Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are working as an intern in an asset management firm that specializes in bonds. Your supervisor has informed you that he expects bond yields

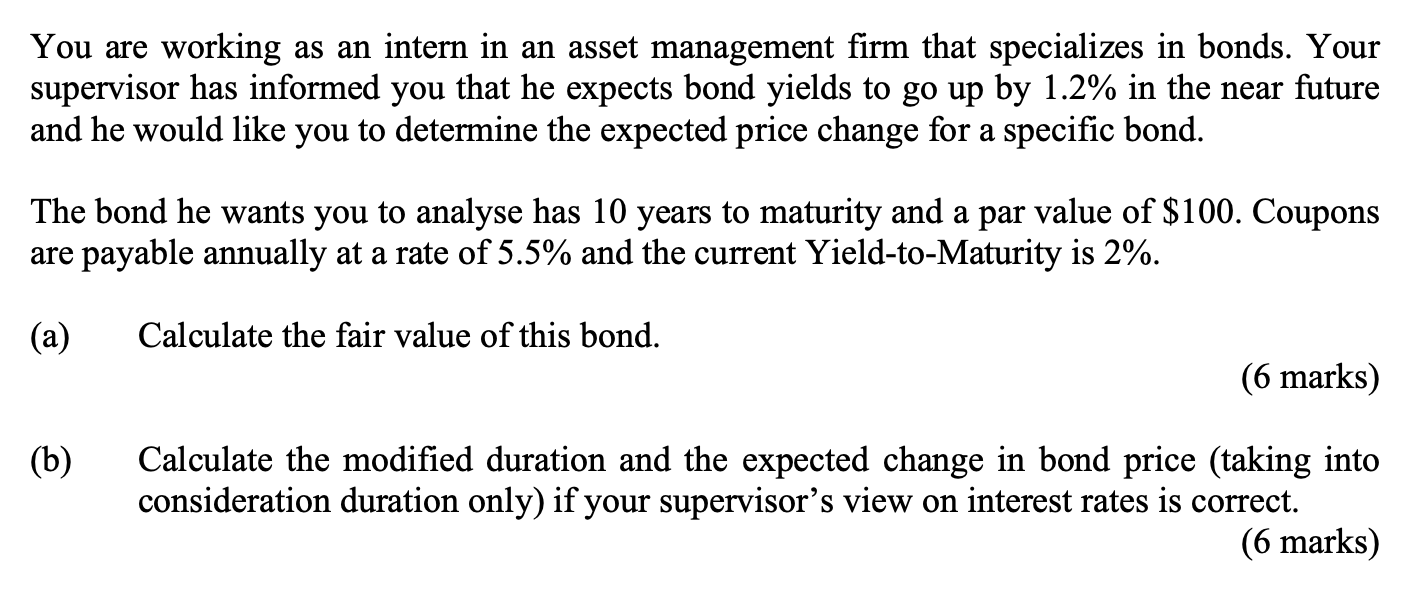

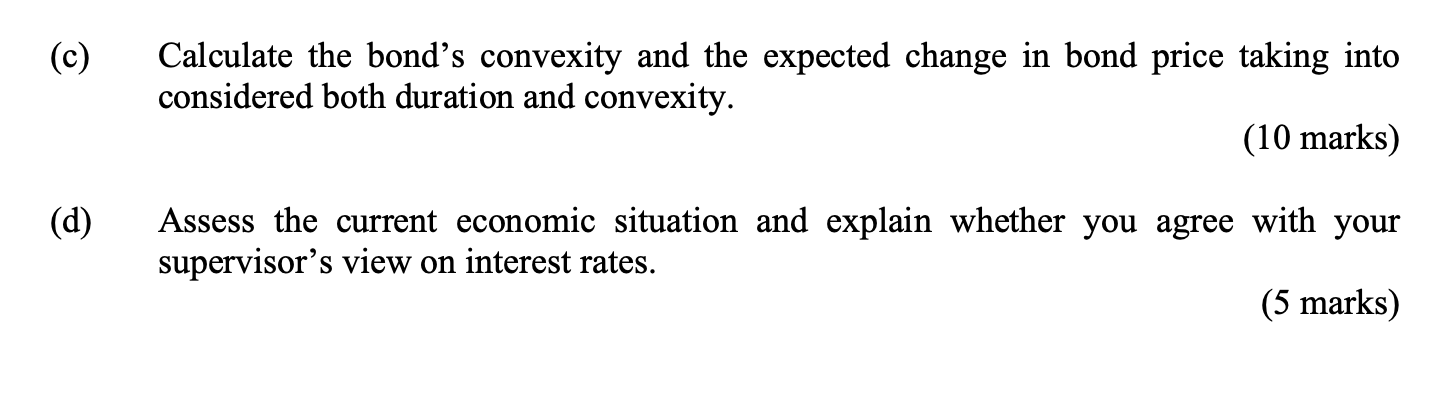

You are working as an intern in an asset management firm that specializes in bonds. Your supervisor has informed you that he expects bond yields to go up by 1.2% in the near future and he would like you to determine the expected price change for a specific bond. The bond he wants you to analyse has 10 years to maturity and a par value of $100. Coupons are payable annually at a rate of 5.5% and the current Yield-to-Maturity is 2%. (a) Calculate the fair value of this bond. (6 marks) (b) Calculate the modified duration and the expected change in bond price (taking into consideration duration only) if your supervisor's view on interest rates is correct. (6 marks) (c) Calculate the bond's convexity and the expected change in bond price taking into considered both duration and convexity. (10 marks) (d) Assess the current economic situation and explain whether you agree with your supervisor's view on interest rates

You are working as an intern in an asset management firm that specializes in bonds. Your supervisor has informed you that he expects bond yields to go up by 1.2% in the near future and he would like you to determine the expected price change for a specific bond. The bond he wants you to analyse has 10 years to maturity and a par value of $100. Coupons are payable annually at a rate of 5.5% and the current Yield-to-Maturity is 2%. (a) Calculate the fair value of this bond. (6 marks) (b) Calculate the modified duration and the expected change in bond price (taking into consideration duration only) if your supervisor's view on interest rates is correct. (6 marks) (c) Calculate the bond's convexity and the expected change in bond price taking into considered both duration and convexity. (10 marks) (d) Assess the current economic situation and explain whether you agree with your supervisor's view on interest rates Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started