y=4

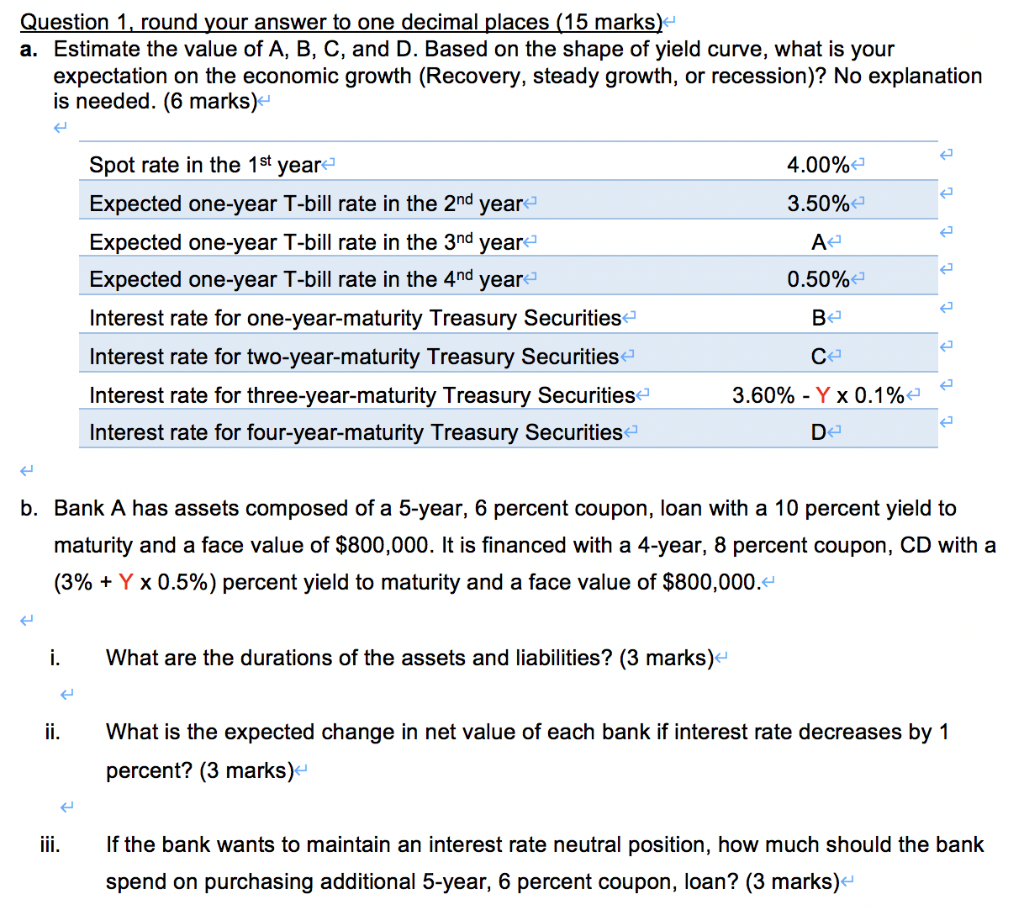

Question 1, round your answer to one decimal places (15 marks) a. Estimate the value of A, B, C, and D. Based on the shape of yield curve, what is your expectation on the economic growth (Recovery, steady growth, or recession)? No explanation is needed. (6 marks) 4.00% 3.50% A2 0.50% Spot rate in the 1st year Expected one-year T-bill rate in the 2nd year Expected one-year T-bill rate in the 3nd year Expected one-year T-bill rate in the 4nd year Interest rate for one-year-maturity Treasury Securities- Interest rate for two-year- maturity Treasury Securities Interest rate for three-year-maturity Treasury Securities Interest rate for four-year-maturity Treasury Securities e Be 3.60% - Yx 0.1% De b. Bank A has assets composed of a 5-year, 6 percent coupon, loan with a 10 percent yield to maturity and a face value of $800,000. It is financed with a 4-year, 8 percent coupon, CD with a (3% + Y x 0.5%) percent yield to maturity and a face value of $800,000.- i. What are the durations of the assets and liabilities? (3 marks) ii. What is the expected change in net value of each bank if interest rate decreases by 1 percent? (3 marks) iii. If the bank wants to maintain an interest rate neutral position, how much should the bank spend on purchasing additional 5-year, 6 percent coupon, loan? (3 marks) Question 1, round your answer to one decimal places (15 marks) a. Estimate the value of A, B, C, and D. Based on the shape of yield curve, what is your expectation on the economic growth (Recovery, steady growth, or recession)? No explanation is needed. (6 marks) 4.00% 3.50% A2 0.50% Spot rate in the 1st year Expected one-year T-bill rate in the 2nd year Expected one-year T-bill rate in the 3nd year Expected one-year T-bill rate in the 4nd year Interest rate for one-year-maturity Treasury Securities- Interest rate for two-year- maturity Treasury Securities Interest rate for three-year-maturity Treasury Securities Interest rate for four-year-maturity Treasury Securities e Be 3.60% - Yx 0.1% De b. Bank A has assets composed of a 5-year, 6 percent coupon, loan with a 10 percent yield to maturity and a face value of $800,000. It is financed with a 4-year, 8 percent coupon, CD with a (3% + Y x 0.5%) percent yield to maturity and a face value of $800,000.- i. What are the durations of the assets and liabilities? (3 marks) ii. What is the expected change in net value of each bank if interest rate decreases by 1 percent? (3 marks) iii. If the bank wants to maintain an interest rate neutral position, how much should the bank spend on purchasing additional 5-year, 6 percent coupon, loan