You are a management accountant working for a company called BHP, which manufactures iron ore. BHP's investment to progress the development of ground-breaking technology

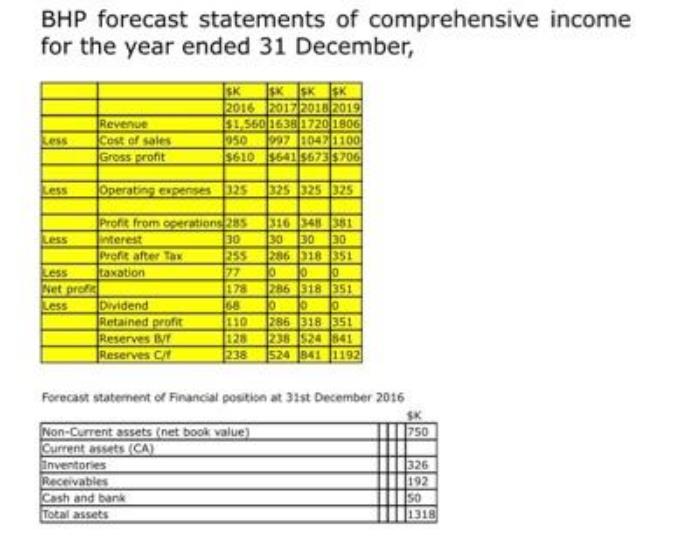

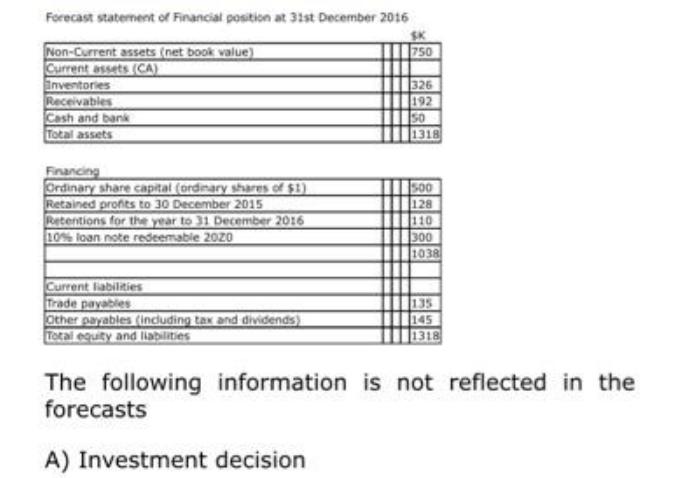

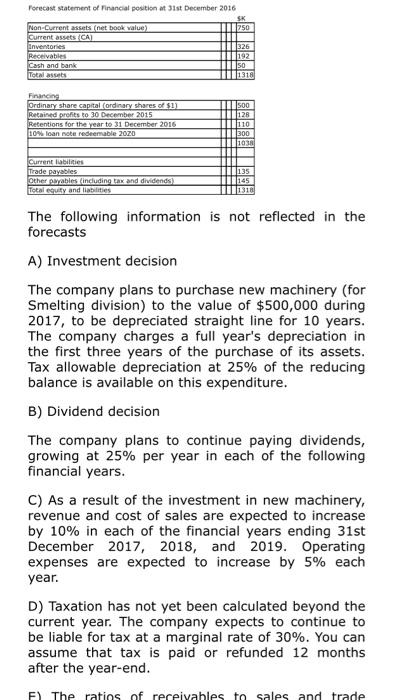

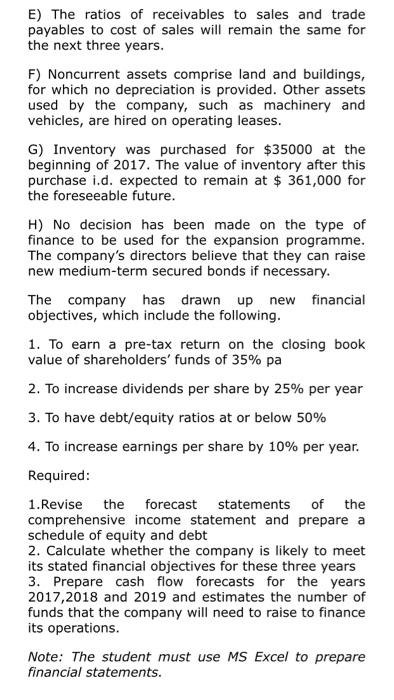

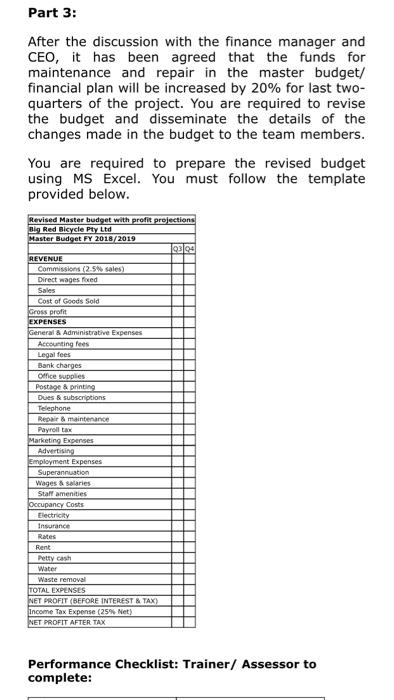

You are a management accountant working for a company called BHP, which manufactures iron ore. BHP's investment to progress the development of ground-breaking technology to reduce carbon emissions from smelter. The following three years forecast, were prepared by your last management accountant but are incomplete and require some adjustments are as follows, BHP forecast statements of comprehensive income for the year ended 31 December, BHP forecast statements of comprehensive income for the year ended 31 December, Ress Less Less Less Net profie Less Revenue Cost of sales Gross profit Operating expenses 325 Profit from operations 285 interest 30 Profit after Tax taxation Dividend Retained profit Reserves BVT Reserves C/f SK SK SK SK 2016 2017 2018 2019 $1.560 1638 1720 1806 950 997 1047 1100 $610 $641 $673 $706 Inventories Receivables Cash and bank Total assets 255 77 178 68 110 128 238 325 325 325 Forecast statement of Financial position at 31st December 2016 Non-Current assets (net book value) Current assets (CA) 316 348 381 30 30 30 286 318 351 10 0 0 286 318 351 10 10 lo 286 318 351 238 524 841 524 841 1192 750 326 192 50 1318 Forecast statement of Financial position at 31st December 2016 Non-Current assets (net book value) Current assets (CA) Inventories Receivables Cash and bank Total assets Financing Ordinary share capital (ordinary shares of $1) Retained profits to 30 December 2015 Retentions for the year to 31 December 2016 10% loan note redeemable 2020 Current liabilities Trade payables Other payables (including tax and dividends) Total equity and liabilities 750 326 192 50 1318 A) Investment decision 500 128 110 300 1038 145 1318 The following information is not reflected in the forecasts Forecast statement of Financial position at 31st December 2016 SK 750 Non-Current assets (net book value) Current assets (CA) Inventories Receivables Cash and bank Total assets Financing Ordinary share capital (ordinary shares of $1) Retained profits to 30 December 2015 Retentions for the year to 31 December 2016 10% loan note redeemable 2020 Current labilities Trade payables Other payables (including tax and dividends) Total equity and liabilities 326 192 50 1318 500 128 110 300 1038 135 145 1318 The following information is not reflected in the forecasts A) Investment decision The company plans to purchase new machinery (for Smelting division) to the value of $500,000 during 2017, to be depreciated straight line for 10 years. The company charges a full year's depreciation in the first three years of the purchase of its assets. Tax allowable depreciation at 25% of the reducing balance is available on this expenditure. B) Dividend decision The company plans to continue paying dividends, growing at 25% per year in each of the following financial years. C) As a result of the investment in new machinery, revenue and cost of sales are expected to increase by 10% in each of the financial years ending 31st December 2017, 2018, and 2019. Operating expenses are expected to increase by 5% each year. D) Taxation has not yet been calculated beyond the current year. The company expects to continue to be liable for tax at a marginal rate of 30%. You can assume that tax is paid or refunded 12 months after the year-end. F) The ratios of receivables to sales and trade E) The ratios of receivables to sales and trade payables to cost of sales will remain the same for the next three years. F) Noncurrent assets comprise land and buildings, for which no depreciation is provided. Other assets used by the company, such as machinery and vehicles, are hired on operating leases. G) Inventory was purchased for $35000 at the beginning of 2017. The value of inventory after this purchase i.d. expected to remain at $ 361,000 for the foreseeable future. H) No decision has been made on the type of finance to be used for the expansion programme. The company's directors believe that they can raise new medium-term secured bonds if necessary. The company has drawn up new financial objectives, which include the following. 