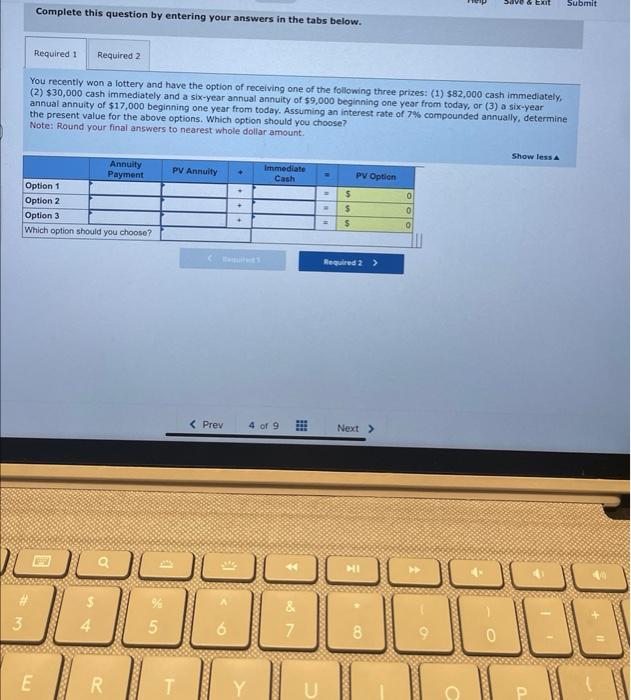

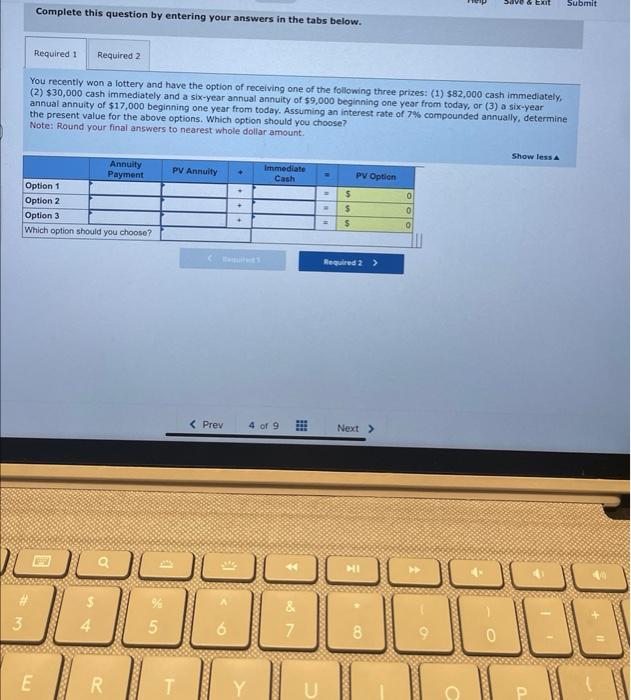

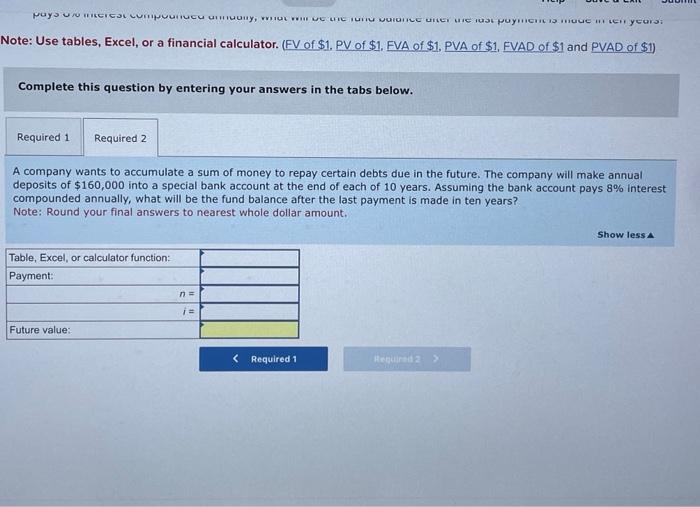

Exercise 5-15 (Algo) Future and present value [LO5-3, 5-7, 5-8] Answer each of the following independent questions. 1. You recently won a lottery and have the option of receiving one of the following three prizes: (1) $82,000 cash immediately, (2) $30,000 cash immediately and a six-year annual annuity of $9,000 beginning one year from today, or (3) a six-year annual annuity of $17,000 beginning one year from today. Assuming an interest rate of 7% compounded annually, determine the present value for the above options. Which option should you choose? 2. A company wants to accumulate a sum of money to repay certain debts due in the future. The company will make annual deposits of $160,000 into a special bank account at the end of each of 10 years. Assuming the bank account pays 8% interest compounded annually, what will be the fund balance after the last payment is made in ten years? Note: Use tables, Excel, or a financial calculator. (FV of \$1. PV of \$1. EVA of \$1. PVA of \$1. EVAD of \$1 and PVAD of S1) Complete this question by entering your answers in the tabs below. You recently won a lottery and have the option of receiving one of the following three prizes: (1) $82,000 cash immediately. (2) $30,000 cash immediately and a six-year annual annuity of $9,000 beginning one year from today, or (3) a six-year annual annulty of $17,000 beginning one year from today. Assuming an interest rate of 7% compounded annually, determine the present value for the above options. Which option should you choose? Note: Round your final answers to nearest whole dollar amount. Complete this question by entering your answers in the tabs below. You recently won a lottery and have the option of receiving one of the following three prizes: (1) 582,000 cash immediately, (2) $30,000 cash immediately and a six-year annual annuity of $9,000 beginning one year from today, or (3) a six-year annual annuity of $17,000 beginning one year from today. Assuming an interest rate of 7% compounded annually, determine the present value for the above options. Which option should you choose? Note: Round your final answers to nearest whole dollar amount: Vote: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1. FVA of $1, PVA of $1, FVAD of $1 and PVAD of \$1) Complete this question by entering your answers in the tabs below. A company wants to accumulate a sum of money to repay certain debts due in the future. The company will make annual deposits of $160,000 into a special bank account at the end of each of 10 years. Assuming the bank account pays 8% interest compounded annually, what will be the fund balance after the last payment is made in ten years? Note: Round your final answers to nearest whole dollar amount