Answered step by step

Verified Expert Solution

Question

1 Approved Answer

with solution please. thank you so much 39. During the lesson, you researched two types of credit cards you could obtain-one from a financial institution

with solution please. thank you so much

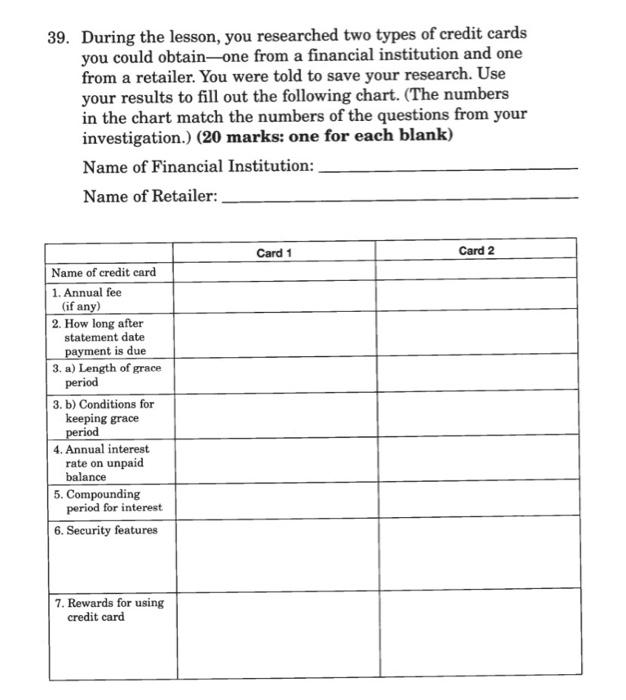

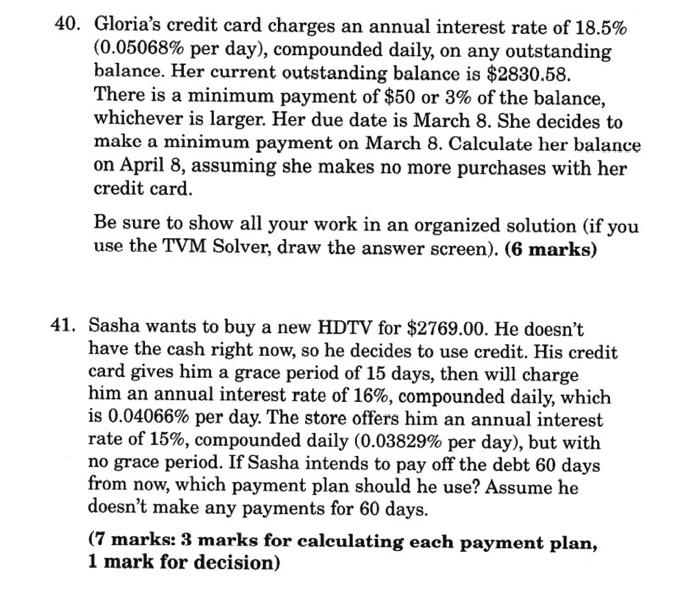

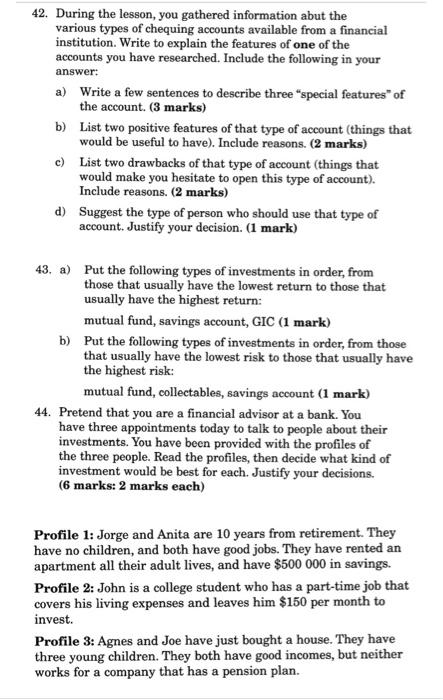

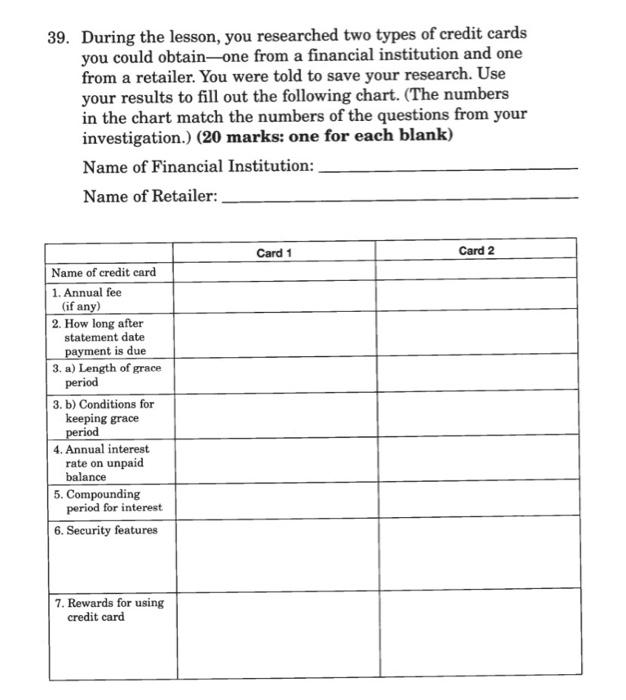

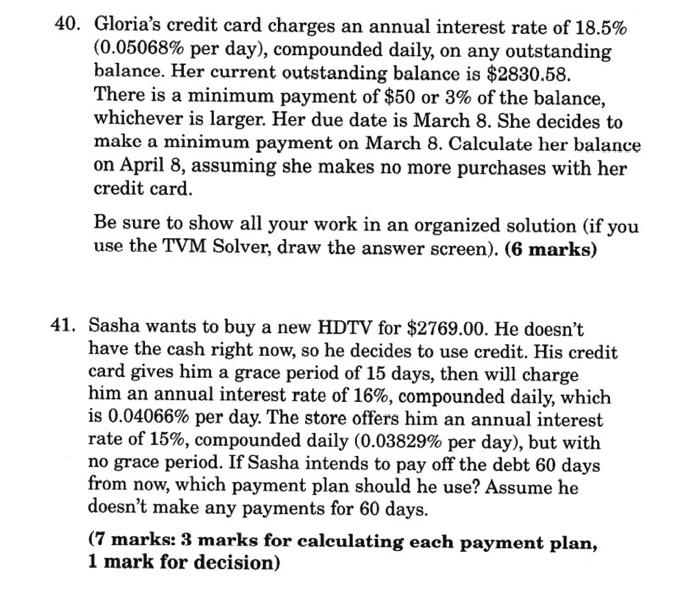

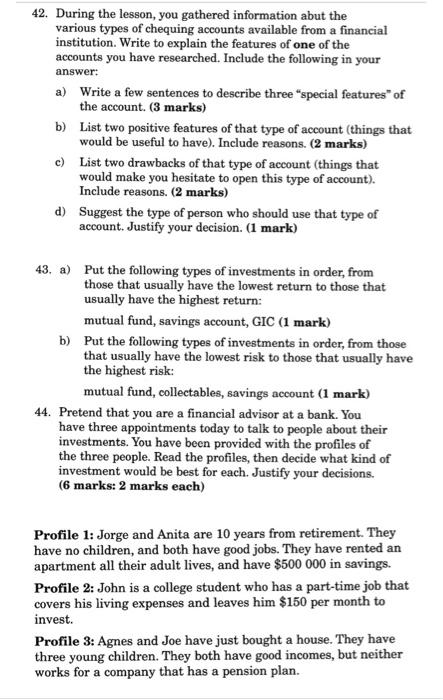

39. During the lesson, you researched two types of credit cards you could obtain-one from a financial institution and one from a retailer. You were told to save your research. Use your results to fill out the following chart. (The numbers in the chart match the numbers of the questions from your investigation.) (20 marks: one for each blank) Name of Financial Institution: Name of Retailer: Card 1 Card 2 Name of credit card 1. Annual fee (if any) 2. How long after statement date payment is due 3. a) Length of grace period 3. b) Conditions for keeping grace period 4. Annual interest rate on unpaid balance 5. Compounding period for interest 6. Security features 7. Rewards for using credit card 40. Gloria's credit card charges an annual interest rate of 18.5% (0.05068% per day), compounded daily, on any outstanding balance. Her current outstanding balance is $2830.58. There is a minimum payment of $50 or 3% of the balance, whichever is larger. Her due date is March 8. She decides to make a minimum payment on March 8. Calculate her balance on April 8, assuming she makes no more purchases with her credit card. Be sure to show all your work in an organized solution (if you use the TVM Solver, draw the answer screen). (6 marks) 41. Sasha wants to buy a new HDTV for $2769.00. He doesn't have the cash right now, so he decides to use credit. His credit card gives him a grace period of 15 days, then will charge him an annual interest rate of 16%, compounded daily, which is 0.04066% per day. The store offers him an annual interest rate of 15%, compounded daily (0.03829% per day), but with no grace period. If Sasha