Will Paramount Paper have to raise external capital over the next 12 months? If so how much?

If not, why not?

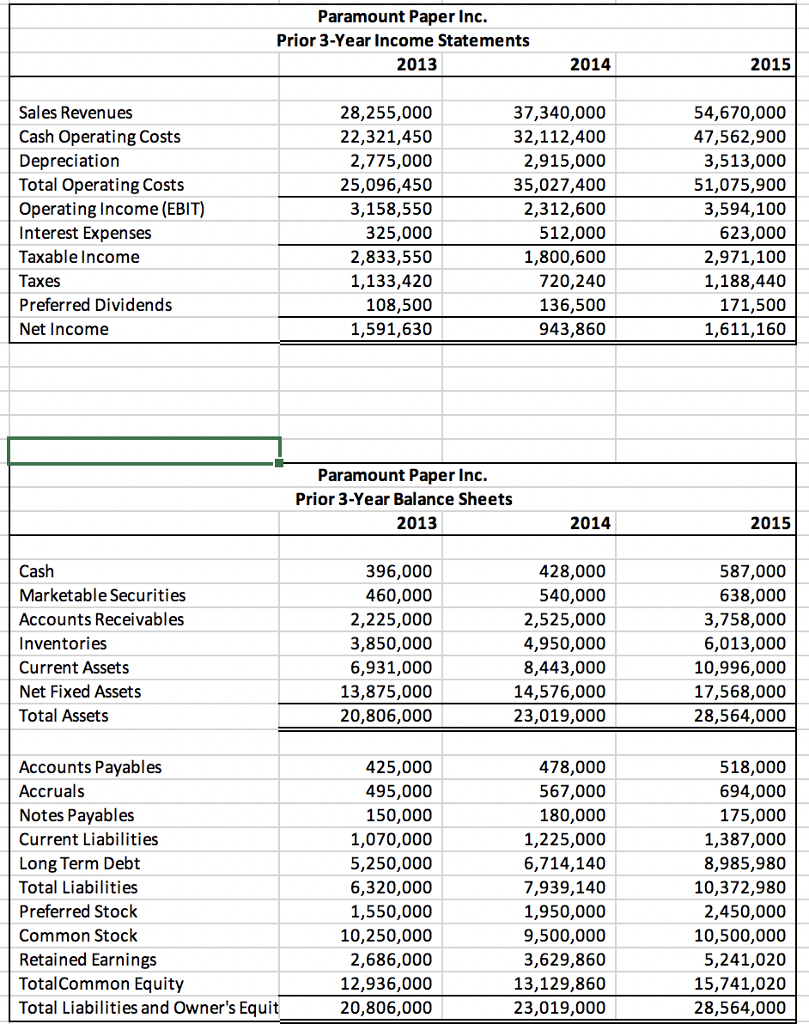

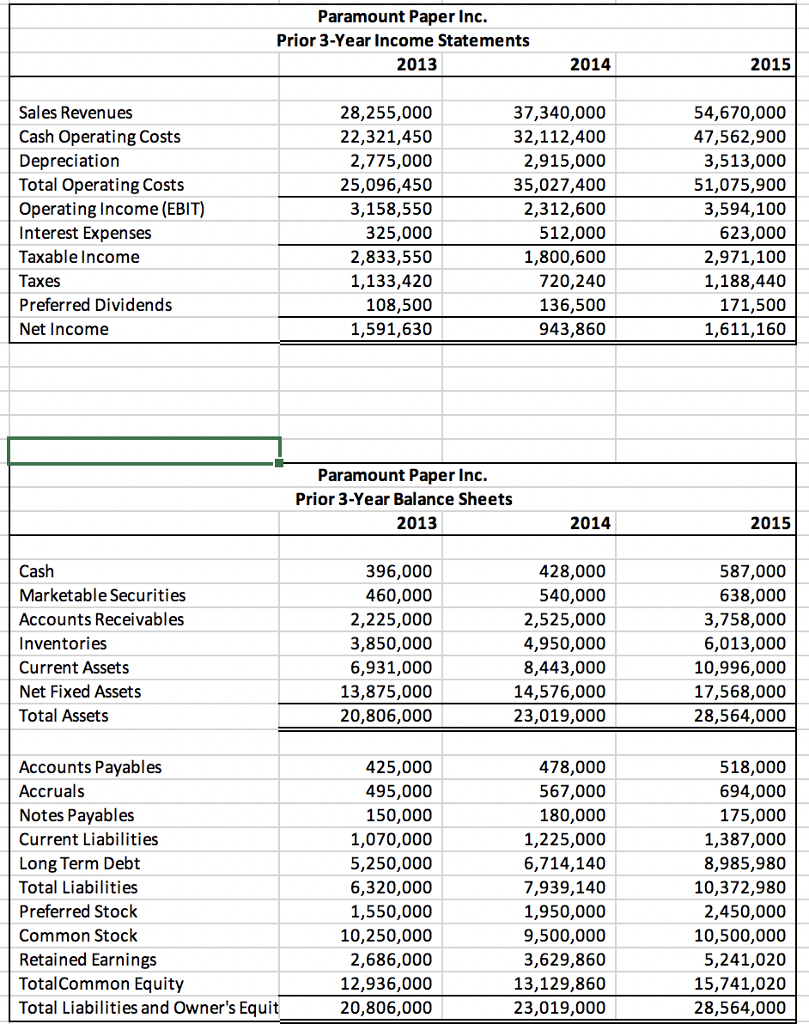

Paramount Paper Inc. Prior 3-Year Income Statements 2014 Sales Revenues Cash Operating Costs Depreciation Total Operating Costs Operating Income (EBIT) Interest Expenses Taxable Income Taxes Preferred Dividends Net Income 28,255,000 22,321,450 2,775,000 25,096,450 3,158,550 325,000 2,833,550 1,133,420 108,500 1,591,630 37,340,000 32,112,400 2,915,000 35,027,400 2,312,600 512,000 1,800,600 720,240 136,500 943,860 54,670,000 47,562,900 3,513,000 51,075,900 3,594,100 623,000 2,971,100 1,188,440 171,500 1,611,160 Paramount Paper Inc. Prior 3-Year Balance Sheets 2013 2014 2015 Marketable Securities Accounts Receivables Inventories Current Assets Net Fixed Assets 396,000 460,000 2,225,000 3,850,000 6,931,000 13,875,000 20,806,000 428,000 540,000 2,525,000 4,950,000 8,443,000 14,576,000 23,019,000 587,000 638,000 3,758,000 6,013,000 10,996,000 17,568,000 28,564,000 Accounts Payables Accruals Notes Payables Current Liabilities Long Term Debt Total Liabilities Preferred Stock Common Stock Retained Earnings TotalCommon Equity Total Liabilities and Owner's Equit 425,000 495,000 150,000 1,070,000 5,250,000 6,320,000 1,550,000 10,250,000 2,686,000 12,936,000 20,806,000 478,000 567,000 180,000 1,225,000 6,714,140 7,939,140 1,950,000 9,500,000 3,629,860 13,129,860 23,019,000 518,000 