X Co. purchased

$2,000 of inventory on account. This inventory was sold for

$3,000 cash. The\ amount of gross margin reported on the income statement and the amount of net cash inflow from\ operating activities reported on the statement of cash flows would be\ r.

$3,(000)/($)1,000.\ (b)

$1,(000)/($)3,000.\ c.

$1,(000)/($)-0-\ d.

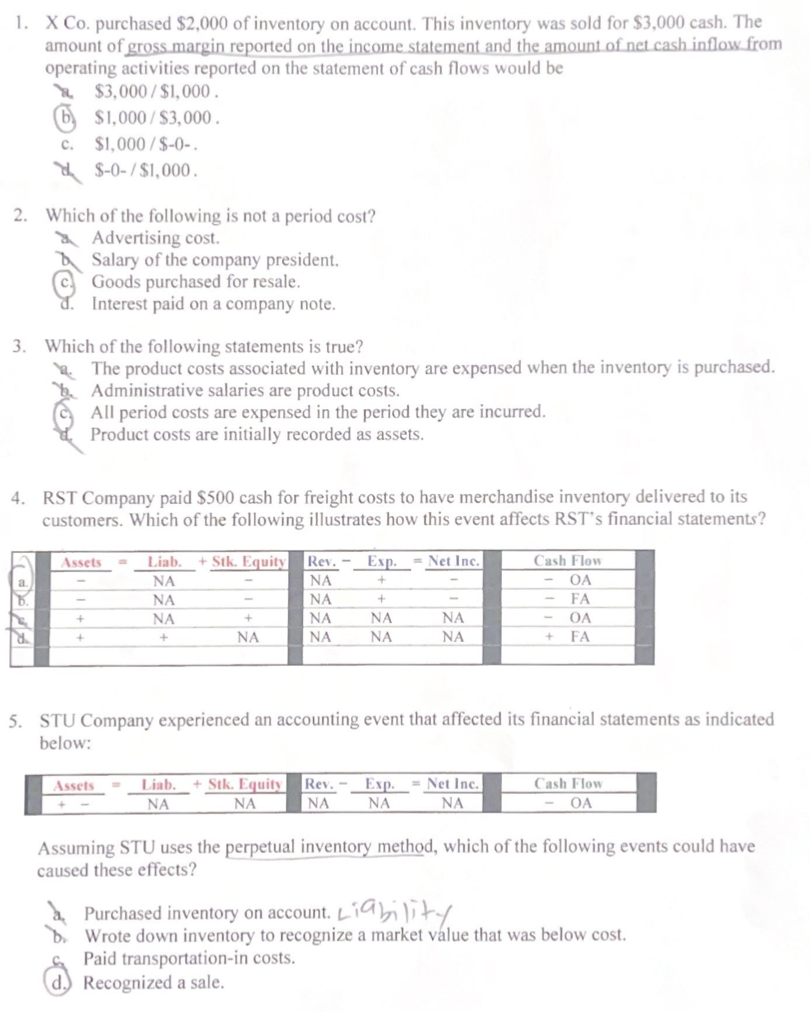

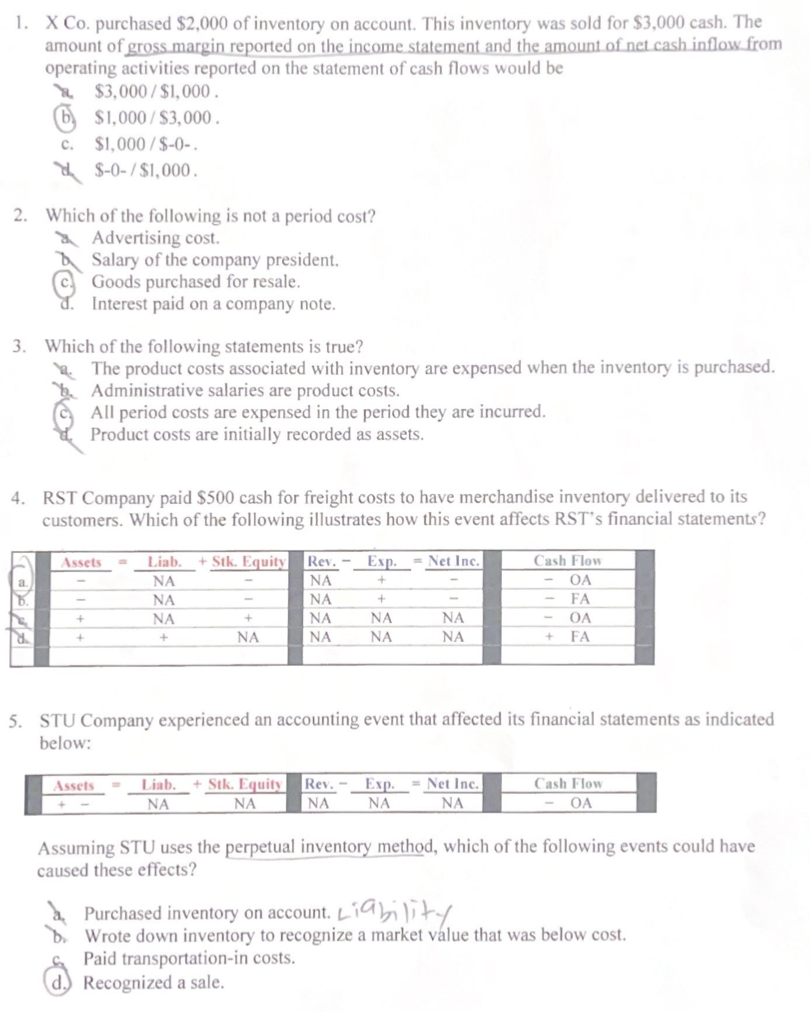

$-0(-)/($)1,000.\ Which of the following is not a period cost?\ Advertising cost.\ Salary of the company president.\ c. Goods purchased for resale.\ d. Interest paid on a company note.\ Which of the following statements is true?\ The product costs associated with inventory are expensed when the inventory is purchased.\ k. Administrative salaries are product costs.\ c. All period costs are expensed in the period they are incurred.\ Product costs are initially recorded as assets.\ RST Company paid

$500 cash for freight costs to have merchandise inventory delivered to its\ customers. Which of the following illustrates how this event affects RST's financial statements?\ STU Company experienced an accounting event that affected its financial statements as indicated\ below:\ Assuming STU uses the perpetual inventory method, which of the following events could have\ caused these effects?\ a. Purchased inventory on account. Liability\ b. Wrote down inventory to recognize a market value that was below cost.\ c. Paid transportation-in costs.\ d. Recognized a sale.

1. X Co. purchased $2,000 of inventory on account. This inventory was sold for $3,000cash. The amount of gross margin reported on the income statement and the amount of net cash inflow from operating activities reported on the statement of cash flows would be a $3,000/$1,000. (b) $1,000/$3,000. c. $1,000/$0 - 2. $0/$1,000. 2. Which of the following is not a period cost? a. Advertising cost. Salary of the company president. c. Goods purchased for resale. . Interest paid on a company note. 3. Which of the following statements is true? a. The product costs associated with inventory are expensed when the inventory is purchased. Administrative salaries are product costs. (C) All period costs are expensed in the period they are incurred. e. Product costs are initially recorded as assets. 