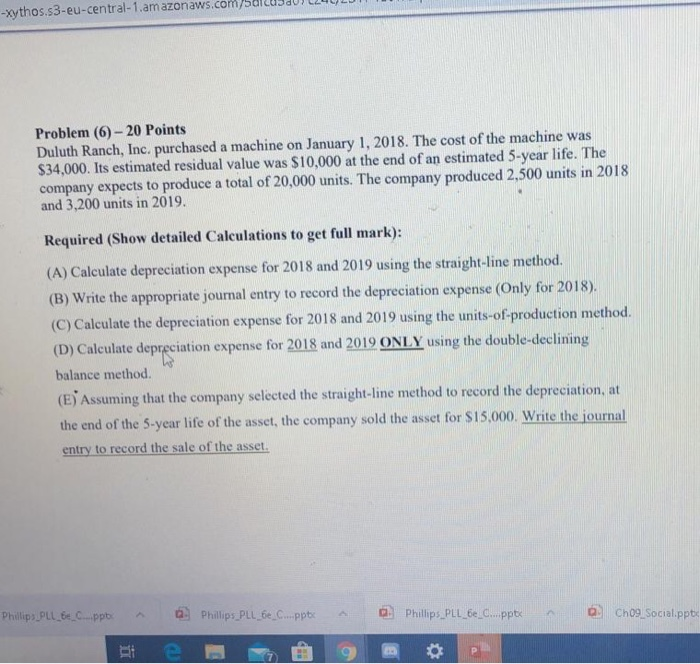

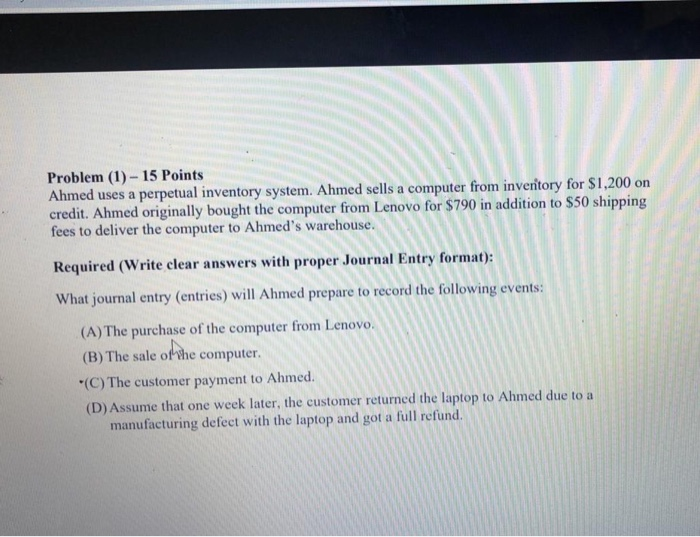

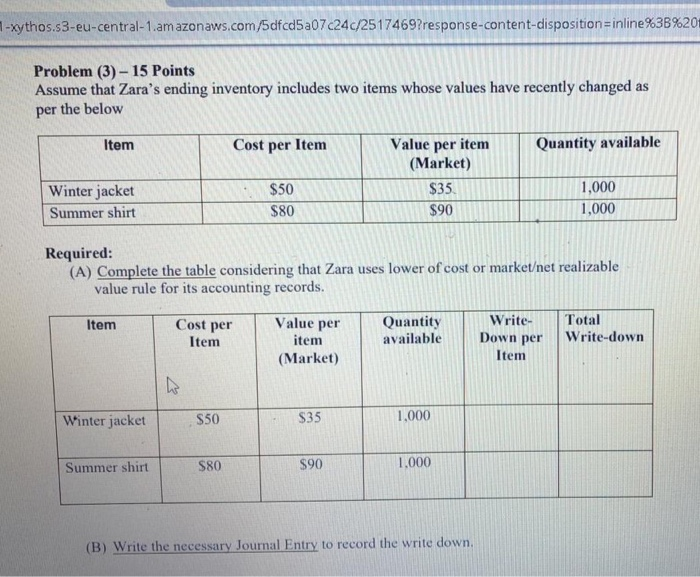

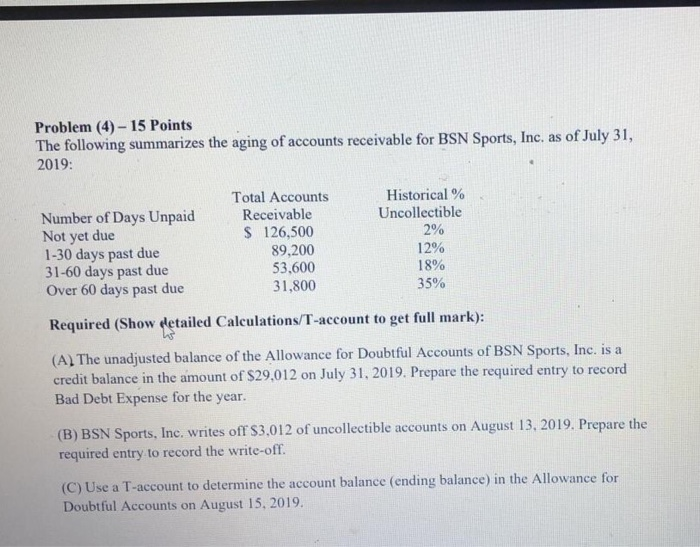

Xythos.33-eu-central-1.dll duldw5.LUI JUICUJUILL Problem (6) - 20 Points Duluth Ranch, Inc. purchased a machine on January 1, 2018. The cost of the machine was $34,000. Its estimated residual value was $10,000 at the end of an estimated 5-year life. The company expects to produce a total of 20,000 units. The company produced 2,500 units in 2018 and 3,200 units in 2019. Required (Show detailed Calculations to get full mark): (A) Calculate depreciation expense for 2018 and 2019 using the straight-line method. (B) Write the appropriate journal entry to record the depreciation expense (Only for 2018). (C) Calculate the depreciation expense for 2018 and 2019 using the units-of-production method. (D) Calculate depreciation expense for 2018 and 2019 ONLY using the double-declining balance method. (E) Assuming that the company selected the straight-line method to record the depreciation, at the end of the 5-year life of the asset, the company sold the asset for $15,000. Write the journal entry to record the sale of the asset. hillip PLL 6 C.ppt 0. Phillips PLL_6_C...ppt Phillips PLL_e_C...ppt - Ch09_Social.ppt Problem (1) - 15 Points Ahmed uses a perpetual inventory system. Ahmed sells a computer from invertory for $1,200 on credit. Ahmed originally bought the computer from Lenovo for $790 in addition to $50 shipping fees to deliver the computer to Ahmed's warehouse Required (Write clear answers with proper Journal Entry format): What journal entry (entries) will Ahmed prepare to record the following events: (A) The purchase of the computer from Lenovo. (B) The sale of Whe