Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Will the interest expense increase or decrease over the years? Why? ( 2 point ) How much does the company pay to retire the bond

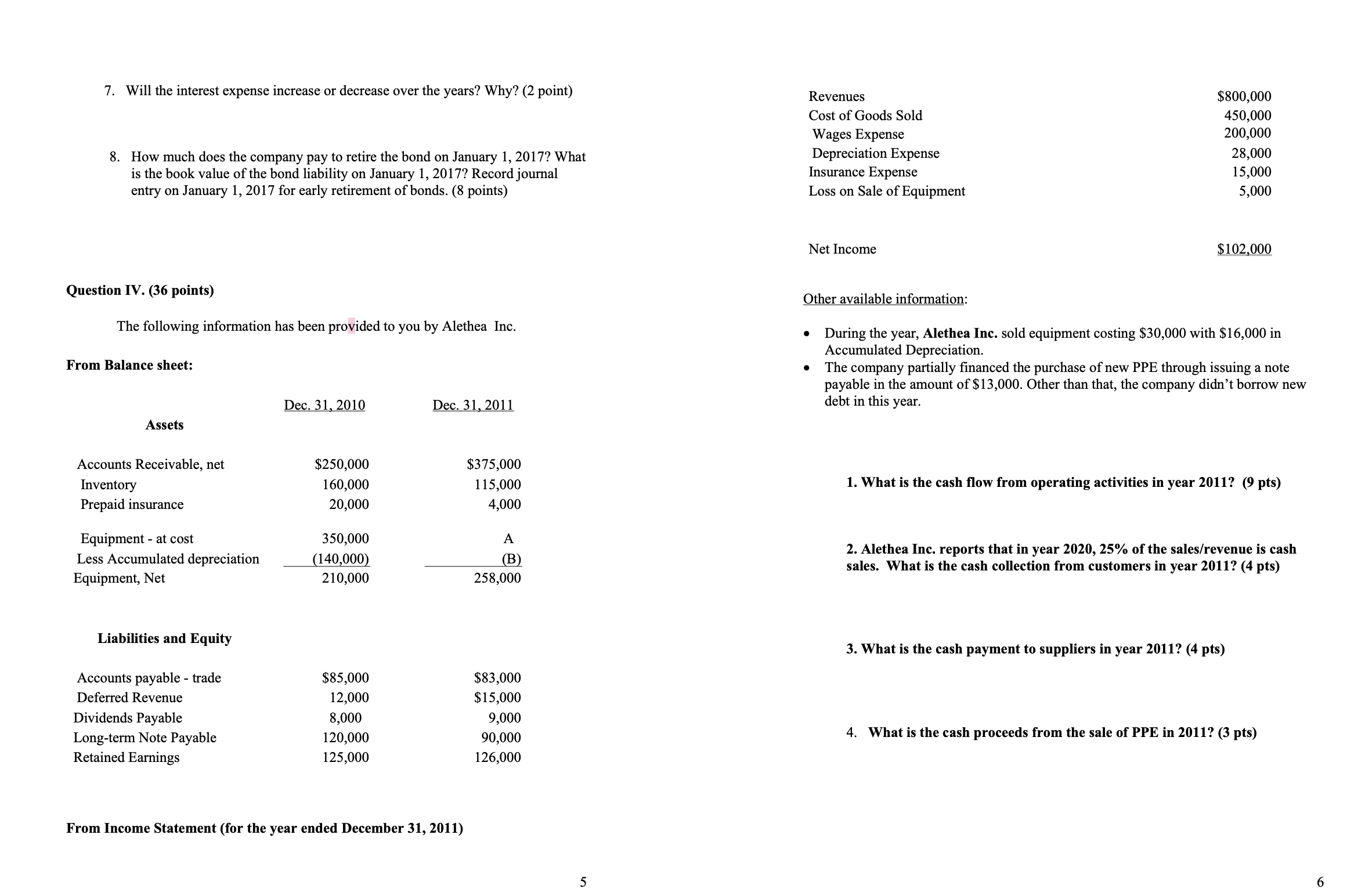

Will the interest expense increase or decrease over the years? Why? point How much does the company pay to retire the bond on January What is the book value of the bond liability on January Record journal entry on January for early retirement of bonds. points Question IV points The following information has been provided to you by Alethea Inc. From Balance sheet: Liabilities and Equity Net Income $ Other available information: During the year, Alethea Inc. sold equipment costing $ with $ in Accumulated Depreciation. The company partially financed the purchase of new PPE through issuing a note payable in the amount of $ Other than that, the company didn't borrow new debt in this year. What is the cash flow from operating activities in year pts Alethea Inc. reports that in year of the salesrevenue is cash sales. What is the cash collection from customers in year pts What is the cash payment to suppliers in year pts What is the cash proceeds from the sale of PPE in pts What is the cash spent to purchase new equipment in points Find the value of A ie Equipmentat cost on Dec points Find the value of B ie Accumulated Depreciation on Dec pts What is the cash flow from financing activities in year pts

Will the interest expense increase or decrease over the years? Why? point

How much does the company pay to retire the bond on January What

is the book value of the bond liability on January Record journal

entry on January for early retirement of bonds. points

Question IV points

The following information has been provided to you by Alethea Inc.

From Balance sheet:

Liabilities and Equity

Net Income

$

Other available information:

During the year, Alethea Inc. sold equipment costing $ with $ in

Accumulated Depreciation.

The company partially financed the purchase of new PPE through issuing a note

payable in the amount of $ Other than that, the company didn't borrow new

debt in this year.

What is the cash flow from operating activities in year pts

Alethea Inc. reports that in year of the salesrevenue is cash

sales. What is the cash collection from customers in year pts

What is the cash payment to suppliers in year pts

What is the cash proceeds from the sale of PPE in pts

What is the cash spent to purchase new equipment in points

Find the value of A ie Equipmentat cost on Dec points

Find the value of B ie Accumulated Depreciation on Dec pts

What is the cash flow from financing activities in year pts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started