Question

You are tasked with comparing two US mutual funds. One fund invests in companies in all kinds of industries, while the other specializes in companies

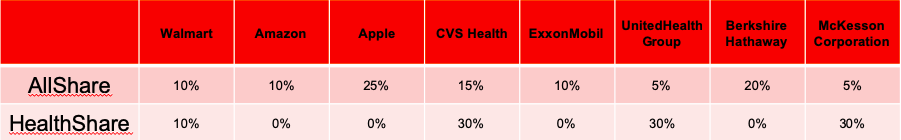

You are tasked with comparing two US mutual funds. One fund invests in companies in all kinds of industries, while the other specializes in companies in the health sector. It is known that the funds had the following ratios in certain shares in the last 3 years (it is not assumed that they received dividends during the period). The proportions did not change over the period.

Draw a picture comparing the development of $ 100,000 investments in each fund made March 17, 2019 (2%) What were the returns of AllShare and HealthShare over the period? (1%) What was the average annual return of AllShare and HealthShare over the period (4%) What is the correlation between the exchange rates of these two funds? Also show calculations with a formula. (3%) What is the variance and what is the standard deviation of each fund? Why is this information important when it comes to investment decisions? (5%)

Walmart Amazon Apple CVS Health ExxonMobil United Health Group Berkshire Hathaway McKesson Corporation AllShare 10% 10% 25% 15% 10% 5% 20% 5% Health Share 10% 0% 0% 30% 0% 30% 0% 30% Walmart Amazon Apple CVS Health ExxonMobil United Health Group Berkshire Hathaway McKesson Corporation AllShare 10% 10% 25% 15% 10% 5% 20% 5% Health Share 10% 0% 0% 30% 0% 30% 0% 30%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started