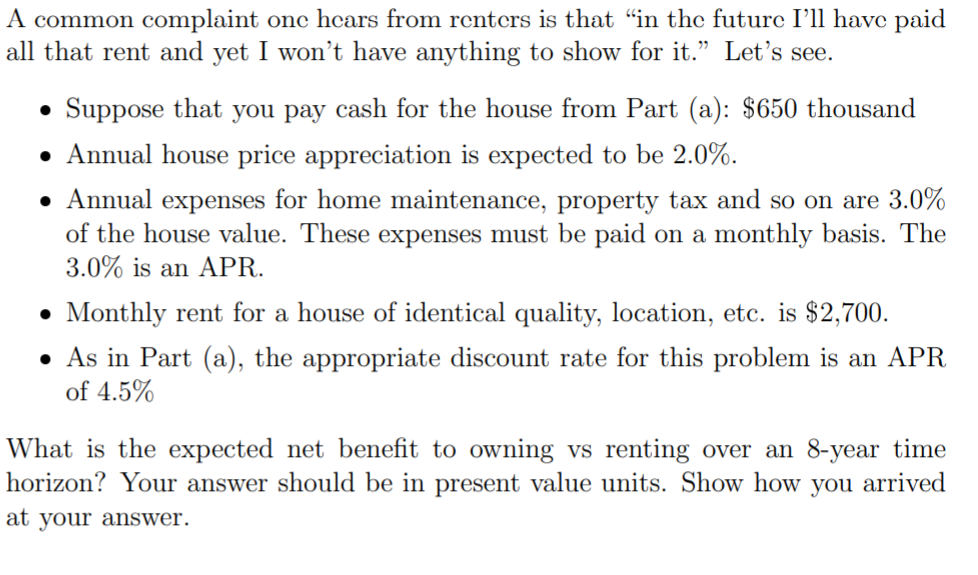

You are going to buy a new house! The house price is $650 thousand. You will fund $250 thousand of this with your own money (often called a downpayment), and fund the remainder with an 8-year home mortgage loan. The mortgage payments will be monthly and your mortgage rate is an APR of 4.50%. A common complaint one hears from renters is that in the future I'll have paid all that rent and yet I won't have anything to show for it. Let's see. Suppose that you pay cash for the house from Part (a): $650 thousand Annual house price appreciation is expected to be 2.0%. Annual expenses for home maintenance, property tax and so on are 3.0% of the house value. These expenses must be paid on a monthly basis. The 3.0% is an APR. Monthly rent for a house of identical quality, location, etc. is $2,700. As in Part (a), the appropriate discount rate for this problem is an APR of 4.5% What is the expected net benefit to owning vs renting over an 8-year time horizon? Your answer should be in present value units. Show how you arrived at your answer. You are going to buy a new house! The house price is $650 thousand. You will fund $250 thousand of this with your own money (often called a downpayment), and fund the remainder with an 8-year home mortgage loan. The mortgage payments will be monthly and your mortgage rate is an APR of 4.50%. A common complaint one hears from renters is that in the future I'll have paid all that rent and yet I won't have anything to show for it. Let's see. Suppose that you pay cash for the house from Part (a): $650 thousand Annual house price appreciation is expected to be 2.0%. Annual expenses for home maintenance, property tax and so on are 3.0% of the house value. These expenses must be paid on a monthly basis. The 3.0% is an APR. Monthly rent for a house of identical quality, location, etc. is $2,700. As in Part (a), the appropriate discount rate for this problem is an APR of 4.5% What is the expected net benefit to owning vs renting over an 8-year time horizon? Your answer should be in present value units. Show how you arrived at your