Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Work through this Income Statement Case Study: CASE I Analyzing Income Statements for Two Merchandising Companies Shown below are the income statements for two different

Work through this Income Statement Case Study:

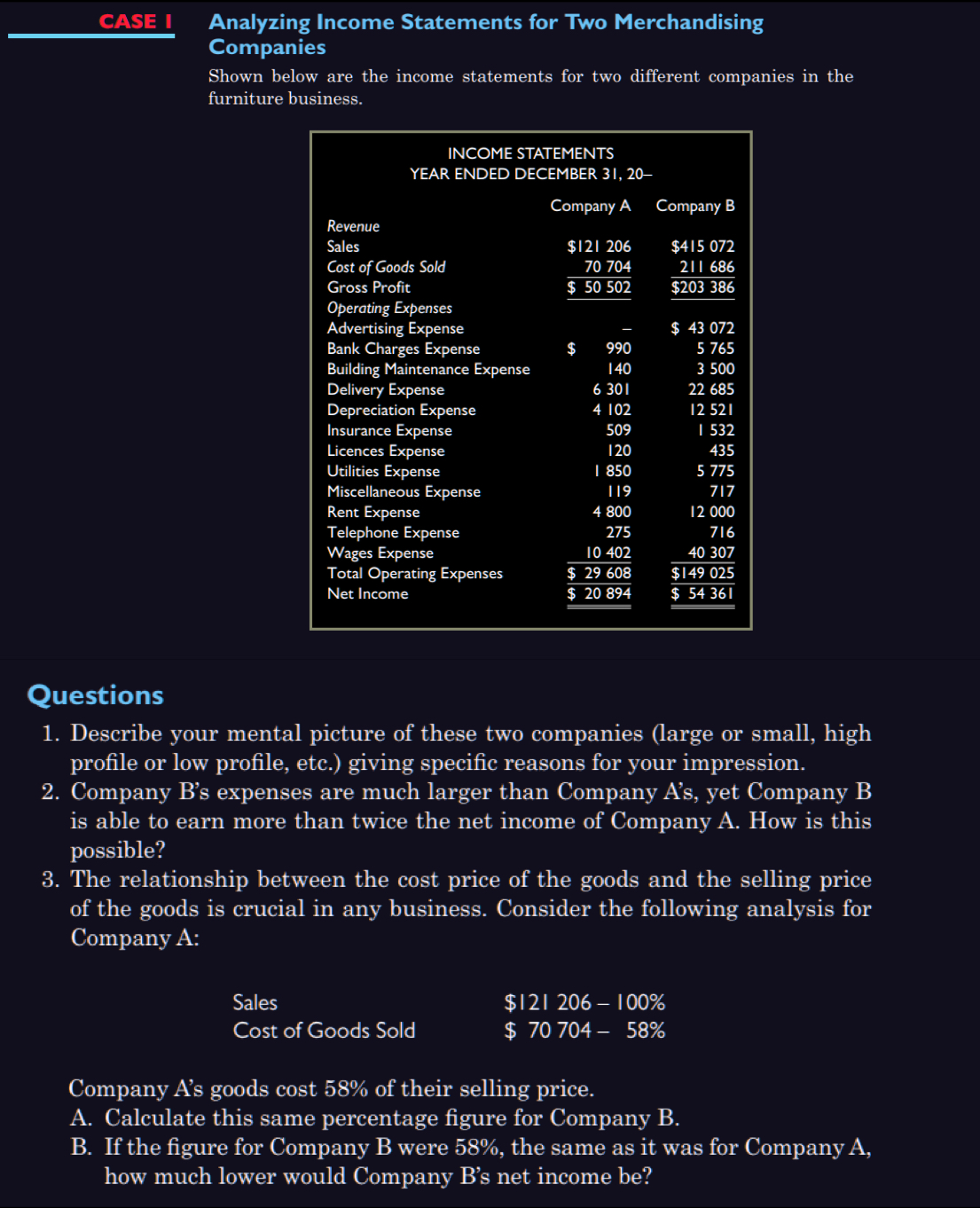

CASE I Analyzing Income Statements for Two Merchandising Companies Shown below are the income statements for two different companies in the furniture business. INCOME STATEMENTS YEAR ENDED DECEMBER 31, 20- Company A Revenue Sales Cost of Goods Sold Gross Profit Operating Expenses Advertising Expense Bank Charges Expense Building Maintenance Expense Delivery Expense Depreciation Expense Insurance Expense Licences Expense Utilities Expense Miscellaneous Expense Rent Expense Telephone Expense Wages Expense Total Operating Expenses Net Income $121 206 70 704 $ 50 502 990 140 6 301 4 102 509 120 I 850 119 4 800 275 10 402 $ 29 608 $20 894 Sales Cost of Goods Sold $ Company B $415 072 211 686 $203 386 $ 43 072 5 765 Questions 1. Describe your mental picture of these two companies (large or small, high profile or low profile, etc.) giving specific reasons for your impression. 2. Company B's expenses are much larger than Company A's, yet Company B is able to earn more than twice the net income of Company A. How is this possible? 3 500 22 685 12 521 1 532 435 5 775 717 12 000 716 40 307 $149 025 $ 54 361 3. The relationship between the cost price of the goods and the selling price of the goods is crucial in any business. Consider the following analysis for Company A: $121 206 - 100% $ 70 704 - 58% Company A's goods cost 58% of their selling price. A. Calculate this same percentage figure for Company B. B. If the figure for Company B were 58%, the same as it was for Company A, how much lower would Company B's net income be?

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1 Mental Picture of the Companies Company A Company A seems to be a smaller or less revenuegenerating company compared to Company B This is inferred from the lower total revenue gross profit and net i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started