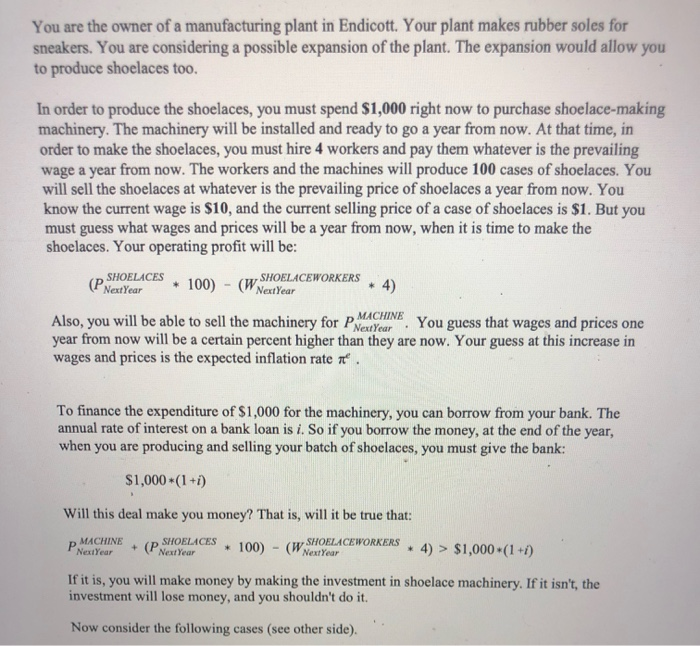

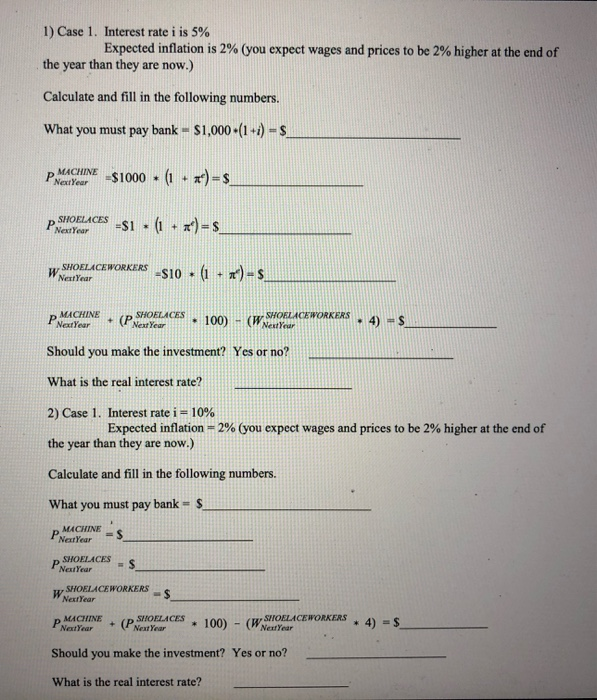

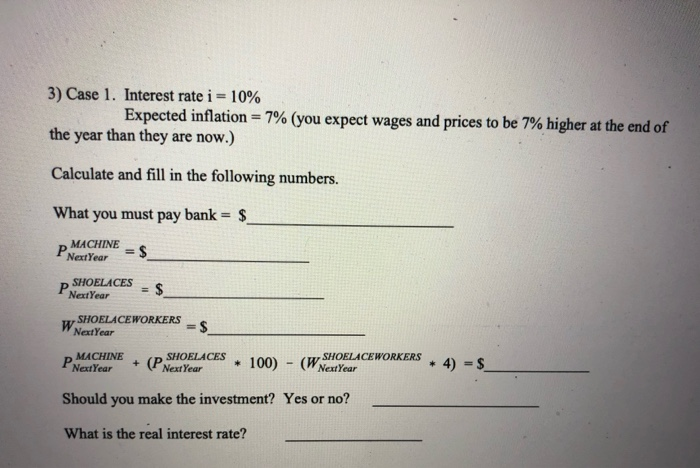

You are the owner of a manufacturing plant in Endicott. Your plant makes rubber soles for sneakers. You are considering a possible expansion of the plant. The expansion would allow you to produce shoelaces too. In order to produce the shoelaces, you must spend $1,000 right now to purchase shoelace-making machinery. The machinery will be installed and ready to go a year from now. At that time, in order to make the shoelaces, you must hire 4 workers and pay them whatever is the prevailing wage a year from now. The workers and the machines will produce 100 cases of shoelaces. You will sell the shoelaces at whatever is the prevailing price of shoelaces a year from now. You know the current wage is $10, and the current selling price of a case of shoelaces is $1. But you must guess what wages and prices will be a year from now, when it is time to make the shoelaces. Your operating profit will be: (P SHOELACES (NexYear 100 * 100) - (W SHOELACEWORKERS Also, you will be able to sell the machinery for P ear. You guess that wages and prices one year from now will be a certain percent higher than they are now. Your guess at this increase in wages and prices is the expected inflation rate . To finance the expenditure of $1,000 for the machinery, you can borrow from your bank. The annual rate of interest on a bank loan is i. So if you borrow the money, at the end of the year, when you are producing and selling your batch of shoelaces, you must give the bank: $1,000 *(1 +1) Will this deal make you money? That is, will it be true that: P MACHINE + (P SHOELACES 100) - (W SHOELACEWORKERS * 4) > $1,000+(1+1) NexiYear If it is, you will make money by making the investment in shoelace machinery. If it isn't, the investment will lose money, and you shouldn't do it. Now consider the following cases (see other side). 1) Case 1. Interest rate i is 5% Expected inflation is 2% (you expect wages and prices to be 2% higher at the end of the year than they are now.) Calculate and fill in the following numbers. What you must pay bank = $1,000 + (1 - 1) = $ PRACUNE -$1000 = (1 + **) = $_ P SHPELACES =$1 = (1 + x) = $_ SHOELACEWORKERS -S10 = (1 + x) - $ W NatYear PM CINE - (P SHPELACES - 100) - (WSHOLACEWORKERS. 4) = $ Should you make the investment? Yes or no? What is the real interest rate? 2) Case 1. Interest rate i = 10% Expected inflation = 2% (you expect wages and prices to be 2% higher at the end of the year than they are now.) Calculate and fill in the following numbers. What you must pay bank = $_ MACHINES Next Year p SWOELACES Next Year = $ SHOKLACEWORKERSS Next Year p MACHINE Next Year + (PSIOELACES Next Year 100) (WSHIOELACEWORKERS * 4) = $ * 100) - NextYear Should you make the investment? Yes or no? What is the real interest rate? 3) Case 1. Interest rate i = 10% Expected inflation = 7% (you expect wages and prices to be 7% higher at the end of the year than they are now.) Calculate and fill in the following numbers. What you must pay bank = $__ MACHINES Next Year SHOELACES Next Year = $ SHOELACEWORKERSS Next Year MACHINE SHOEL Next Year + (PHOELACES100) (W SHOELACEWORKERS + Next Year * 4) = $ Should you