Answered step by step

Verified Expert Solution

Question

1 Approved Answer

you can zoom it Arial 10 Xor lo Copy Paste Format Painter ' 29 Wrap Text a A Merge & Center Custom BIU $ %

you can zoom it

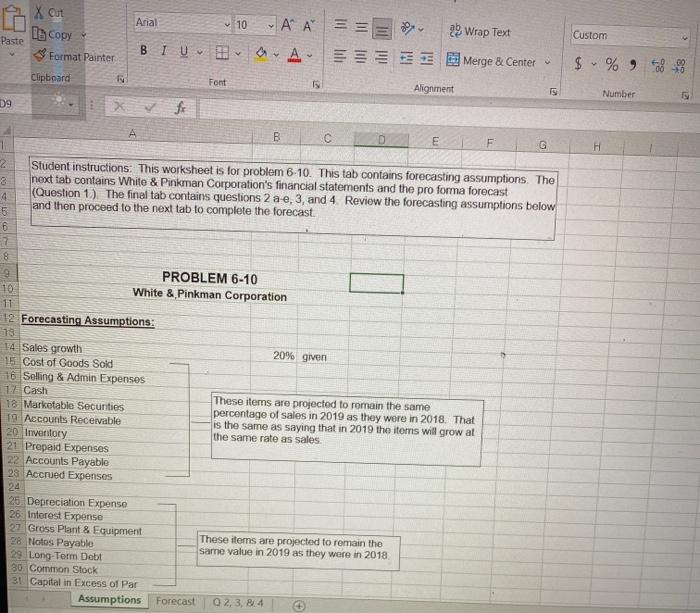

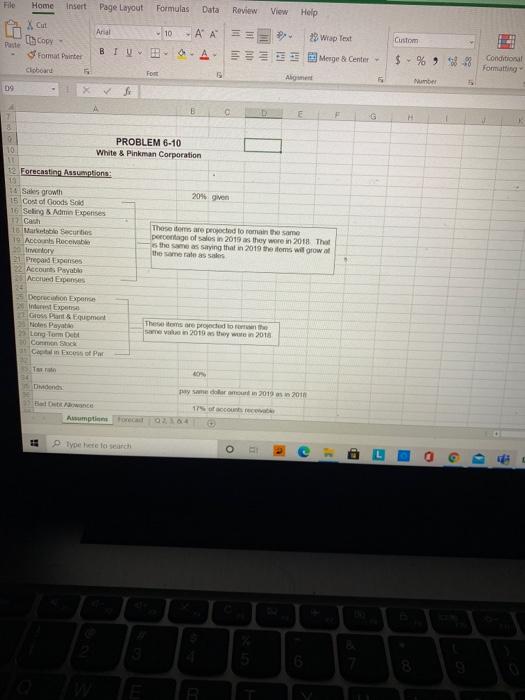

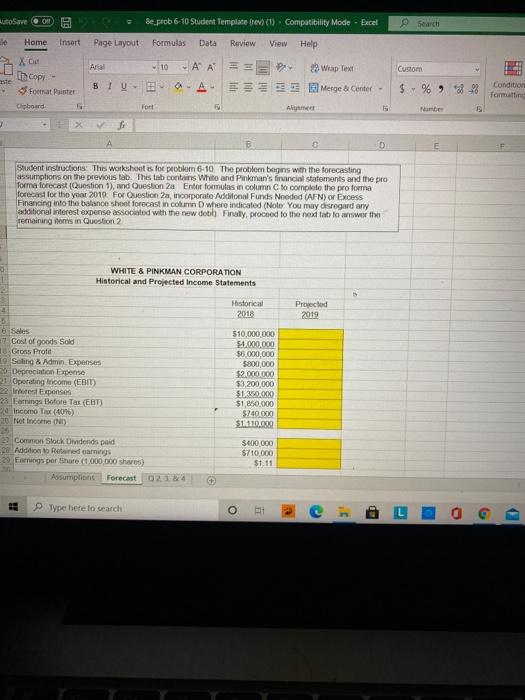

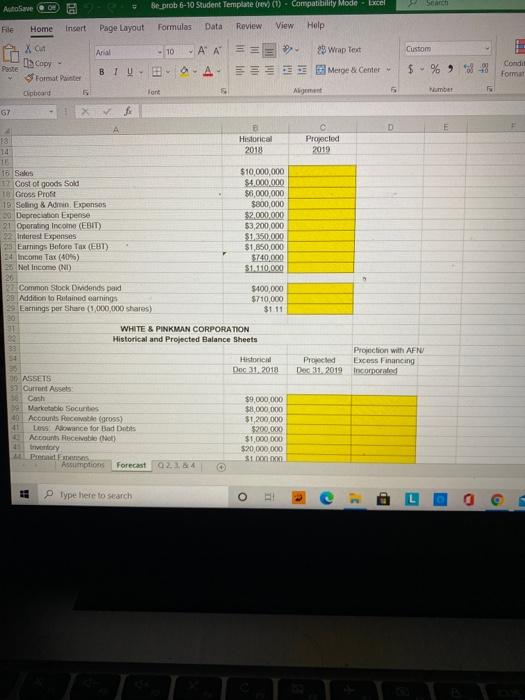

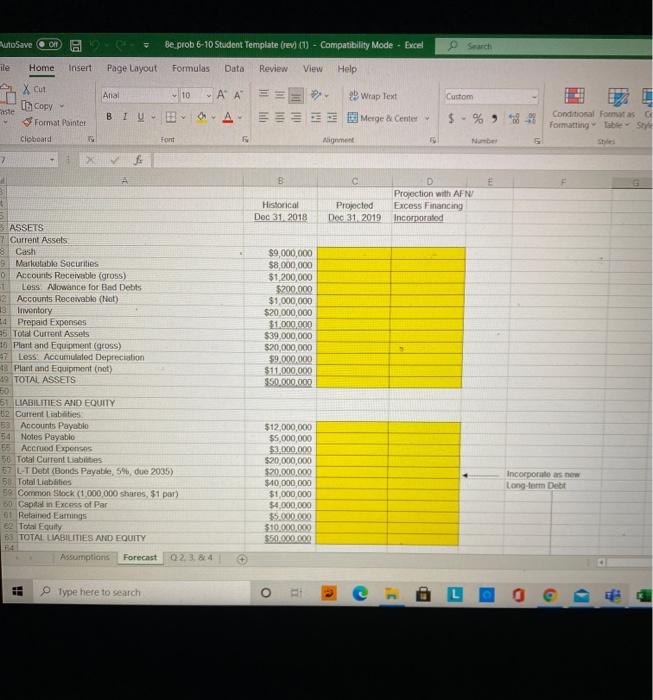

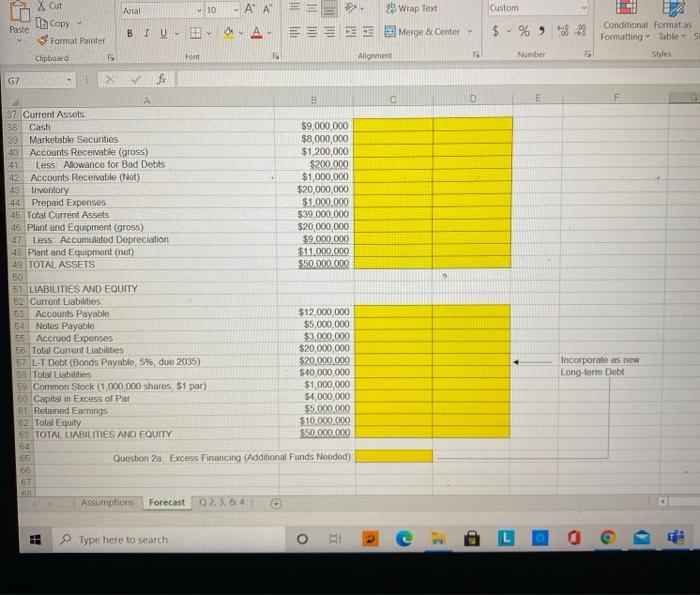

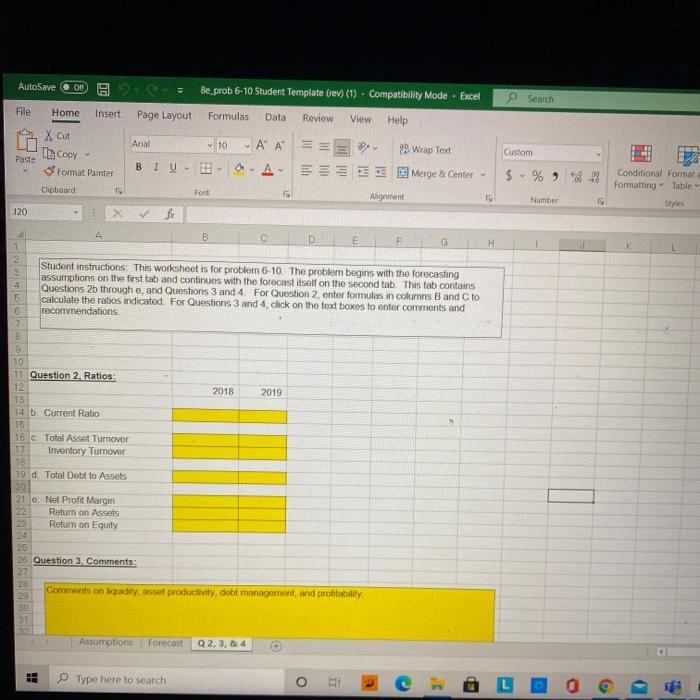

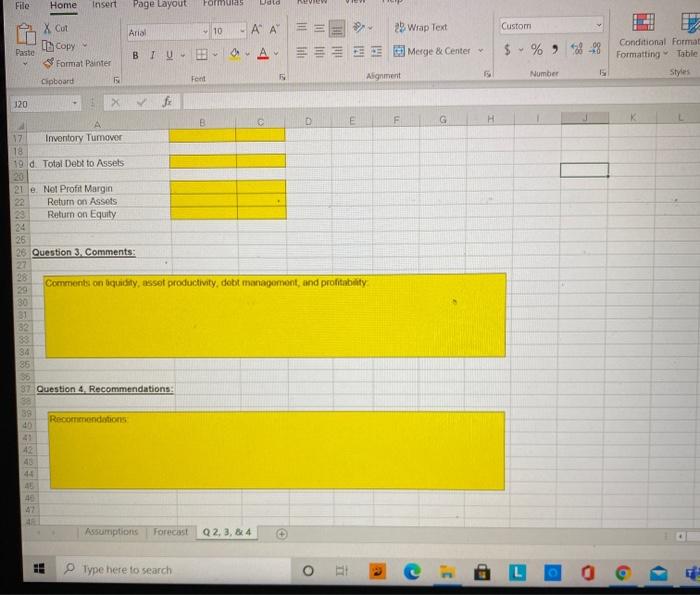

Arial 10 Xor lo Copy Paste Format Painter ' 29 Wrap Text a A Merge & Center Custom BIU $ % & Clipboard Font 15 Alignment IS Number D9 x for B C 1 E F G H 2 Student instructions. This worksheet is for problem 6-10. This tab contains forecasting assumptions. The 8 next tab contains White & Pinkman Corporation's financial statements and the pro forma forecast (Question 1) The final tab contains questions 2 ae, 3, and 4 Review the forecasting assumptions below and then proceed to the next tab to complete the forecast 5 6 7 8 9 PROBLEM 6-10 10 White & Pinkman Corporation 11 12 Forecasting Assumptions: 18 14 Sales growth 20% given 15 Cost of Goods Sold 16 Selling & Admin Expenses 17 Cash These items are projected to remain the same 18 Markotable Securities percentage of sales in 2019 as they were in 2018. That 19 Accounts Receivable is the same as saying that in 2019 the items will grow at 20 Inventory the same rate as sales 21 Prepaid Expenses 22 Accounts Payable 28 Accrued Expenses 24 25 Depreciation Expense 26. Interest Expense 27. Gross Plant & Equipment 28 Motos Payable These items are projected to remain the same value in 2019 as they were in 2018 29 Long-Term Debt 30 Common Stock 31 Capital in Excess of Par Assumptions Forecast 2, 3, 8.4 File Home Insert Page Layout Formulas Data Review View Help Custom XC Copy Paste Format Painter Cioboard - 10 A A 2 Wrap Test BTVBOA Merge Center - 5 Alge $ -% -% Conditional Formatting Font Number D9 E 10 PROBLEM 6-10 White & Pinkman Corporation 20% gen 12 Forecasting Assumptions: 13 Sales growth 15 Cost of Goods Sold 16 Seling & Admin Expenses 12 h 10 Marble Secure 19 Accos Rece tvory 21 Precand penses Accounts Payabil Accrued Expenses These are projected to remain the same percentage of sales in 2019 as they were in 2018. That the same saying that in 2019 the foms will grow the same Derecho Expenses In Expre Gloss Pants Equipment Miles Payable Long Tomb Commons Gelin Excess of Par The are proud to the Samea in 2019 2018 y de 2019 2018 A motorech 2.104 Type here to search O a . 