Answered step by step

Verified Expert Solution

Question

1 Approved Answer

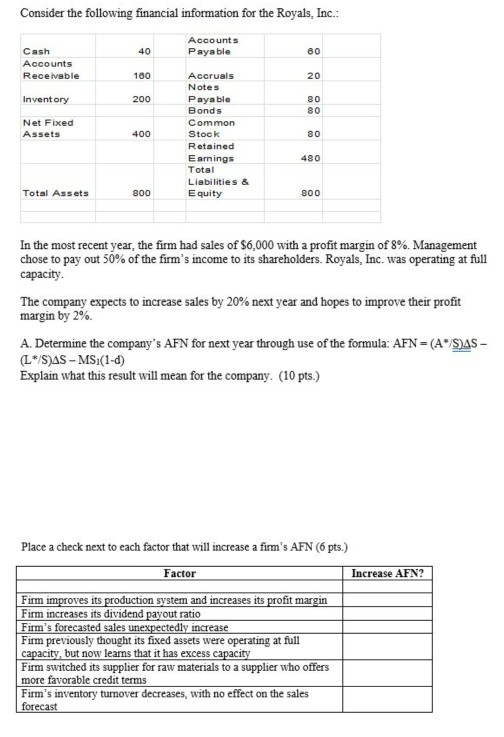

Yes, the amount is in millions Consider the following financial information for the Royals, Inc.: 40 Accounts Payable 80 Cash Accounts Receivable 100 20 Inventory

Yes, the amount is in millions

Consider the following financial information for the Royals, Inc.: 40 Accounts Payable 80 Cash Accounts Receivable 100 20 Inventory 200 80 80 Net Fixed Assets 400 Accruals Notes Payable Bonds Common Stock Retained Earnings Total Liabilities & Equity 80 480 Total Assets 800 800 In the most recent year, the firm had sales of $6,000 with a profit margin of 8% Management chose to pay out 50% of the firm's income to its shareholders. Royals, Inc. was operating at full capacity The company expects to increase sales by 20% next year and hopes to improve their profit margin by 2%. A. Determine the company's AFN for next year through use of the formula: AFN = (A/S)AS - (L*S)AS-MS (1-4) Explain what this result will mean for the company. (10 pts.) Increase AFN? Place a check next to each factor that will increase a firm's AFN (6 pts.) Factor Firm improves its production system and increases its profit margin Firm increases its dividend payout ratio Firm's forecasted sales unexpectedly increase Firm previously thought its fixed assets were operating at full capacity, but now learns that it has excess capacity Firm switched its supplier for raw materials to a supplier who offers more favorable credit terms Firm's inventory turnover decreases, with no effect on the sales forecastStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started