Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Win Win Top (WWT) experienced a slight drop in the cash balance. You, as the accountant of WWT, are requested to analyze the impacts

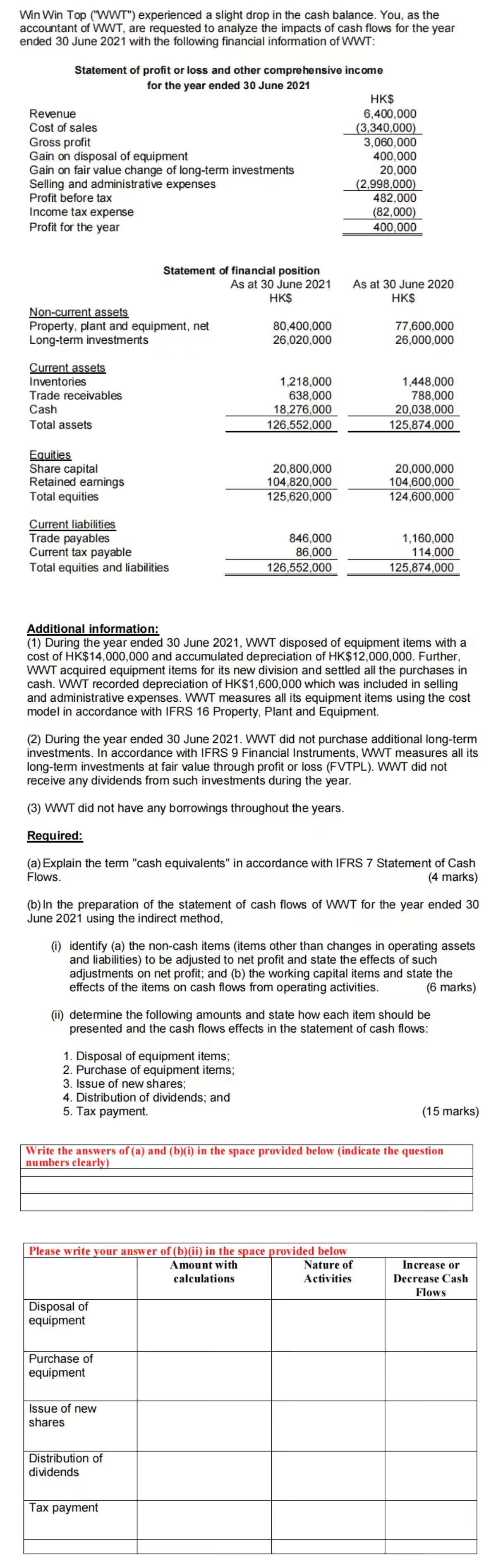

Win Win Top ("WWT") experienced a slight drop in the cash balance. You, as the accountant of WWT, are requested to analyze the impacts of cash flows for the year ended 30 June 2021 with the following financial information of WWT: Statement of profit or loss and other comprehensive income for the year ended 30 June 2021 Revenue Cost of sales HK$ 6,400,000 (3,340,000) Gross profit Gain on disposal of equipment Gain on fair value change of long-term investments 3,060,000 400,000 20,000 Selling and administrative expenses Profit before tax Income tax expense Profit for the year (2,998,000) 482,000 (82,000) 400,000 Statement of financial position As at 30 June 2021 HK$ As at 30 June 2020 HK$ 80,400,000 26,020,000 77,600,000 26,000,000 Non-current assets Property, plant and equipment, net Long-term investments Current assets Inventories Trade receivables Cash Total assets 1,218,000 1,448,000 638,000 788,000 18,276,000 20,038,000 126,552,000 125,874,000 Equities Share capital 20,800,000 Retained earnings 104,820,000 20,000,000 104,600,000 Total equities 125,620,000 124,600,000 Current liabilities Trade payables Current tax payable Total equities and liabilities 846,000 1,160,000 86,000 126,552,000 114,000 125,874,000 Additional information: (1) During the year ended 30 June 2021, WWT disposed of equipment items with a cost of HK$14,000,000 and accumulated depreciation of HK$12,000,000. Further, WWT acquired equipment items for its new division and settled all the purchases in cash. WWT recorded depreciation of HK$1,600,000 which was included in selling and administrative expenses. WWT measures all its equipment items using the cost model in accordance with IFRS 16 Property, Plant and Equipment. (2) During the year ended 30 June 2021. WWT did not purchase additional long-term investments. In accordance with IFRS 9 Financial Instruments, WWT measures all its long-term investments at fair value through profit or loss (FVTPL). WWT did not receive any dividends from such investments during the year. (3) WWT did not have any borrowings throughout the years. Required: (a) Explain the term "cash equivalents" in accordance with IFRS 7 Statement of Cash Flows. (4 marks) (b) In the preparation of the statement of cash flows of WWT for the year ended 30 June 2021 using the indirect method, (i) identify (a) the non-cash items (items other than changes in operating assets and liabilities) to be adjusted to net profit and state the effects of such adjustments on net profit; and (b) the working capital items and state the effects of the items on cash flows from operating activities. (6 marks) (ii) determine the following amounts and state how each item should be presented and the cash flows effects in the statement of cash flows: 1. Disposal of equipment items; 2. Purchase of equipment items; 3. Issue of new shares; 4. Distribution of dividends; and 5. Tax payment. (15 marks) Write the answers of (a) and (b)(i) in the space provided below (indicate the question numbers clearly) Please write your answer of (b)(ii) in the space provided below Disposal of equipment Purchase of equipment Issue of new shares Distribution of dividends Tax payment Amount with calculations Nature of Activities Increase or Decrease Cash Flows

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a Cash equivalents refers to shortterm highly liquid investments that are readily convertible into known amounts of cash and have original maturities ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started