694,000 175,000 1,387,000 8,985,980 10,372,980 2,450,000 10,500,000 5,241,020 15,741,020 28,564,000 Paramount Paper Inc. Prior 3-Year Income Statements 2014 Sales Revenues Cash Operating Costs Depreciation Total Operating Costs Operating Income (EBIT) Interest Expenses Taxable Income Taxes Preferred Dividends Net Income 28,255,000 22,321,450 2,775,000 25,096,450 3,158,550 325,000 2,833,550 1,133,420 108,500 1,591,630 37,340,000 32,112,400 2,915,000 35,027,400 2,312,600 512,000 1,800,600 720,240 136,500 943,860 54,670,000 47,562,900 3,513,000 51,075,900 3,594,100 623,000 2,971,100 1,188,440 171,500 1,611,160 Paramount Paper Inc. Prior 3-Year Balance Sheets 2013 2014 2015 Marketable Securities Accounts Receivables Inventories Current Assets Net Fixed Assets 396,000 460,000 2,225,000 3,850,000 6,931,000 13,875,000 20,806,000 428,000 540,000 2,525,000 4,950,000 8,443,000 14,576,000 23,019,000 587,000 638,000 3,758,000 6,013,000 10,996,000 17,568,000 28,564,000 Accounts Payables Accruals Notes Payables Current Liabilities Long Term Debt Total Liabilities Preferred Stock Common Stock Retained Earnings TotalCommon Equity Total Liabilities and Owner's Equit 425,000 495,000 150,000 1,070,000 5,250,000 6,320,000 1,550,000 10,250,000 2,686,000 12,936,000 20,806,000 478,000 567,000 180,000 1,225,000 6,714,140 7,939,140 1,950,000 9,500,000 3,629,860 13,129,860 23,019,000 518,000 694,000 175,000 1,387,000 8,985,980 10,372,980 2,450,000 10,500,000 5,241,020 15,741,020 28,564,000