6 AutoSave OM de_prob 6-10 Student Template (1) Compatibility Mode - Excel Search Home Insert Page Layout Formulas Data Review View Help X cut 10 - A A P 29 Wrap Text Merge & Center - Custom % 9-23 BIU a-A Format Painter Gabond Condition Formatting Font A E Student instructions. This workshootes for probilom 6-10 The problem begins with the forecasting assumptions on the previous tab. This tab contains White and Pinkman's financial statements and the pro forma forecast (Question 1), and Question 2a Entor formulas in column C to complete the proforma forecast for the year 2010 For Question 2a, incorporate Additonal Funds Needed (AFN) or Excess Financing into the balance sheet forecast incolumn where indicated (Note: You may disregard any additional interest expense associated with the new dobb Finally, proceed to the next tab to answer the remaining Homes in Question 2 WHITE & PINKMAN CORPORATION Historical and Projected Income Statements Historical 2018 Projected 2019 Sales 17 Cost of goods Sold 16. Gross Profit 19 Saling & Admin Expenses Depreciation Expense 2 Operating Income (EBIT) 22 st Expenses 23 strings Before Tas (EBT) 2 Income Tax (40%) 510,000,000 54.000.000 $6.000.000 $800,000 $2.000.000 $3,200,000 51.350.000 $1,850.000 $740.000 $110.000 Common Stock Dividends pad 28 Addition to deaming Frings por Share (1,000,000 shes) Assumptions Forecast 02124 $400.000 $710,000 $1.11 + Type here to search O 6 G AutoSave Be_prob 6-10 Student Template (rev) () - Compatibility Mode - bice Search File Insert Home Page Layout Formulas Data Review View Help X Custom - 10 AA== A 2 Wrap Text Merge Center BTU $ %**% Is copy - Format Patel Clipboard Condi Format Font Algement Number 67 A A D E 13 Historical 2018 Projected 2019 18 Salus 1 Cost of goods Sold Gross Profit 19 Selling & Admin Expensos Depreciation Expense 21 Operating Income (EBIT) 22 Interest Expenses Earnings Before Tax (EBT) 24 Income Tax (40%) 26 Not Income (NI) $10,000,000 $4,000,000 $6,000,000 $800,000 $2.000.000 $3,200,000 $1,350.000 $1,850,000 1740.000 $1.110.000 Projection with AFN Projected