Answered step by step

Verified Expert Solution

Question

1 Approved Answer

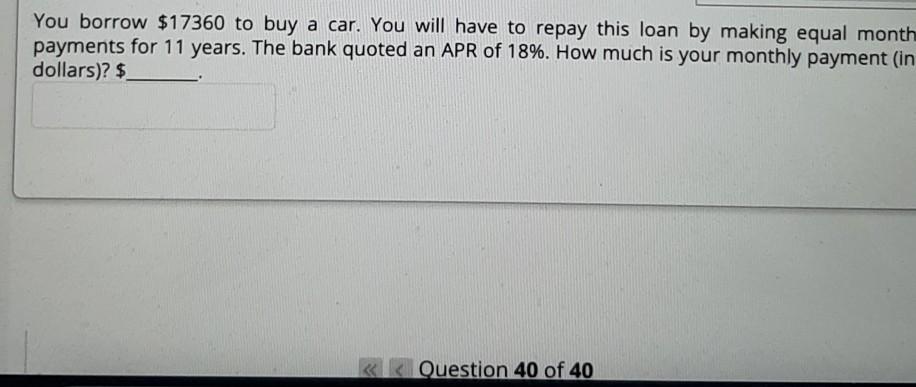

You borrow $17360 to buy a car. You will have to repay this loan by making equal month payments for 11 years. The bank quoted

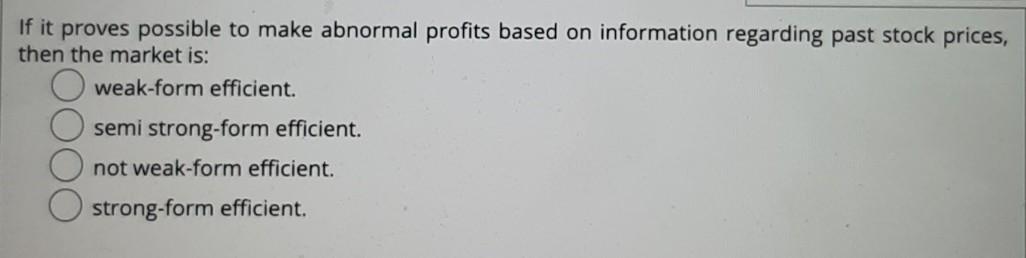

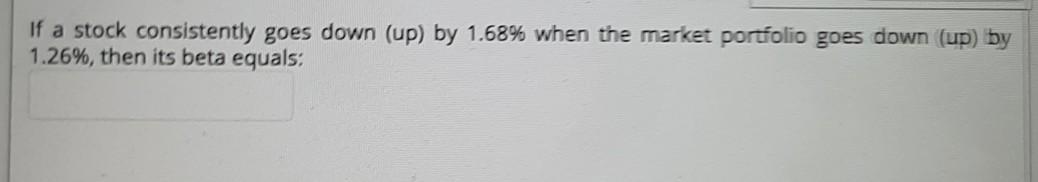

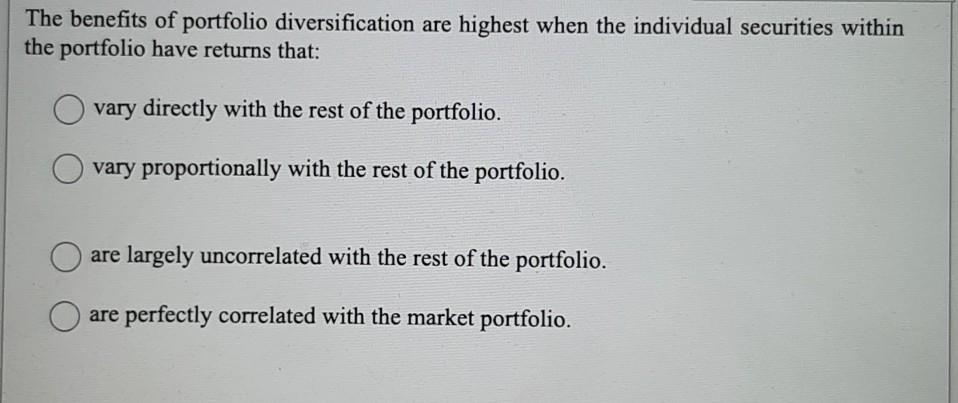

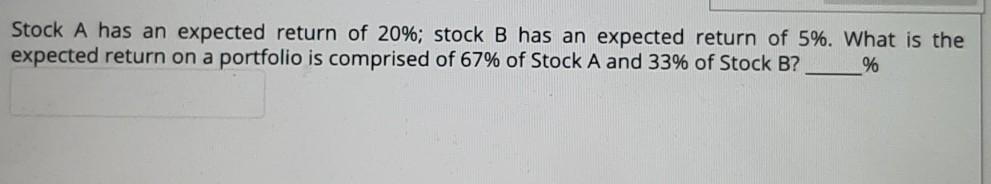

You borrow $17360 to buy a car. You will have to repay this loan by making equal month payments for 11 years. The bank quoted an APR of 18%. How much is your monthly payment (in dollars)? $ Question 40 of 40 If it proves possible to make abnormal profits based on information regarding past stock prices, then the market is: weak-form efficient. semi strong-form efficient. not weak-form efficient. strong-form efficient. If a stock consistently goes down (up) by 1.68% when the market portrolio goes down (up) by 1.26%, then its beta eguals: The benefits of portfolio diversification are highest when the individual securities within the portfolio have returns that: vary directly with the rest of the portfolio. vary proportionally with the rest of the portfolio. are largely uncorrelated with the rest of the portfolio. are perfectly correlated with the market portfolio. Stock A has an expected return of 20%; stock B has an expected return of 5%. What is the expected return on a portfolio is comprised of 67% of Stock A and 33% of Stock B? %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started