Answered step by step

Verified Expert Solution

Question

1 Approved Answer

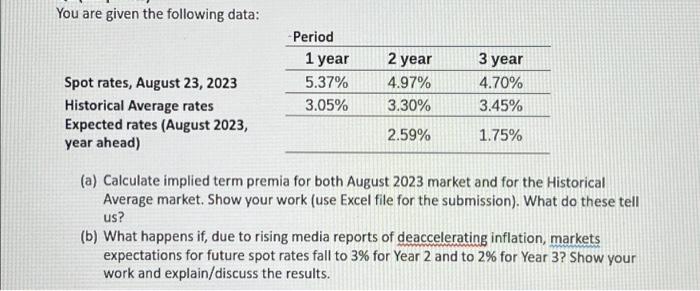

You are given the following data: Spot rates, August 23, 2023 Historical Average rates Expected rates (August 2023, year ahead) -Period 1 year 5.37% 3.05%

You are given the following data: Spot rates, August 23, 2023 Historical Average rates Expected rates (August 2023, year ahead) -Period 1 year 5.37% 3.05% 2 year 4.97% 3.30% 2.59% 3 year 4.70% 3.45% 1.75% (a) Calculate implied term premia for both August 2023 market and for the Historical Average market. Show your work (use Excel file for the submission). What do these tell us? (b) What happens if, due to rising media reports of deaccelerating inflation, markets expectations for future spot rates fall to 3% for Year 2 and to 2% for Year 3? Show your work and explain/discuss the results.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started