intends to pay off the debt 60 days from now, which payment plan should he use? Assume he doesn't make any payments for 60 days. (7 marks: 3 marks for calculating each payment plan, 1 mark for decision) 42. During the lesson, you gathered information abut the various types of chequing accounts available from a financial institution. Write to explain the features of one of the accounts you have researched. Include the following in your answer: a) Write a few sentences to describe three "special features of the account. (3 marks) b) List two positive features of that type of account things that would be useful to have). Include reasons. (2 marks) c) List two drawbacks of that type of account (things that would make you hesitate to open this type of account). Include reasons. (2 marks) d) Suggest the type of person who should use that type of account. Justify your decision. (1 mark) 43. a) Put the following types of investments in order, from those that usually have the lowest return to those that usually have the highest return: mutual fund, savings account, GIC (1 mark) b) Put the following types of investments in order, from those that usually have the lowest risk to those that usually have the highest risk: mutual fund, collectables, savings account (1 mark) 44. Pretend that you are a financial advisor at a bank. You have three appointments today to talk to people about their investments. You have been provided with the profiles of the three people. Read the profiles, then decide what kind of investment would be best for each. Justify your decisions. (6 marks: 2 marks each) Profile 1: Jorge and Anita are 10 years from retirement. They have no children, and both have good jobs. They have rented an apartment all their adult lives, and have $500 000 in savings. Profile 2: John is a college student who has a part-time job that covers his living expenses and leaves him $150 per month to invest. Profile 3: Agnes and Joe have just bought a house. They have three young children. They both have good incomes, but neither works for a company that has a pension plan

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started