Answered step by step

Verified Expert Solution

Question

1 Approved Answer

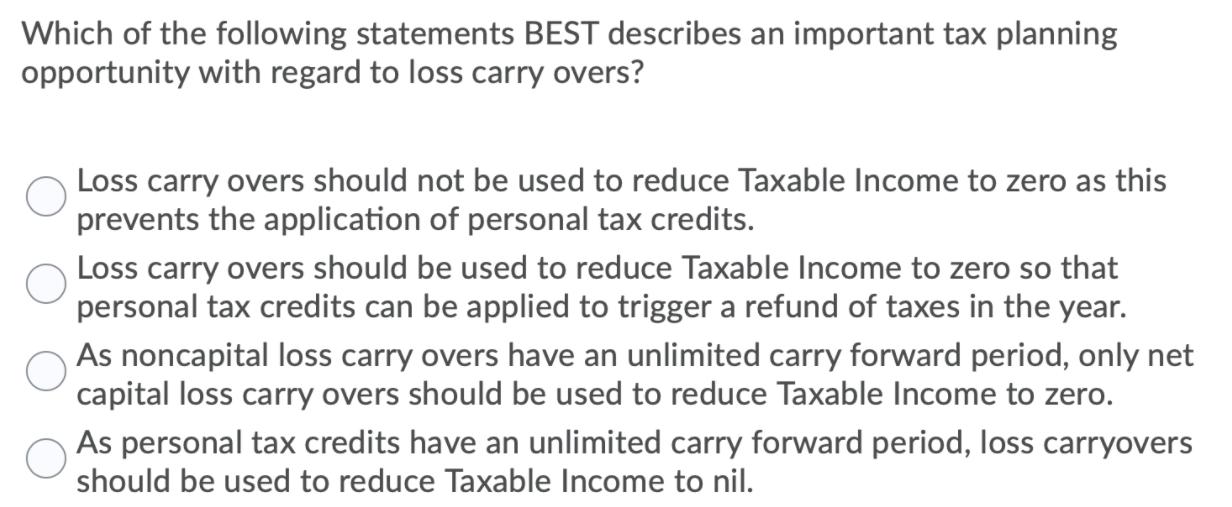

Which of the following statements BEST describes an important tax planning opportunity with regard to loss carry overs? Loss carry overs should not be

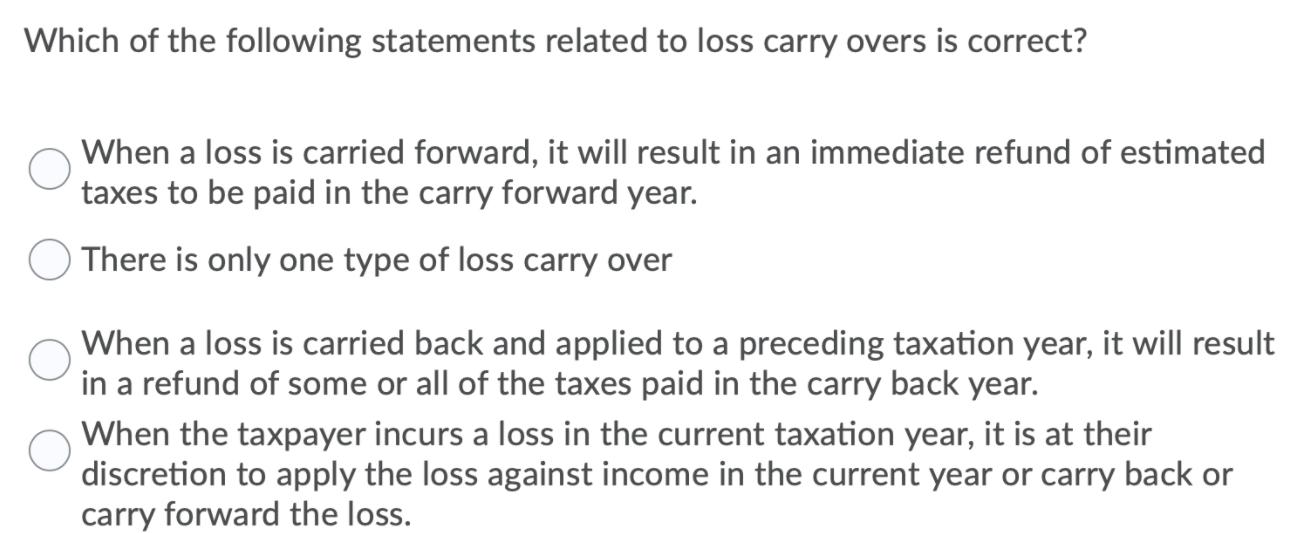

Which of the following statements BEST describes an important tax planning opportunity with regard to loss carry overs? Loss carry overs should not be used to reduce Taxable Income to zero as this prevents the application of personal tax credits. Loss carry overs should be used to reduce Taxable Income to zero so that personal tax credits can be applied to trigger a refund of taxes in the year. As noncapital loss carry overs have an unlimited carry forward period, only net capital loss carry overs should be used to reduce Taxable Income to zero. As personal tax credits have an unlimited carry forward period, loss carryovers should be used to reduce Taxable Income to nil. Which of the following statements related to loss carry overs is correct? When a loss is carried forward, it will result in an immediate refund of estimated taxes to be paid in the carry forward year. There is only one type of loss carry over When a loss is carried back and applied to a preceding taxation year, it will result in a refund of some or all of the taxes paid in the carry back year. When the taxpayer incurs a loss in the current taxation year, it is at their discretion to apply the loss against income in the current year or carry back or carry forward the loss.

Step by Step Solution

★★★★★

3.61 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

8 Option B Loss carry overs should be used to reduce taxable income to zero so ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started