Answered step by step

Verified Expert Solution

Question

1 Approved Answer

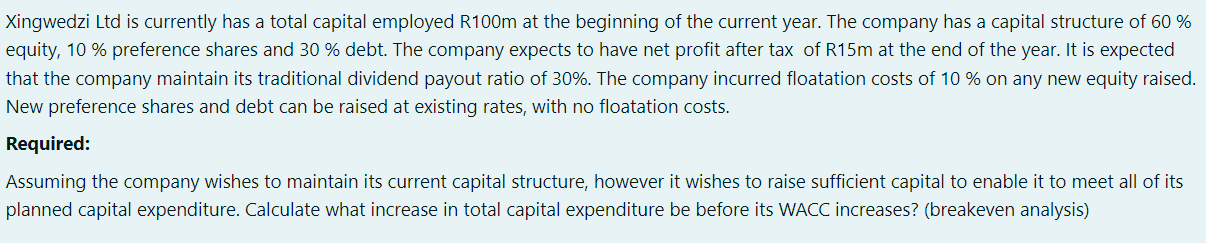

Xingwedzi Ltd is currently has a total capital employed R 1 0 0 m at the beginning of the current year. The company has a

Xingwedzi Ltd is currently has a total capital employed Rm at the beginning of the current year. The company has a capital structure of

equity, preference shares and debt. The company expects to have net profit after tax of R at the end of the year. It is expected

that the company maintain its traditional dividend payout ratio of The company incurred floatation costs of on any new equity raised.

New preference shares and debt can be raised at existing rates, with no floatation costs.

Required:

Assuming the company wishes to maintain its current capital structure, however it wishes to raise sufficient capital to enable it to meet all of its

planned capital expenditure. Calculate what increase in total capital expenditure be before its WACC increases? breakeven analysis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started