Excess Financing Dec 31, 2019 incorporated 27 Common Stock Dividends paid $100,000 33 Addition to Retained earnings $710.000 29 Earnings per Share (1,000,000 shares) $1.11 20 31 WHITE & PINKMAN CORPORATION Historical and Projected Balance Sheets 33 Historical Dec 31, 2018 00 ASSETS 52 Current Assets Cash $9,000,000 Marketablo Securities $8.000.000 40 Accounts Receive gross) $1,200,000 41 LOS Awance for Bad Dobs $200.000 Accounts Receivable) $1,000 000 try $20,000,000 Presentes $100 Assumptions Forecast 0214 a type here to search O > . 2 utoSave Off og Be prob 6-10 Student Template (revi (1) - Compatibility Mode - Excel ile Home Insert Page Layout Formulas Data Review View Help L Xcut Atial 10 Custom In copy AA = A 29 Wrap Text Merge Center Format Pointer BI $ - % -29 Conditional fomas G Formatting besh Cloboard Font Mignment c Historical Dec 31, 2018 Projected Dec 31, 2019 Projection with AFN Excess Financing Incorporated ASSETS Current Assets Cash 9 Marketable Securities 0 Accounts Receivable (gross) 1 Less. Allowance for Bad Debts 2 Accounts Receivable (Not) 13 leivontory 4 Prepaid Expenses 45 Total Current Assels 16 Plant and Equipment (OSS) 47 Less: Accumulated Depreciation 19 plant and Equipment (not) 49 TOTAL ASSETS $9,000,000 $8,000,000 $1,200,000 $200.000 $1 000,000 $20,000,000 $1.000.000 $39.000.000 $20,000,000 $9.000.000 $11.000.000 $50.000.000 51 LIABILITIES AND EQUITY U2 Current Liabilities 33 Accounts Payablo 54 Notes Payablo 55 Accrued Expenses 50 Total Current Liabilities 07 L-T Debt (Bonds Payable, 59, due 2035) 5 Total Liabilities 59 Common Stock (1.000.000 shares, $1 per) Capelin Excess of Par o Retained Earings 62 Total Equity 63 TOTAL LIABILITIES AND EQUITY $12,000,000 $5,000,000 $3.000.000 $20,000,000 $20.000.000 $40 000 000 $1,000,000 $4.000.000 $5.000.000 $10.000.000 $50.000.000 Incorporate a new Long-term De Assumptions Forecast 02.3.84 6 1 type here to search O Arial 10 - " ' 2 Wrap Text Custom X out In cops Paste Format Painter Clipboard . A Merge & Center $ % 38 Conditional Formatos Formatting Tables Font Algement 15 Number G7 X E A B 37 Current Assots Cash $9.000.000 39 Marketable Securities $8,000,000 10 Accounts Receivable (gross) $1,200,000 41 Less Allowance for Bad Debts $200,000 42 Accounts Receivable (Net) $1,000,000 48 triventory $20,000,000 44 Prepaid Expenses $1.000.000 46. Total Current Assets $39.000.000 46 Plant and Equipment (gross) $20,000,000 47 Less Accumulated Depreciation $9.000.000 48 Plant and Equipment (not) $11.000.000 49 TOTAL ASSETS $50.000.000 50 51 LIABILITIES AND EQUITY 52 Current Liabilities 58 Accounts Payable $12.000.000 54 Notes Payable $5,000,000 55 Accrued Expenses $3.000.000 E6 Total Current Liabilities $20,000,000 57 LT Debt (Bonds Payable, 5% due 2035) $20.000.000 60 Total Liabilities $40,000,000 59 Common Stock (1.000.000 shares, 51 par) $1,000,000 B0 Capital in Excess of Par $4,000,000 61 Retained Earnings $5.000.000 62 Total Equity $10.000.000 69 TOTAL LIABILMES AND EQUITY $60.000.000 84 65 Question 2a Excess Financing (Additional Funds Needed) Incorporate as now Long torm Debt Assumptions Forecast 02384 Type here to search 09 O a File Home Insert Page Layout Formulas did Custom Arial 10 X Cut Copy Format Painter - ' ' A 29 Wrap Text Merge & Center Paste BIU $ % 78-98 Conditional Format Formatting Table Styles Fert Alignment Number Cipboard J20 > B c D E F G H 17 Inventory Tumovor 18 19 d. Total Debt to Assets 20 21 e. Net Profit Margin 22 Return on Assets Return on Equity 24 26 26 Question 3 Comments: Comments on iquidity, asset productivity, debt managemont, and profitability 29 80 33 34 85 37 Question 4. Recommendations: 38 40 Recommendations 42 44 41 45 47 Assumptions Forecast Q 2, 3,84 Type here to search Arial 10 Xor lo Copy Paste Format Painter ' 29 Wrap Text a A Merge & Center Custom BIU $ % & Clipboard Font 15 Alignment IS Number D9 x for B C 1 E F G H 2 Student instructions. This worksheet is for problem 6-10. This tab contains forecasting assumptions. The 8 next tab contains White & Pinkman Corporation's financial statements and the pro forma forecast (Question 1) The final tab contains questions 2 ae, 3, and 4 Review the forecasting assumptions below and then proceed to the next tab to complete the forecast 5 6 7 8 9 PROBLEM 6-10 10 White & Pinkman Corporation 11 12 Forecasting Assumptions: 18 14 Sales growth 20% given 15 Cost of Goods Sold 16 Selling & Admin Expenses 17 Cash These items are projected to remain the same 18 Markotable Securities percentage of sales in 2019 as they were in 2018. That 19 Accounts Receivable is the same as saying that in 2019 the items will grow at 20 Inventory the same rate as