1. To earn a pre-tax return on the closing book value of shareholders' funds of 35% pa 2. To increase dividends per share by 25% per year 3. To have debt/equity ratios at or below 50% 4. To increase earnings per share by 10% per year. Required: 1.Revise the forecast statements of the comprehensive income statement and prepare a schedule of equity and debt 2. Calculate whether the company is likely to meet its stated financial objectives for these three years 3. Prepare cash flow forecasts for the years 2017,2018 and 2019 and estimates the number of funds that the company will need to raise to finance its operations. Note: The student must use MS Excel to prepare financial statements. Part 1: Considering the outcomes of the previous assessment task, you will be required to present the following to the management: Areas/quarter of the financial budget that is not achievable. Negotiations in the financial budget Impact of these negotiations Areas that need adjustment to make improvements in the team budget/financial plan . Cost variations and expenditure overruns for each quarter Contingency plan Ageing summaries, cash flow, petty cash, Goods and Services Tax (GST), and profit and loss statements based on the specified budget. You must prepare 8-10 presentation slides. Part 2: Scenario: After delivering the presentation, you are then required to engage in discussion with the CEO and Finance Manager of the company to negotiate the following: Due to decreasing the budget for maintenance and repair cost, some of the machines have not been repaired during the first two quarters. You must negotiate with the Finance manager to increase the funds for maintenance and repair in the master budget/ financial plan by 20%. To increase the overhead cost such as office supplies by 10%. Negotiate this with the CEO. Come to a mutual agreement on the on financial budget/plan. The role of the CEO will be played by your of of the finance trainer/assessor and the role Due to decreasing the budget for maintenance and repair cost, some of the machines have not been repaired during the first two quarters. You must negotiate with the Finance manager to increase the funds for maintenance and repair in the master budget/ financial plan by 20%. To increase the overhead cost such as office supplies by 10%. Negotiate this with the CEO. Come to a mutual agreement on the on financial budget/plan. The role of the CEO will be played by your trainer/assessor, and the role of the finance manager will be allocated to the student by your trainer/assessor. If there are an insufficient number of students in the class, then your trainer/assessor will take on multiple roles and switch roles based on requirements. During the discussion/Roleplay: The finance manager will agree to the change as it is an essential cost that must be incurred. Otherwise, this will lead to damage to the machinery. The CEO will obstruct to increase the overhead cost because this will decrease the company's overall profit and with the increased wages, it is not possible for the company to increase the overhead cost by 10%. Part 3: After the discussion with the finance manager and CEO, it has been agreed that the funds for maintenance and repair in the master budget/ financial plan will be increased by 20% for last two- quarters of the project. You are required to revise the budget and disseminate the details of the changes made in the budget to the team members. You are required to prepare the revised budget using MS Excel. You must follow the template Part 3: After the discussion with the finance manager and CEO, it has been agreed that the funds for maintenance and repair in the master budget/ financial plan will be increased by 20% for last two- quarters of the project. You are required to revise the budget and disseminate the details of the changes made in the budget to the team members. You are required to prepare the revised budget using MS Excel. You must follow the template provided below. Revised Master budget with profit projections Big Red Bicycle Pty Ltd Master