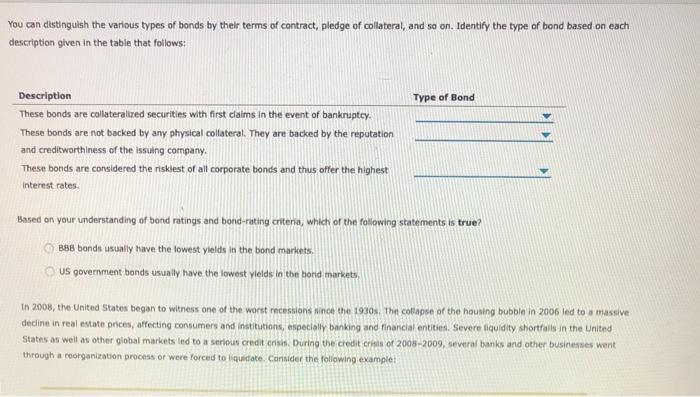

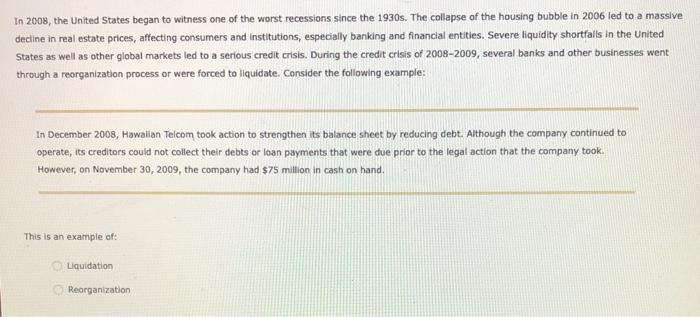

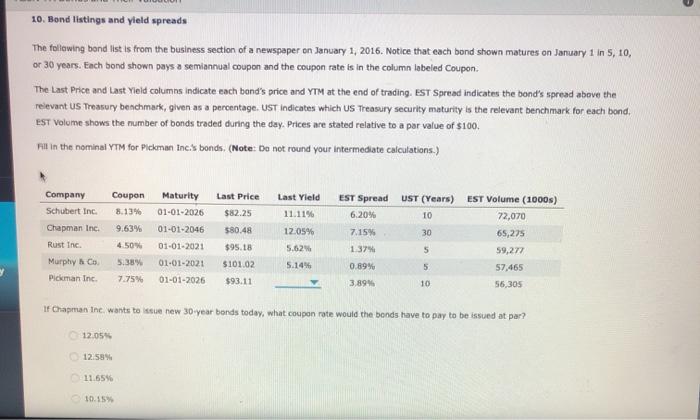

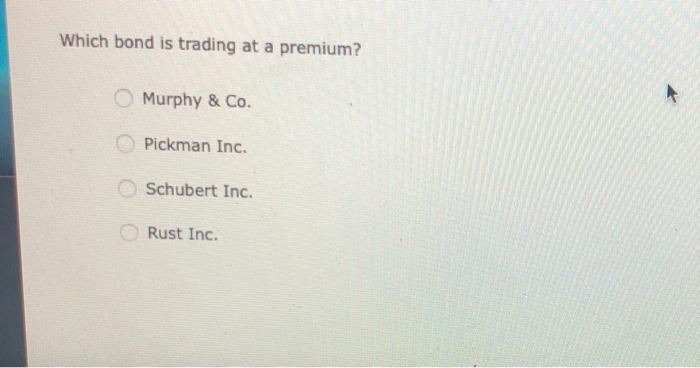

You can distinguish the various types of bonds by their terms of contract, pledge of collateral, and so on. Identify the type of bond based on each description given in the table that follows: Type of Bond Description These bonds are collateralized securities with first claims in the event of bankruptcy. These bonds are not backed by any physical collateral. They are backed by the reputation and creditworthiness of the issuing company These bonds are considered the risklest of all corporate bonds and thus offer the highest Interest rates Based on your understanding of bond ratings and bond-rating criteria, which of the following statements is true? B&B bonds usually have the lowest yields in the bond markets. US government bonds usually have the lowest vields in the bord markets, In 2008, the United States began to witness one of the worst recessions in the 1930s. The collapse of the housing bubble in 2006 led to a massive decline in real estate prices, affecting consumers and institutions, especially banking and financial entities Severe liquidity shortfalls in the United States as well as other global markets led to a serious credit crisis. During the credit crisis of 2008-2009, several banks and other businesses went through a reorganization process or were forced to liquidate. Consider the following example: In 2008, the United States began to witness one of the worst recessions since the 1930s. The collapse of the housing bubble in 2006 led to a massive decline in real estate prices, affecting consumers and institutions, especially banking and financial entities. Severe liquidity shortfalls in the United States as well as other global markets led to a serious credit crisis. During the credit crisis of 2008-2009, several banks and other businesses went through a reorganization process or were forced to liquidate. Consider the following example: In December 2008, Hawaiian Telcom took action to strengthen its balance sheet by reducing debt. Although the company continued to operate, its creditors could not collect their debts or loan payments that were due prior to the legal action that the company took. However, on November 30, 2009, the company had $75 million in cash on hand. This is an example of Liquidation Reorganization 10. Bond listings and yield spreads The following bond list is from the business section of a newspaper on January 1, 2016. Notice that each bond shown matures on January 1 in 5, 10, or 30 years. Each bond shown pays a semiannual coupon and the coupon rate is in the column labeled Coupon The Last Price and Last Yield columns indicate each band's price and YTM at the end of trading. EST Spread indicates the bond's spread above the relevant US Treasury benchmark, given as a percentage. UST indicates which US Treasury security maturity is the relevant benchmark for each bond. EST Volume shows the number of bonds traded during the day. Prices are stated relative to a par value of $100. All in the nominal YTM for Pickman Inc.'s bonds. (Note: Do not round your Intermediate calculations.) Company Schubert Inc. Chapman Inc. EST Spread UST (Years) 6,20% 10 Coupon 8.13% 9.63% 4.50 Maturity 01-01-2026 01-01-2046 01-01-2021 01-01-2021 01-01-2026 Last Yield 11.11% 12.05% 5.62% 7.15% Last Price $82.25 580.48 $95.18 $101.02 $93.11 30 Rust Inc. EST Volume (1000) 72,070 65,275 59,277 57,465 56,305 1.37% 5.38% 5 5 5.14 0.89% Murphy Co Pickman Inc. 7.75% 3,89% 10 IF Chapman Ine wants to see new 30 year bonds today, what coupon rate would the bonds have to pay to be issued at par? 12.05 12.58% 11.65% 10.15% Which bond is trading at a premium? Murphy & Co. Pickman Inc. Schubert Inc. Rust Inc