Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are at your trading desk and obtain information on two bonds issued by the gov- ernment of Canada. Bond A has a maturity

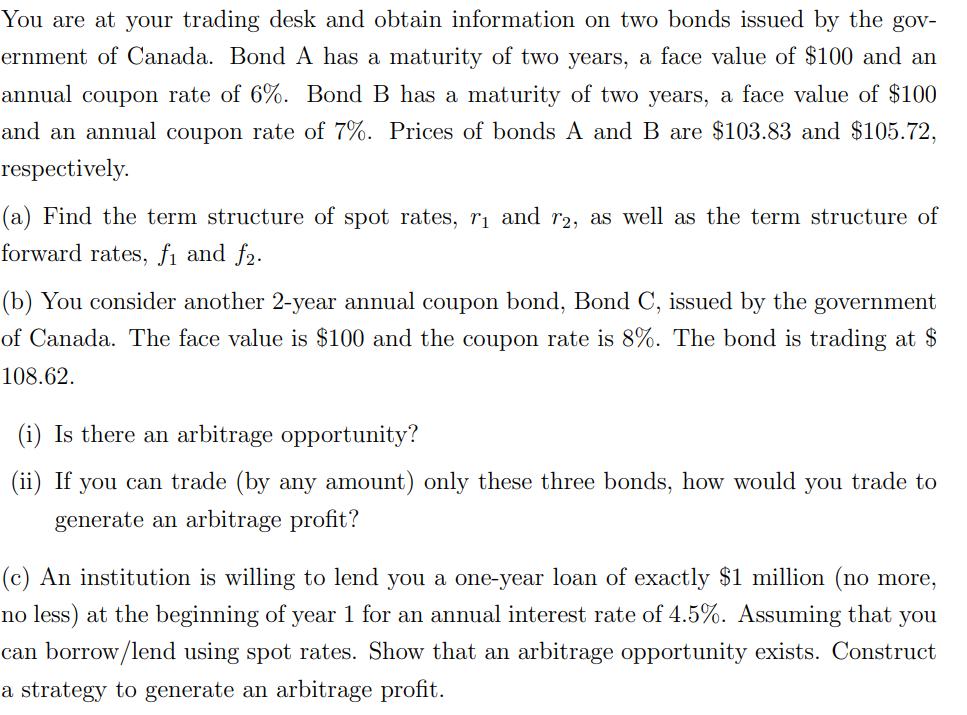

You are at your trading desk and obtain information on two bonds issued by the gov- ernment of Canada. Bond A has a maturity of two years, a face value of $100 and an annual coupon rate of 6%. Bond B has a maturity of two years, a face value of $100 and an annual coupon rate of 7%. Prices of bonds A and B are $103.83 and $105.72, respectively. (a) Find the term structure of spot rates, r and r2, as well as the term structure of forward rates, fi and f2. (b) You consider another 2-year annual coupon bond, Bond C, issued by the government of Canada. The face value is $100 and the coupon rate is 8%. The bond is trading at $ 108.62. (i) Is there an arbitrage opportunity? (ii) If you can trade (by any amount) only these three bonds, how would you trade to generate an arbitrage profit? (c) An institution is willing to lend you a one-year loan of exactly $1 million (no more, no less) at the beginning of year 1 for an annual interest rate of 4.5%. Assuming that you can borrow/lend using spot rates. Show that an arbitrage opportunity exists. Construct a strategy to generate an arbitrage profit.

Step by Step Solution

★★★★★

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started