sales 21 Prepaid Expenses 22 Accounts Payable 28 Accrued Expenses 24 25 Depreciation Expense 26. Interest Expense 27. Gross Plant & Equipment 28 Motos Payable These items are projected to remain the same value in 2019 as they were in 2018 29 Long-Term Debt 30 Common Stock 31 Capital in Excess of Par Assumptions Forecast 2, 3, 8.4 File Home Insert Page Layout Formulas Data Review View Help Custom XC Copy Paste Format Painter Cioboard - 10 A A 2 Wrap Test BTVBOA Merge Center - 5 Alge $ -% -% Conditional Formatting Font Number D9 E 10 PROBLEM 6-10 White & Pinkman Corporation 20% gen 12 Forecasting Assumptions: 13 Sales growth 15 Cost of Goods Sold 16 Seling & Admin Expenses 12 h 10 Marble Secure 19 Accos Rece tvory 21 Precand penses Accounts Payabil Accrued Expenses These are projected to remain the same percentage of sales in 2019 as they were in 2018. That the same saying that in 2019 the foms will grow the same Derecho Expenses In Expre Gloss Pants Equipment Miles Payable Long Tomb Commons Gelin Excess of Par The are proud to the Samea in 2019 2018 y de 2019 2018 A motorech 2.104 Type here to search O a . 6 AutoSave OM de_prob 6-10 Student Template (1) Compatibility Mode - Excel Search Home Insert Page Layout Formulas Data Review View Help X cut 10 - A A P 29 Wrap Text Merge & Center - Custom % 9-23 BIU a-A Format Painter Gabond Condition Formatting Font A E Student instructions. This workshootes for probilom 6-10 The problem begins with the forecasting assumptions on the previous tab. This tab contains White and Pinkman's financial statements and the pro forma forecast (Question 1), and Question 2a Entor formulas in column C to complete the proforma forecast for the year 2010 For Question 2a, incorporate Additonal Funds Needed (AFN) or Excess Financing into the balance sheet forecast incolumn where indicated (Note: You may disregard any additional interest expense associated with the new dobb Finally, proceed to the next tab to answer the remaining Homes in Question 2 WHITE & PINKMAN CORPORATION Historical and Projected Income Statements Historical 2018 Projected 2019 Sales 17 Cost of goods Sold 16. Gross Profit 19 Saling & Admin Expenses Depreciation Expense 2 Operating Income (EBIT) 22 st Expenses 23 strings Before Tas (EBT) 2 Income Tax (40%) 510,000,000 54.000.000 $6.000.000 $800,000 $2.000.000 $3,200,000 51.350.000 $1,850.000 $740.000 $110.000 Common Stock Dividends pad 28 Addition to deaming Frings por Share (1,000,000 shes) Assumptions Forecast 02124 $400.000 $710,000 $1.11 + Type here to search O 6 G AutoSave Be_prob 6-10 Student Template (rev) () - Compatibility Mode - bice Search File Insert Home Page Layout Formulas Data Review View Help X Custom - 10 AA== A 2 Wrap Text Merge Center BTU $ %**% Is copy - Format Patel Clipboard Condi Format Font Algement Number 67 A A D E 13 Historical 2018 Projected 2019 18 Salus 1 Cost of goods Sold Gross Profit 19 Selling & Admin Expensos Depreciation Expense 21 Operating Income (EBIT) 22 Interest Expenses Earnings Before Tax (EBT) 24 Income Tax (40%) 26 Not Income (NI) $10,000,000 $4,000,000 $6,000,000 $800,000 $2.000.000 $3,200,000 $1,350.000 $1,850,000 1740.000 $1.110.000 Projection with AFN Projected Excess Financing Dec 31, 2019 incorporated 27 Common Stock Dividends paid $100,000 33 Addition to Retained earnings $710.000 29 Earnings per Share (1,000,000 shares) $1.11 20 31 WHITE & PINKMAN CORPORATION Historical and Projected Balance Sheets 33 Historical Dec 31, 2018 00 ASSETS 52 Current Assets Cash $9,000,000 Marketablo Securities $8.000.000 40 Accounts Receive gross) $1,200,000 41 LOS Awance for Bad Dobs $200.000 Accounts Receivable) $1,000 000 try $20,000,000 Presentes $100 Assumptions Forecast 0214 a type here to search O > . 2 utoSave Off og Be prob 6-10 Student Template (revi (1) - Compatibility Mode - Excel ile Home Insert Page Layout Formulas Data Review View Help L Xcut Atial 10 Custom In copy AA = A 29 Wrap Text Merge Center Format Pointer BI $ - % -29 Conditional fomas G Formatting besh Cloboard Font Mignment c Historical Dec 31, 2018 Projected Dec 31, 2019 Projection with AFN Excess Financing Incorporated ASSETS Current Assets Cash 9 Marketable Securities 0 Accounts Receivable (gross) 1 Less. Allowance for Bad Debts 2 Accounts Receivable (Not) 13 leivontory 4 Prepaid Expenses 45 Total Current Assels 16 Plant and Equipment (OSS) 47 Less: Accumulated Depreciation 19 plant and Equipment (not) 49 TOTAL ASSETS $9,000,000 $8,000,000 $1,200,000 $200.000 $1 000,000 $20,000,000 $1.000.000 $39.000.000 $20,000,000 $9.000.000 $11.000.000 $50.000.000 51 LIABILITIES AND EQUITY U2 Current Liabilities 33 Accounts Payablo 54 Notes Payablo 55 