Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are managing the family office for a retired hedge fund manager (a family office is an investment fund which manages the money of a

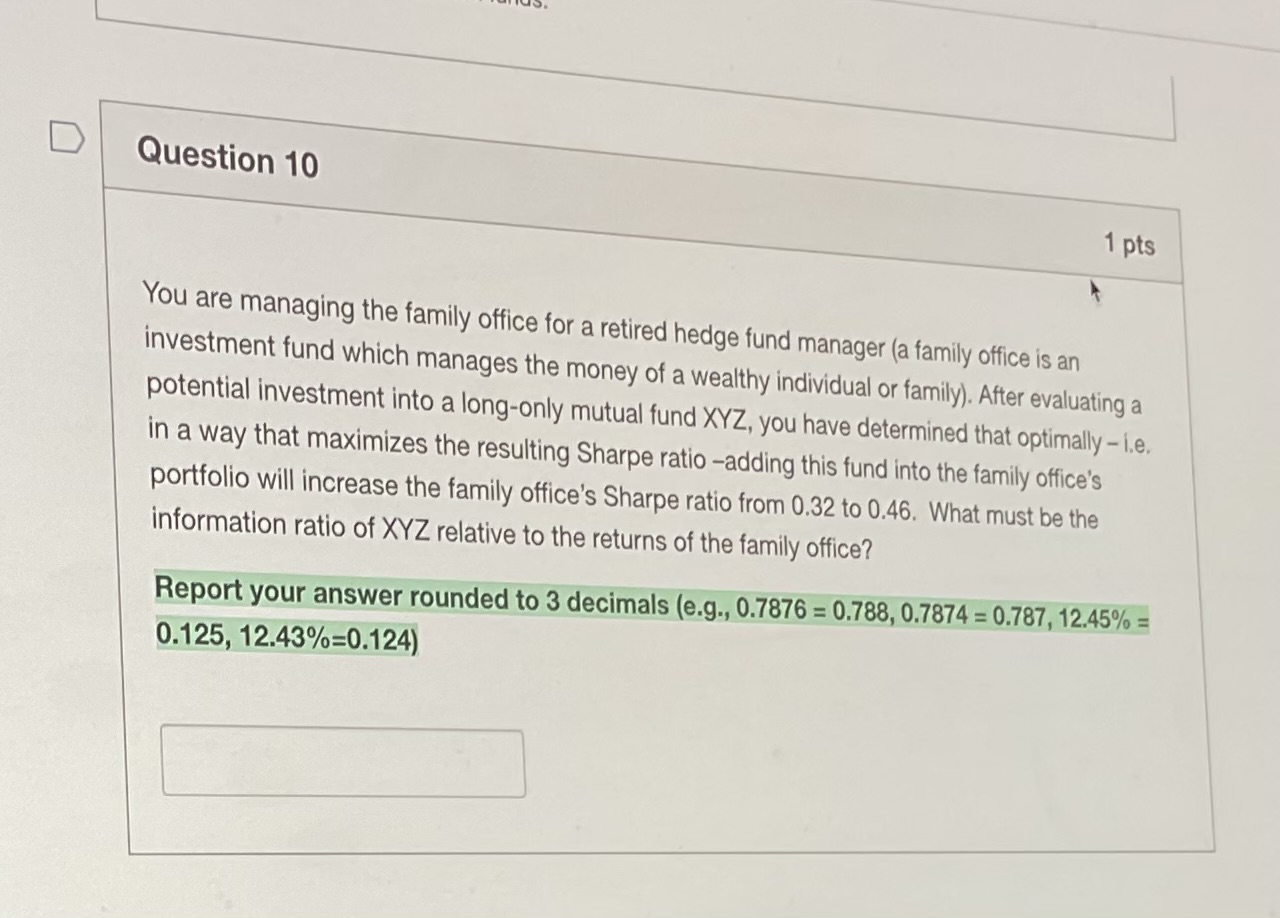

You are managing the family office for a retired hedge fund manager (a family office is an investment fund which manages the money of a wealthy individual or family). After evaluating a potential investment into a long-only mutual fund XYZ, you have determined that optimally - i.e. in a way that maximizes the resulting Sharpe ratio-adding this fund into the family office's portfolio will increase the family office's Sharpe ratio from 0.32 to 0.46 . What must be the information ratio of XYZ relative to the returns of the family office? Report your answer rounded to 3 decimals (e.g., 0.7876=0.788,0.7874=0.787,12.45%= 0.125,12.43%=0.124 )

You are managing the family office for a retired hedge fund manager (a family office is an investment fund which manages the money of a wealthy individual or family). After evaluating a potential investment into a long-only mutual fund XYZ, you have determined that optimally - i.e. in a way that maximizes the resulting Sharpe ratio-adding this fund into the family office's portfolio will increase the family office's Sharpe ratio from 0.32 to 0.46 . What must be the information ratio of XYZ relative to the returns of the family office? Report your answer rounded to 3 decimals (e.g., 0.7876=0.788,0.7874=0.787,12.45%= 0.125,12.43%=0.124 ) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started