Budget FY 2018/2019 REVENUE Commissions (2.5% sales) Direct wages fixed Sales Cost of Goods Sold Gross profit EXPENSES General & Administrative Expenses Accounting fees Legal fees Bank charges Office supplies Postage & printing Dues & subscriptions Telephone Repair & maintenance Payroll tax Marketing Expenses Advertising Employment Expenses Superannuation Wages & salaries Staff amenities Occupancy Costs Electricity Insurance Rates Rent Petty cash Water Waste removal TOTAL EXPENSES NET PROFIT (BEFORE INTEREST & TAX) Income Tax Expense (25% Net) NET PROFIT AFTER TAX Q3 Q4 Performance Checklist: Trainer/ Assessor to complete: Project This task is in continuation of part E of assessment task 3. To complete this task, you will require the financial statements prepared as part of assessment task 2. Considering those financial statements (cash flow forecast and forecasted income statement), you will be required to review and evaluate these financial management processes with the work team. Your trainer, along with another student, will form a team with you. Your team will have 3 team members. You will then be required to analyse the following: Cash flow statement: o Identify how much cash flowed into the business in the fourth quarter. Deduce the source of finance most appropriate for this business, starting in quarter 3. o Identify how much cash the business had in its account at the end of the cash flow statement period. o Identify the quarter in which the business had the highest level of cash inflow. o Identify the quarter in which the business had the highest level of cash outflow. Income statement o Evaluate the legal structure of this business. o Identify items that would be included under Financial Expenses. Calculate the tax liabilities for this business in 2019. Financial ratios O o Current ratio (working capital ratio) o Debt to equity ratio o Identify how much cash flowed into the business in the fourth quarter. Deduce the source of finance most appropriate for this business, starting in quarter 3. o Identify how much cash the business had in its account at the end of the cash flow statement period. o Identify the quarter in which the business had the highest level of cash inflow. o Identify the quarter in which the business had the highest level of cash outflow. Income statement o Evaluate the legal structure of this business. o Identify items that would be included under Financial Expenses. o Calculate the tax liabilities for this business in 2019. Financial ratios o Current ratio (working capital ratio) o Debt to equity ratio o Return on equity (ROE) O After analysing the financial management processes of the organisation, you will then be required to prepare a report for the board of directors (trainer/assessor) that must include the following: . Outcomes of analysis of cash flow statement. Outcomes of analysis of income statement. Outcomes of financial rations. Your recommendations for improvement in the existing process. Implement the improvements in Contingency plan and attach to the report. Record-keeping requirements for the Australian Taxation Office (ATO) and for auditing purposes . existing process. Implement the improvements in Contingency plan and attach to the report. Record-keeping requirements for the Australian Taxation Office (ATO) and for auditing purposes Template for the report: Evaluation report of the financial management processes A cover sheet of the unit of competency Version control information Disclaimer and Acknowledgement An introduction to the project List of symbols and their explanations Table of contents The main body of the report covering the following topics: *Outcomes of analysis of cash flow statement. *Outcomes of analysis of income statement. *Outcomes of financial rations. Your recommendations for improvement in the existing process. Implement the improvements in Contingency plan and attach to the report Record-keeping requirements for the Australian Taxation Office (ATO) and for auditing purposes Summary and review Glossary References |

Step by Step Solution

3.57 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Less Less Less Less Less Less Income Statement Reve...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started