Answered step by step

Verified Expert Solution

Question

1 Approved Answer

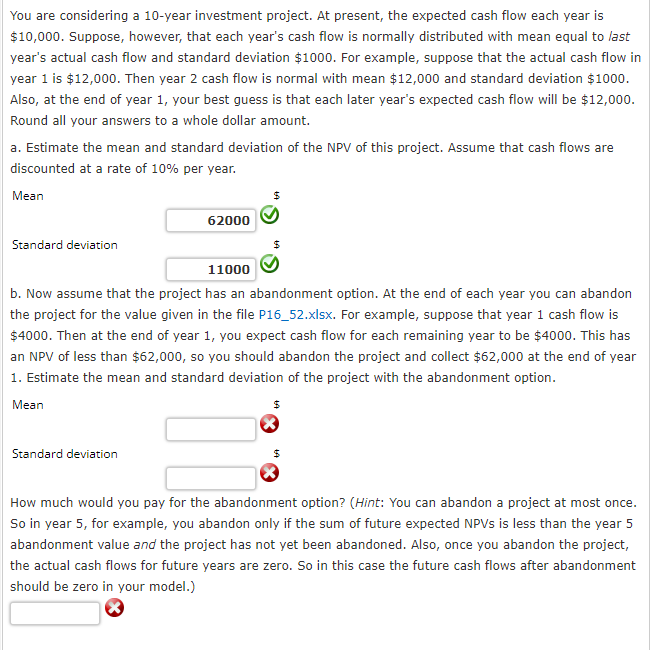

You are considering a 1 0 - year investment project. At present, the expected cash flow each year is $ 1 0 , 0 0

You are considering a year investment project. At present, the expected cash flow each year is

$ Suppose, however, that each year's cash flow is normally distributed with mean equal to last

year's actual cash flow and standard deviation $ For example, suppose that the actual cash flow in

year is $ Then year cash flow is normal with mean $ and standard deviation $

Also, at the end of year your best guess is that each later year's expected cash flow will be $

Round all your answers to a whole dollar amount.

a Estimate the mean and standard deviation of the NPV of this project. Assume that cash flows are

discounted at a rate of per year.

Mean

Standard deviation

b Now assume that the project has an abandonment option. At the end of each year you can abandon

the project for the value given in the file Pxlsx For example, suppose that year cash flow is

$ Then at the end of year you expect cash flow for each remaining year to be $ This has

an NPV of less than $ so you should abandon the project and collect $ at the end year

Estimate the mean and standard deviation of the project with the abandonment option.

Mean

How much would you pay for the abandonment option? Hint: You can abandon a project at most once.

So in year for example, you abandon only if the sum of future expected NPVs is less than the year

abandonment value and the project has not yet been abandoned. Also, once you abandon the project,

the actual cash flows for future years are zero. So in this case the future cash flows after abandonment

should be zero in your model.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started