With the case outlined below answer the required questions,Before the next meeting with Samantha, Wayne knows he needs to a) assess the situation b) identify the issues c) analyze the issues d) advise and recommend

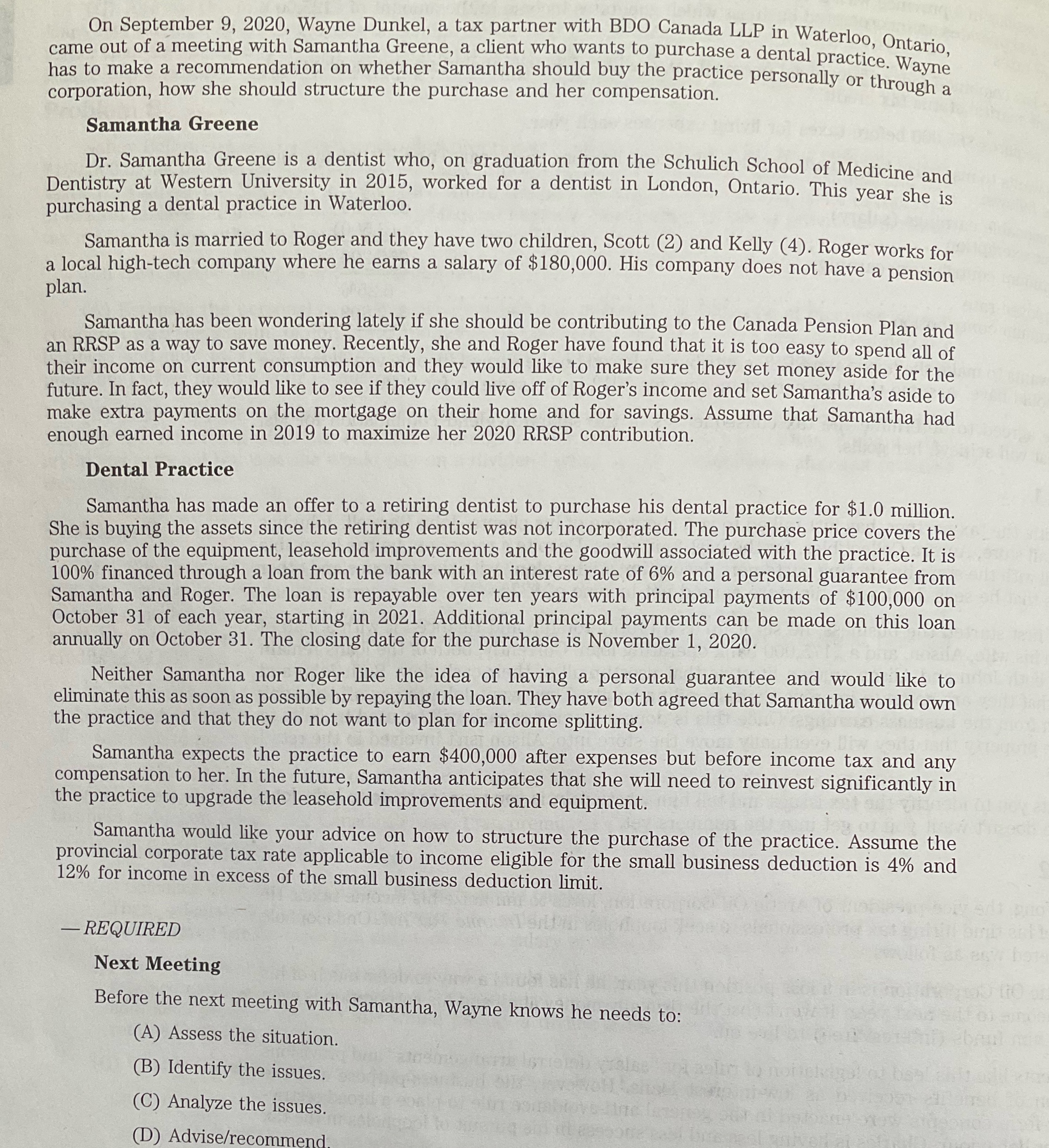

On September 9, 2020, Wayne Dunkel, a tax partner with BDO Canada LLP in Waterloo, Ontario, came out of a meeting with Samantha Greene, a client who wants to purchase a dental practice. Wayne has to make a recommendation on whether Samantha should buy the practice personally or through a corporation, how she should structure the purchase and her compensation. Samantha Greene Dr. Samantha Greene is a dentist who, on graduation from the Schulich School of Medicine and Dentistry at Western University in 2015, worked for a dentist in London, Ontario. This year she is purchasing a dental practice in Waterloo. Samantha is married to Roger and they have two children, Scott (2) and Kelly (4). Roger works for a local high-tech company where he earns a salary of $180,000. His company does not have a pension plan. Samantha has been wondering lately if she should be contributing to the Canada Pension Plan and an RRSP as a way to save money. Recently, she and Roger have found that it is too easy to spend all of their income on current consumption and they would like to make sure they set money aside for the future. In fact, they would like to see if they could live off of Roger's income and set Samantha's aside to make extra payments on the mortgage on their home and for savings. Assume that Samantha had enough earned income in 2019 to maximize her 2020 RRSP contribution. Dental Practice Samantha has made an offer to a retiring dentist to purchase his dental practice for $1.0 million. She is buying the assets since the retiring dentist was not incorporated. The purchase price covers the purchase of the equipment, leasehold improvements and the goodwill associated with the practice. It is 100% financed through a loan from the bank with an interest rate of 6% and a personal guarantee from Samantha and Roger. The loan is repayable over ten years with principal payments of $100,000 on October 31 of each year, starting in 2021. Additional principal payments can be made on this loan annually on October 31. The closing date for the purchase is November 1, 2020. Neither Samantha nor Roger like the idea of having a personal guarantee and would like to eliminate this as soon as possible by repaying the loan. They have both agreed that Samantha would own the practice and that they do not want to plan for income splitting. Samantha expects the practice to earn $400,000 after expenses but before income tax and any compensation to her. In the future, Samantha anticipates that she will need to reinvest significantly in the practice to upgrade the leasehold improvements and equipment. Samantha would like your advice on how to structure the purchase of the practice. Assume the provincial corporate tax rate applicable to income eligible for the small business deduction is 4% and 12% for income in excess of the small business deduction limit. REQUIRED Next Meeting Before the next meeting with Samantha, Wayne knows he needs to: (A) Assess the situation. (B) Identify the issues. (C) Analyze the issues. (D) Advise/recomme