make the investment? Yes or no? What is the real interest rate? You are the owner of a manufacturing plant in Endicott. Your plant makes rubber soles for sneakers. You are considering a possible expansion of the plant. The expansion would allow you to produce shoelaces too. In order to produce the shoelaces, you must spend $1,000 right now to purchase shoelace-making machinery. The machinery will be installed and ready to go a year from now. At that time, in order to make the shoelaces, you must hire 4 workers and pay them whatever is the prevailing wage a year from now. The workers and the machines will produce 100 cases of shoelaces. You will sell the shoelaces at whatever is the prevailing price of shoelaces a year from now. You know the current wage is $10, and the current selling price of a case of shoelaces is $1. But you must guess what wages and prices will be a year from now, when it is time to make the shoelaces. Your operating profit will be: (P SHOELACES (NexYear 100 * 100) - (W SHOELACEWORKERS Also, you will be able to sell the machinery for P ear. You guess that wages and prices one year from now will be a certain percent higher than they are now. Your guess at this increase in wages and prices is the expected inflation rate . To finance the expenditure of $1,000 for the machinery, you can borrow from your bank. The annual rate of interest on a bank loan is i. So if you borrow the money, at the end of the year, when you are producing and selling your batch of shoelaces, you must give the bank: $1,000 *(1 +1) Will this deal make you money? That is, will it be true that: P MACHINE + (P SHOELACES 100) - (W SHOELACEWORKERS * 4) > $1,000+(1+1) NexiYear If it is, you will make money by making the investment in shoelace machinery. If it isn't, the investment will lose money, and you shouldn't do it. Now consider the following cases (see other side). 1) Case 1. Interest rate i is 5% Expected inflation is 2% (you expect wages and prices to be 2% higher at the end of the year than they are now.) Calculate and fill in the following numbers. What you must pay bank = $1,000 + (1 - 1) = $ PRACUNE -$1000 = (1 + **) = $_ P SHPELACES =$1 = (1 + x) = $_ SHOELACEWORKERS -S10 = (1 + x) - $ W NatYear PM CINE - (P SHPELACES - 100) - (WSHOLACEWORKERS. 4) = $ Should you make the investment? Yes or no? What is the real interest rate? 2) Case 1. Interest rate i = 10% Expected inflation = 2% (you expect wages and prices to be 2% higher at the end of the year than they are now.) Calculate and fill in the following numbers. What you must pay bank = $_ MACHINES Next Year p SWOELACES Next Year = $ SHOKLACEWORKERSS Next Year p MACHINE Next Year + (PSIOELACES Next Year 100) (WSHIOELACEWORKERS * 4) = $ * 100) - NextYear Should you make the investment? Yes or no? What is the real interest rate? 3) Case 1. Interest rate i = 10% Expected inflation = 7% (you expect wages and prices to be 7% higher at the end of the year than they are now.) Calculate and fill in the following numbers. What you must pay bank = $__ MACHINES Next Year SHOELACES Next Year = $ SHOELACEWORKERSS Next Year MACHINE SHOEL Next Year + (PHOELACES100) (W SHOELACEWORKERS + Next Year * 4) = $ Should you make the investment? Yes or no? What is the real interest rate