Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are an analyst for Wheel Wealth Management. One of your clients is intrigued by three companies he's seen recently as the focus of news

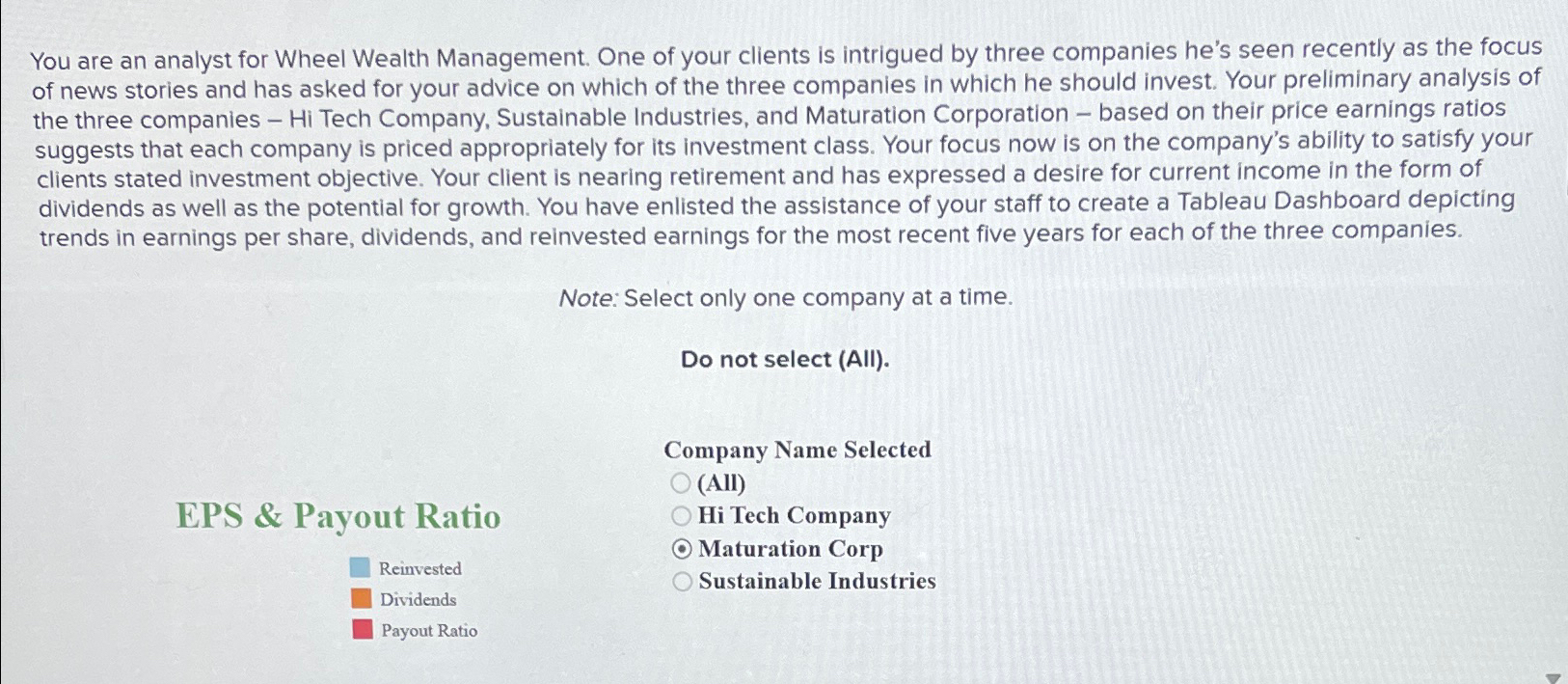

You are an analyst for Wheel Wealth Management. One of your clients is intrigued by three companies he's seen recently as the focus of news stories and has asked for your advice on which of the three companies in which he should invest. Your preliminary analysis of the three companies Hi Tech Company, Sustainable Industries, and Maturation Corporation based on their price earnings ratios suggests that each company is priced appropriately for its investment class. Your focus now is on the company's ability to satisfy your clients stated investment objective. Your client is nearing retirement and has expressed a desire for current income in the form of dividends as well as the potential for growth. You have enlisted the assistance of your staff to create a Tableau Dashboard depicting trends in earnings per share, dividends, and reinvested earnings for the most recent five years for each of the three companies.

Note: Select only one company at a time.

Do not select AII

EPS & Payout Ratio

Reinvested

Dividends

Payout Ratio

Company Name Selected

All

Hi Tech Company

Maturation Corp

Sustainable Industries

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started