4. RST Company paid $500 cash for freight costs to have merchandise inventory delivered to its customers. Which of the following illustrates how this event affects RST's financial statements? 5. STU Company experienced an accounting event that affected its financial statements as indicated below: Assuming STU uses the perpetual inventory method, which of the following events could have caused these effects? a. Purchased inventory on account. Liability b. Wrote down inventory to recognize a market value that was below cost. c. Paid transportation-in costs. d. Recognized a sale. 1. X Co. purchased $2,000 of inventory on account. This inventory was sold for $3,000cash. The amount of gross margin reported on the income statement and the amount of net cash inflow from operating activities reported on the statement of cash flows would be a $3,000/$1,000. (b) $1,000/$3,000. c. $1,000/$0 - 2. $0/$1,000. 2. Which of the following is not a period cost? a. Advertising cost. Salary of the company president. c. Goods purchased for resale. . Interest paid on a company note. 3. Which of the following statements is true? a. The product costs associated with inventory are expensed when the inventory is purchased. Administrative salaries are product costs. (C) All period costs are expensed in the period they are incurred. e. Product costs are initially recorded as assets. 4. RST Company paid $500 cash for freight costs to have merchandise inventory delivered to its customers. Which of the following illustrates how this event affects RST's financial statements? 5. STU Company experienced an accounting event that affected its financial statements as indicated below: Assuming STU uses the perpetual inventory method, which of the following events could have caused these effects? a. Purchased inventory on account. Liability b. Wrote down inventory to recognize a market value that was below cost. c. Paid transportation-in costs. d. Recognized a sale