computer, *(C) The customer payment to Ahmed. (D) Assume that one week later, the customer returned the laptop to Ahmed due to a manufacturing defect with the laptop and got a full refund -Xythos.s3-eu-central-1.amazonaws.com/5dfcd5a07c24c/2517469?response-content-disposition=inline%3B%20 Problem (3) - 15 Points Assume that Zara's ending inventory includes two items whose values have recently changed as per the below Item Cost per Item Quantity available Value per item (Market) $50 $35. Winter jacket Summer shirt $80 1,000 1,000 $90 Required: (A) Complete the table considering that Zara uses lower of cost or marketet realizable value rule for its accounting records. Item Cost per Item Value per item (Market) Quantity available Write Down per Item Total Write-down Winter jacket S50 $35 1,000 Summer shirt $80 S90 1.000 (B) Write the necessary Journal Entry to record the write down. Problem (4) - 15 Points The following summarizes the aging of accounts receivable for BSN Sports, Inc, as of July 31, 2019: Number of Days Unpaid Not yet due 1-30 days past due 31-60 days past due Over 60 days past due Total Accounts Receivable $ 126,500 89.200 53.600 31,800 Historical % Uncollectible 2% 12% 18% 35% Required (Show detailed Calculations/T-account to get full mark): (Al The unadjusted balance of the Allowance for Doubtful Accounts of BSN Sports, Inc. is a credit balance in the amount of $29,012 on July 31, 2019. Prepare the required entry to record Bad Debt Expense for the year. (B) BSN Sports, Inc. writes off $3,012 of uncollectible accounts on August 13, 2019. Prepare the required entry to record the write-off. (C) Use a T-account to determine the account balance (ending balance) in the Allowance for Doubtful Accounts on August 15, 2019