Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are bullish on Telecom stock. The current market price is $80 per share, and you have $10,000 of your own to invest. You borrov

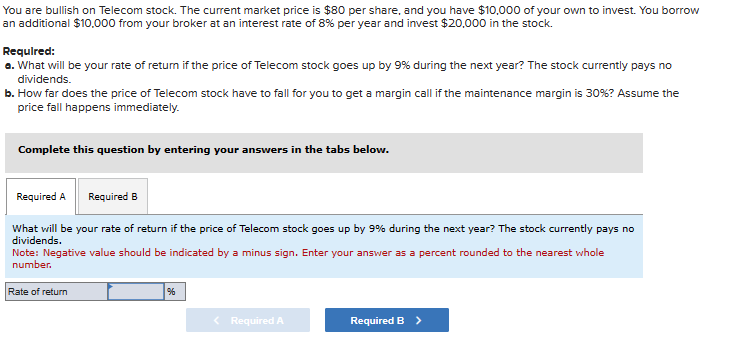

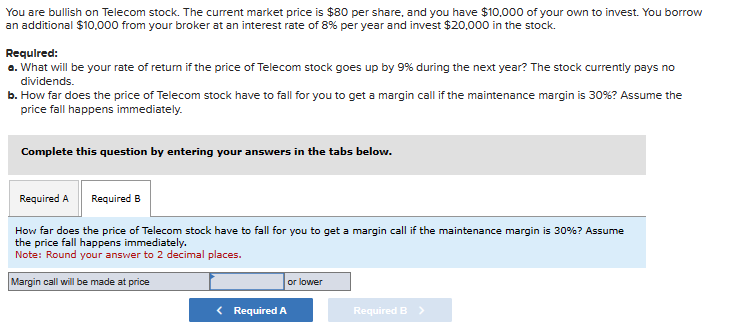

You are bullish on Telecom stock. The current market price is $80 per share, and you have $10,000 of your own to invest. You borrov an additional $10,000 from your broker at an interest rate of 8% per year and invest $20,000 in the stock. Required: o. What will be your rate of return if the price of Telecom stock goes up by 9% during the next year? The stock currently pays no dividends. b. How far does the price of Telecom stock have to fall for you to get a margin call if the maintenance margin is 30% ? Assume the price fall happens immediately. Complete this question by entering your answers in the tabs below. What will be your rate of return if the price of Telecom stock goes up by 9% during the next year? The stock currently pays no dividends. Note: Negative value should be indicated by a minus sign. Enter your answer as a percent rounded to the nearest whole number. You are bullish on Telecom stock. The current market price is $80 per share, and you have $10,000 of your own to invest. You borrow an additional $10,000 from your broker at an interest rate of 8% per year and invest $20,000 in the stock. Requlred: . What will be your rate of return if the price of Telecom stock goes up by 9% during the next year? The stock currently pays no dividends. b. How far does the price of Telecom stock have to fall for you to get a margin call if the maintenance margin is 30% ? Assume the price fall happens immediately. Complete this question by entering your answers in the tabs below. How far does the price of Telecom stock have to fall for you to get a margin call if the maintenance margin is 30% ? Assume the price fall happens immediately. Note: Round your answer to 2 decimal places

You are bullish on Telecom stock. The current market price is $80 per share, and you have $10,000 of your own to invest. You borrov an additional $10,000 from your broker at an interest rate of 8% per year and invest $20,000 in the stock. Required: o. What will be your rate of return if the price of Telecom stock goes up by 9% during the next year? The stock currently pays no dividends. b. How far does the price of Telecom stock have to fall for you to get a margin call if the maintenance margin is 30% ? Assume the price fall happens immediately. Complete this question by entering your answers in the tabs below. What will be your rate of return if the price of Telecom stock goes up by 9% during the next year? The stock currently pays no dividends. Note: Negative value should be indicated by a minus sign. Enter your answer as a percent rounded to the nearest whole number. You are bullish on Telecom stock. The current market price is $80 per share, and you have $10,000 of your own to invest. You borrow an additional $10,000 from your broker at an interest rate of 8% per year and invest $20,000 in the stock. Requlred: . What will be your rate of return if the price of Telecom stock goes up by 9% during the next year? The stock currently pays no dividends. b. How far does the price of Telecom stock have to fall for you to get a margin call if the maintenance margin is 30% ? Assume the price fall happens immediately. Complete this question by entering your answers in the tabs below. How far does the price of Telecom stock have to fall for you to get a margin call if the maintenance margin is 30% ? Assume the price fall happens immediately. Note: Round your answer to 2 decimal places Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started