Accrued Expenses 50 Total Current Liabilities 07 L-T Debt (Bonds Payable, 59, due 2035) 5 Total Liabilities 59 Common Stock (1.000.000 shares, $1 per) Capelin Excess of Par o Retained Earings 62 Total Equity 63 TOTAL LIABILITIES AND EQUITY $12,000,000 $5,000,000 $3.000.000 $20,000,000 $20.000.000 $40 000 000 $1,000,000 $4.000.000 $5.000.000 $10.000.000 $50.000.000 Incorporate a new Long-term De Assumptions Forecast 02.3.84 6 1 type here to search O Arial 10 - " ' 2 Wrap Text Custom X out In cops Paste Format Painter Clipboard . A Merge & Center $ % 38 Conditional Formatos Formatting Tables Font Algement 15 Number G7 X E A B 37 Current Assots Cash $9.000.000 39 Marketable Securities $8,000,000 10 Accounts Receivable (gross) $1,200,000 41 Less Allowance for Bad Debts $200,000 42 Accounts Receivable (Net) $1,000,000 48 triventory $20,000,000 44 Prepaid Expenses $1.000.000 46. Total Current Assets $39.000.000 46 Plant and Equipment (gross) $20,000,000 47 Less Accumulated Depreciation $9.000.000 48 Plant and Equipment (not) $11.000.000 49 TOTAL ASSETS $50.000.000 50 51 LIABILITIES AND EQUITY 52 Current Liabilities 58 Accounts Payable $12.000.000 54 Notes Payable $5,000,000 55 Accrued Expenses $3.000.000 E6 Total Current Liabilities $20,000,000 57 LT Debt (Bonds Payable, 5% due 2035) $20.000.000 60 Total Liabilities $40,000,000 59 Common Stock (1.000.000 shares, 51 par) $1,000,000 B0 Capital in Excess of Par $4,000,000 61 Retained Earnings $5.000.000 62 Total Equity $10.000.000 69 TOTAL LIABILMES AND EQUITY $60.000.000 84 65 Question 2a Excess Financing (Additional Funds Needed) Incorporate as now Long torm Debt Assumptions Forecast 02384 Type here to search 09 O a File Home Insert Page Layout Formulas did Custom Arial 10 X Cut Copy Format Painter - ' ' A 29 Wrap Text Merge & Center Paste BIU $ % 78-98 Conditional Format Formatting Table Styles Fert Alignment Number Cipboard J20 > B c D E F G H 17 Inventory Tumovor 18 19 d. Total Debt to Assets 20 21 e. Net Profit Margin 22 Return on Assets Return on Equity 24 26 26 Question 3 Comments: Comments on iquidity, asset productivity, debt managemont, and profitability 29 80 33 34 85 37 Question 4. Recommendations: 38 40 Recommendations 42 44 41 45 47 Assumptions Forecast Q 2, 3,84 Type here to search Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started