructions:

-

Prepare a trial balance from the chart of accounts to be sure that the total debits are equal to the

total credits.

-

Prepare the journal entries. Assume that no entries for annual adjustments have been made for the

current year. Use ONLY the accounts listed on the trial balance for your journal entries.

-

Post the transactions to individual accounts and prepare an adjusted trial balance for The Widget

Company as of December 31, 2020.

-

Prepare a full Multi-step Income Statement, Statement of Retained Earnings, and a Classified

Balance Sheet from the adjusted trial balance.

Balance* 46,000 19,000 45,000 1,000 50,000 Widget Company Chart of Accounts December 31, 2020 Account Description Cash Available for Sale securities Accounts Receivable Allowance for Doubtful Accounts Note Receivable Interest Receivable Supplies Inventory Land Building Equipment Accumulated Depreciation Patent Held to Maturity Investments, 2020 Accounts Payable Interest Payable Bond Payable Premium on Bond Payable Common Stock Additional paid in capital Treasury Stock Retained Earnings/Deficit Dividends Sales Sales Returns & Allowances Sales Discounts Cost of Goods Sold Bad Debts Expense Depreciation Expense Delivery Expense Wages Expense Maintenance Expense Office Expense Supplies Expense Insurance Expense Interest Expense Loss on sale of equipment Interest Income Income Tax Expense 3,700 47,000 140,000 660,000 520,000 125,000 38,000 25,000 75,000 36,000 600,000 10,200 100,000 521,500 4,000 8,000 10,000 1,300,000 10,000 7,000 500,000 29,000 350,000 80,000 51,000 16,000 36,000 30,000 2,000 8,000 50,000 All accounts have the normal or typical debit/credit balance for the type of account it represents, except etained earnings which is a deficit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started