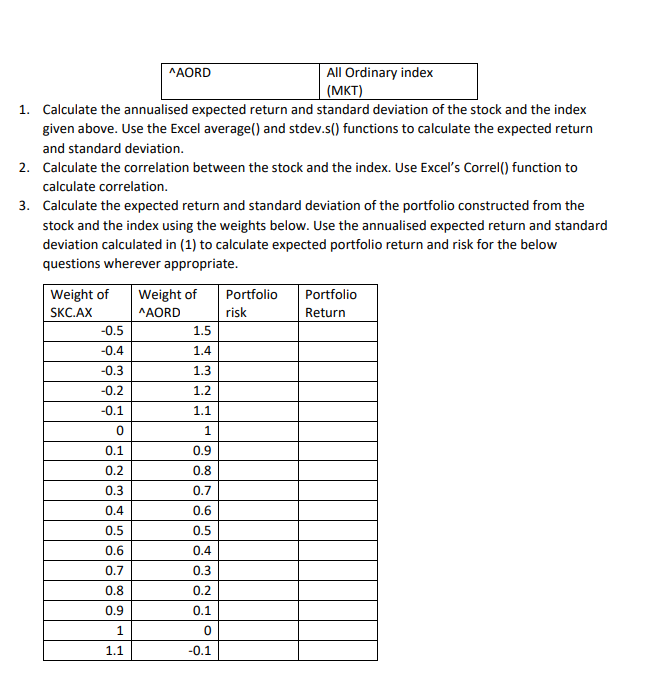

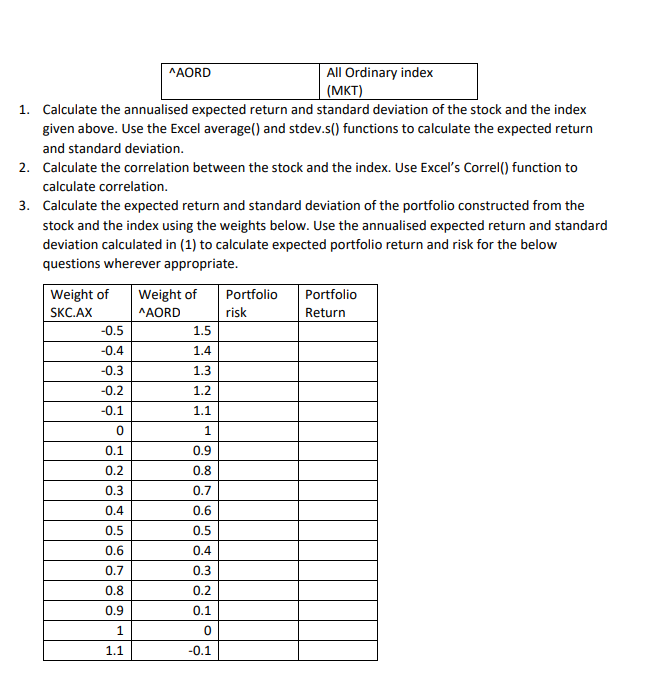

You are required to form a two-asset portfolio from the stock and the index shown below. The data is provided under the assessment folder from the unit site. For the portfolio, answer the following questions: ASX Code SKC.AX Company/Index Name Skycity Entertainment Group AORD All Ordinary index (MKT) 1. Calculate the annualised expected return and standard deviation of the stock and the index given above. Use the Excel average() and stdev.s() functions to calculate the expected return and standard deviation. 2. Calculate the correlation between the stock and the index. Use Excel's Correl() function to calculate correlation. 3. Calculate the expected return and standard deviation of the portfolio constructed from the stock and the index using the weights below. Use the annualised expected return and standard deviation calculated in (1) to calculate expected portfolio return and risk for the below questions wherever appropriate. Portfolio risk Portfolio Return Weight of SKC.AX -0.5 -0.4 -0.3 Weight of AAORD 1.5 1.4 1.3 1.2 1.1 -0.2 -0.1 0 1 0.9 0.1 0.2 0.8 0.3 0.7 0.6 0.4 0.5 0.5 0.6 0.4 0.7 0.3 0.8 0.2 0.9 0.1 1 0 1.1 -0.1 You are required to form a two-asset portfolio from the stock and the index shown below. The data is provided under the assessment folder from the unit site. For the portfolio, answer the following questions: ASX Code SKC.AX Company/Index Name Skycity Entertainment Group AORD All Ordinary index (MKT) 1. Calculate the annualised expected return and standard deviation of the stock and the index given above. Use the Excel average() and stdev.s() functions to calculate the expected return and standard deviation. 2. Calculate the correlation between the stock and the index. Use Excel's Correl() function to calculate correlation. 3. Calculate the expected return and standard deviation of the portfolio constructed from the stock and the index using the weights below. Use the annualised expected return and standard deviation calculated in (1) to calculate expected portfolio return and risk for the below questions wherever appropriate. Portfolio risk Portfolio Return Weight of SKC.AX -0.5 -0.4 -0.3 Weight of AAORD 1.5 1.4 1.3 1.2 1.1 -0.2 -0.1 0 1 0.9 0.1 0.2 0.8 0.3 0.7 0.6 0.4 0.5 0.5 0.6 0.4 0.7 0.3 0.8 0.2 0.9 0.1 1 0 1.1 -0.1